Question: You are considering a business to make screen-printed T-shirts. Use the following information to determine the Fully Allocated Cost (FAC). You are leasing a

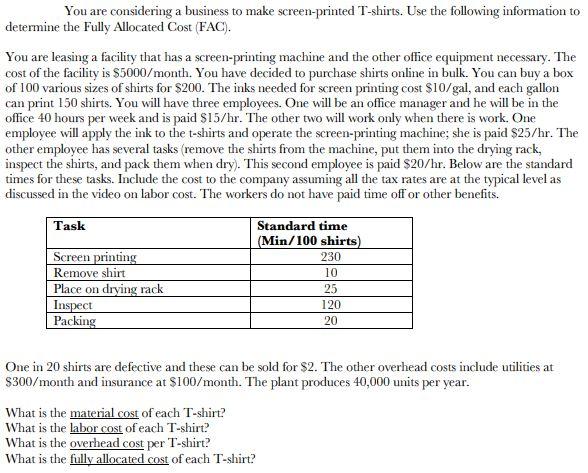

You are considering a business to make screen-printed T-shirts. Use the following information to determine the Fully Allocated Cost (FAC). You are leasing a facility that has a screen-printing machine and the other office equipment necessary. The cost of the facility is $5000/month. You have decided to purchase shirts online in bulk. You can buy a box of 100 various sizes of shirts for $200. The inks needed for screen printing cost $10/gal, and each gallon can print 150 shirts. You will have three employees. One will be an office manager and he will be in the office 40 hours per week and is paid $15/hr. The other two will work only when there is work. One employee will apply the ink to the t-shirts and operate the screen-printing machine; she is paid $25/hr. The other employee has several tasks (remove the shirts from the machine, put them into the drying rack, inspect the shirts, and pack them when dry). This second employee is paid $20/hr. Below are the standard times for these tasks. Include the cost to the company assuming all the tax rates are at the typical level as discussed in the video on labor cost. The workers do not have paid time off or other benefits. Task Standard time (Min/100 shirts) Screen printing 230 Remove shirt 10 Place on drying rack Inspect Packing 25 120 20 One in 20 shirts are defective and these can be sold for $2. The other overhead costs include utilities at $300/month and insurance at $100/month. The plant produces 40,000 units per year. What is the material cost of each T-shirt? What is the labor cost of each T-shirt? What is the overhead cost per T-shirt? What is the fully allocated cost of each T-shirt?

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts