Question: Problem. You manage a bank that has been borrowing in the U.S. markets and lending abroad, thereby incurring foreign exchange risk. In a recent transaction,

Problem. You manage a bank that has been borrowing in the U.S. markets and lending abroad, thereby incurring foreign exchange risk. In a recent transaction, it issued a one-year $5 million CD at 4% and is planning to fund a loan in Japanese yen at 6%. The spot rate USD/JPY is $0.00950/JPY.

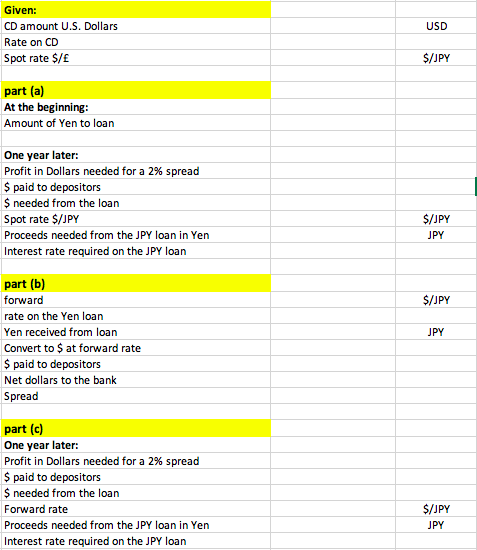

(a) The bank's FX department forecasts that the spot rate 1 year from now will be $0.009483/JPY. If they are correct, what rate should the bank charge on the loan to maintain the 2% spread?

(b) The bank has been offered a forward contract at $0.009493/JPY. Assuming the bank keeps the loan rate at 6%, what is the spread if the bank uses the forward contract?

(c) If the bank uses the forward contract, what rate on the loan is necessary to maintain a 2% spread?

ASSUME THE LOAN ENDS AFTER ONE YEAR, SO THE PRINCIPAL WILL BE REPAID

USD Given: CD amount U.S. Dollars Rate on CD Spot rate $/ $/JPY part (a) At the beginning: Amount of Yen to loan One year later: Profit in Dollars needed for a 2% spread $ paid to depositors $ needed from the loan Spot rate $/JPY Proceeds needed from the JPY loan in Yen Interest rate required on the JPY loan $/JPY JPY $/JPY JPY part (b) forward rate on the Yen loan Yen received from loan Convert to $ at forward rate $ paid to depositors Net dollars to the bank Spread part (c) One year later: Profit in Dollars needed for a 2% spread $ paid to depositors $ needed from the loan Forward rate Proceeds needed from the JPY loan in Yen Interest rate required on the JPY loan $/JPY JPY USD Given: CD amount U.S. Dollars Rate on CD Spot rate $/ $/JPY part (a) At the beginning: Amount of Yen to loan One year later: Profit in Dollars needed for a 2% spread $ paid to depositors $ needed from the loan Spot rate $/JPY Proceeds needed from the JPY loan in Yen Interest rate required on the JPY loan $/JPY JPY $/JPY JPY part (b) forward rate on the Yen loan Yen received from loan Convert to $ at forward rate $ paid to depositors Net dollars to the bank Spread part (c) One year later: Profit in Dollars needed for a 2% spread $ paid to depositors $ needed from the loan Forward rate Proceeds needed from the JPY loan in Yen Interest rate required on the JPY loan $/JPY JPY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts