Question: Problem: You work for a company that is currently considering a new manufacturing project. In detail, this project will provide a new type of economic

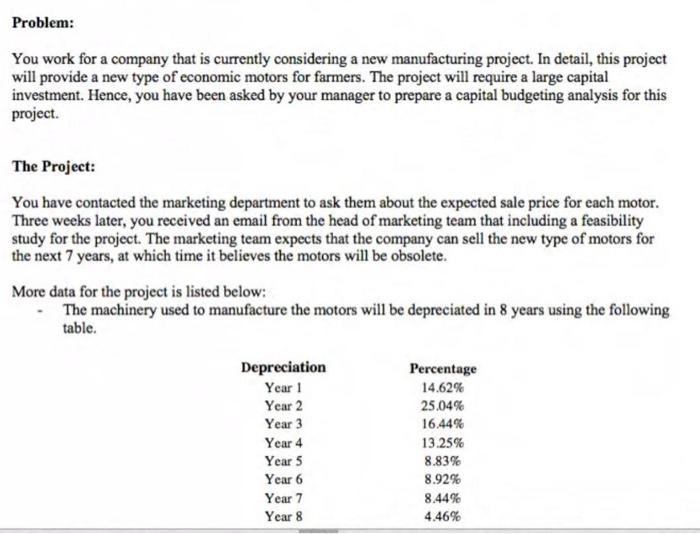

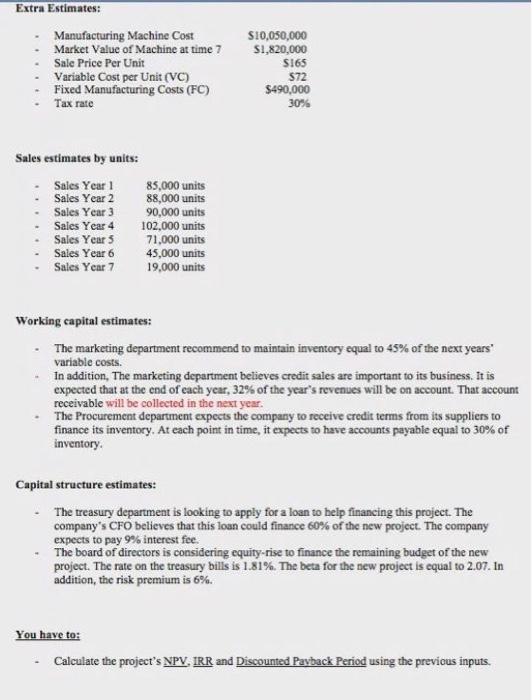

Problem: You work for a company that is currently considering a new manufacturing project. In detail, this project will provide a new type of economic motors for farmers. The project will require a large capital investment. Hence, you have been asked by your manager to prepare a capital budgeting analysis for this project. The Project: You have contacted the marketing department to ask them about the expected sale price for each motor. Three weeks later, you received an email from the head of marketing team that including a feasibility study for the project. The marketing team expects that the company can sell the new type of motors for the next 7 years, at which time it believes the motors will be obsolete. More data for the project is listed below: The machinery used to manufacture the motors will be depreciated in 8 years using the following table. Depreciation Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Percentage 14.62% 25.04% 16.44% 13.25% 8.83% 8.92% 8.44% 4.46% Extra Estimates: Manufacturing Machine Cost Market Value of Machine at time 7 Sale Price Per Unit Variable Cost per Unit (VC) Fixed Manufacturing Costs (FC) Tax rate $10,050,000 $1,820,000 $165 S72 $490,000 30% Sales estimates by units: Sales Year 1 85,000 units Sales Year 2 88,000 units Sales Year 3 90,000 units Sales Year 4 102,000 units Sales Year 5 71,000 units Sales Year 6 45,000 units Sales Year 7 19,000 units Working capital estimates: The marketing department recommend to maintain inventory equal to 45% of the next years In addition, The marketing department believes credit sales are important to its business. It is expected that at the end of each year, 32% of the year's revenues will be on account. That account receivable will be collected in the next year. The Procurement department expects the company to receive credit terms from its suppliers to finance its inventory. At each point in time, it expects to have accounts payable equal to 30% of inventory Capital structure estimates: The treasury department is looking to apply for a loan to help financing this project. The company's CFO believes that this loan could finance 60% of the new project. The company expects to pay 9% interest fee. The board of directors is considering equity-rise to finance the remaining budget of the new project. The rate on the treasury bills is 1.81%. The beta for the new project is equal to 2.07. In addition, the risk premium is 6%. You have to: Calculate the project's NPV, IRR and Discounted Payback period using the previous inputs. Problem: You work for a company that is currently considering a new manufacturing project. In detail, this project will provide a new type of economic motors for farmers. The project will require a large capital investment. Hence, you have been asked by your manager to prepare a capital budgeting analysis for this project. The Project: You have contacted the marketing department to ask them about the expected sale price for each motor. Three weeks later, you received an email from the head of marketing team that including a feasibility study for the project. The marketing team expects that the company can sell the new type of motors for the next 7 years, at which time it believes the motors will be obsolete. More data for the project is listed below: The machinery used to manufacture the motors will be depreciated in 8 years using the following table. Depreciation Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Percentage 14.62% 25.04% 16.44% 13.25% 8.83% 8.92% 8.44% 4.46% Extra Estimates: Manufacturing Machine Cost Market Value of Machine at time 7 Sale Price Per Unit Variable Cost per Unit (VC) Fixed Manufacturing Costs (FC) Tax rate $10,050,000 $1,820,000 $165 S72 $490,000 30% Sales estimates by units: Sales Year 1 85,000 units Sales Year 2 88,000 units Sales Year 3 90,000 units Sales Year 4 102,000 units Sales Year 5 71,000 units Sales Year 6 45,000 units Sales Year 7 19,000 units Working capital estimates: The marketing department recommend to maintain inventory equal to 45% of the next years In addition, The marketing department believes credit sales are important to its business. It is expected that at the end of each year, 32% of the year's revenues will be on account. That account receivable will be collected in the next year. The Procurement department expects the company to receive credit terms from its suppliers to finance its inventory. At each point in time, it expects to have accounts payable equal to 30% of inventory Capital structure estimates: The treasury department is looking to apply for a loan to help financing this project. The company's CFO believes that this loan could finance 60% of the new project. The company expects to pay 9% interest fee. The board of directors is considering equity-rise to finance the remaining budget of the new project. The rate on the treasury bills is 1.81%. The beta for the new project is equal to 2.07. In addition, the risk premium is 6%. You have to: Calculate the project's NPV, IRR and Discounted Payback period using the previous inputs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts