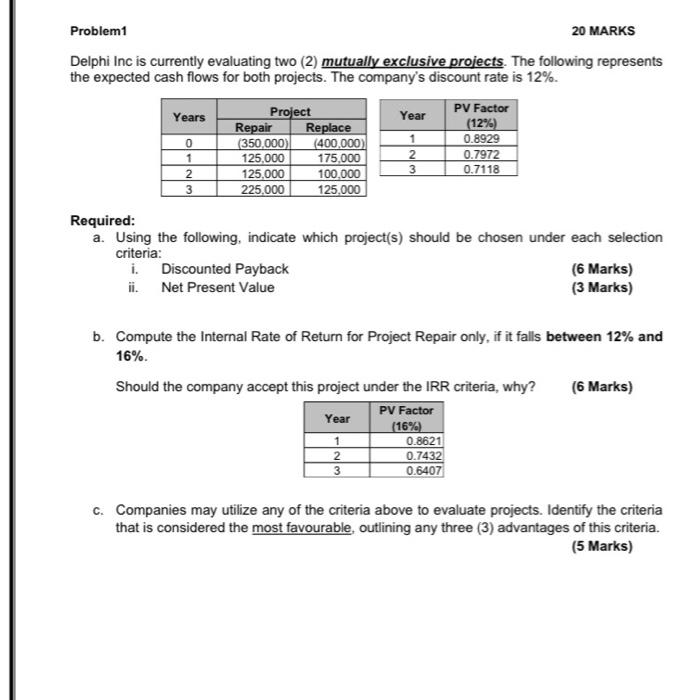

Question: Problem1 20 MARKS Delphi Inc is currently evaluating two (2) mutually exclusive projects. The following represents the expected cash flows for both projects. The company's

Problem1 20 MARKS Delphi Inc is currently evaluating two (2) mutually exclusive projects. The following represents the expected cash flows for both projects. The company's discount rate is 12%. Year Years 0 Project Repair Replace (350.000 (400.000) 125.000 175,000 125.000 100,000 225.000 125,000 PV Factor (12%) 0.8929 0.7972 0.7118 1 2 3 1 2 3 Required: a. Using the following, indicate which project(s) should be chosen under each selection criteria: i. Discounted Payback (6 Marks) ii. Net Present Value (3 Marks) b. Compute the Internal Rate of Return for Project Repair only, if it falls between 12% and 16% Should the company accept this project under the IRR criteria, why? (6 Marks) Year PV Factor (16%) 0.8621 0.7432 0.6407 1 2 3 C. Companies may utilize any of the criteria above to evaluate projects. Identify the criteria that is considered the most favourable, outlining any three (3) advantages of this criteria

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts