Question: Problem1 (25 points). Two machines are being evaluated for possible acquisition by the Mortensen Corporation. Information relating to the two machines is provided below MORTENSEN

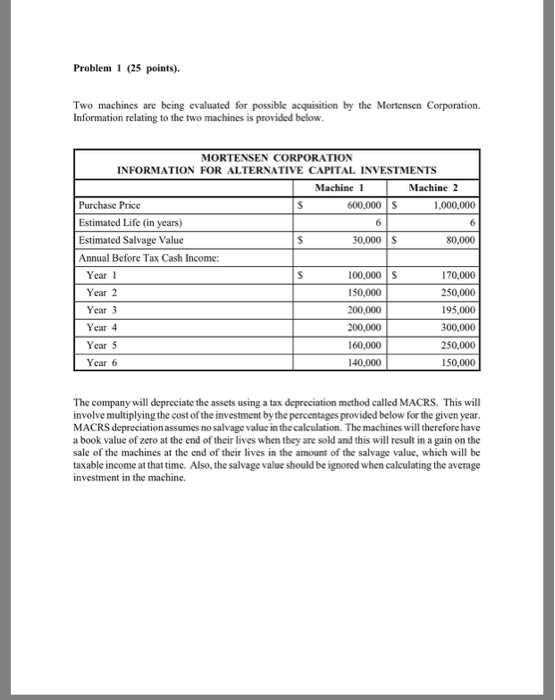

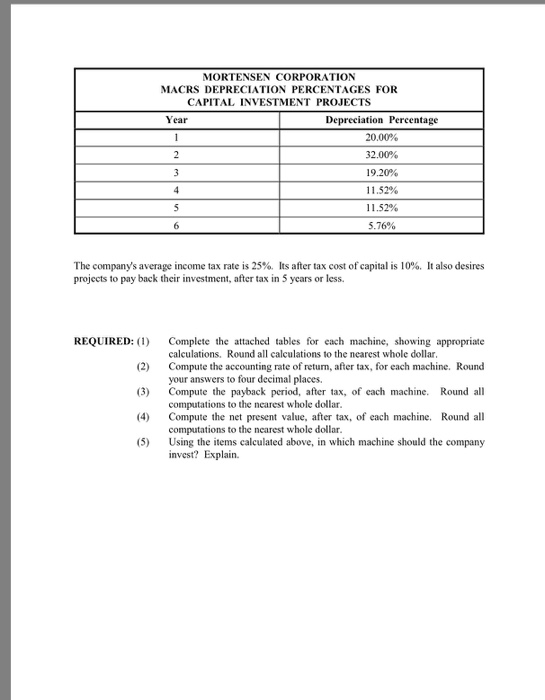

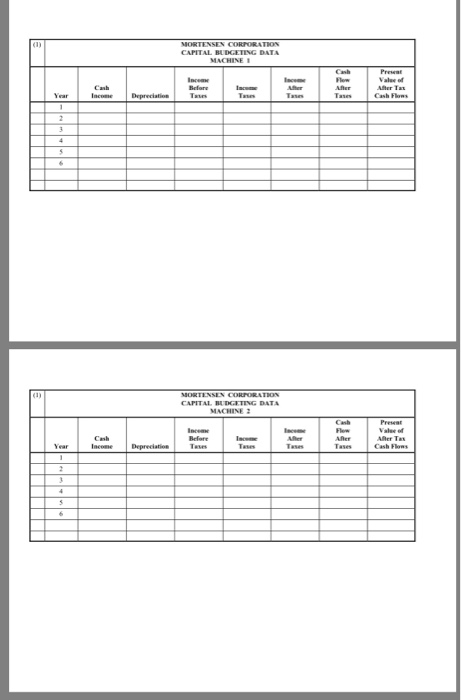

Problem1 (25 points). Two machines are being evaluated for possible acquisition by the Mortensen Corporation. Information relating to the two machines is provided below MORTENSEN CORPORATION INFORMATION FOR ALTERNATIVE CAPITAL INVESTMENTS Machine 1 Machine 2 Purchase Price Estimated Life (in years) Estimated Salvage Value Annual Before Tax Cash Income: 600,000 S 1,000,000 0,000 S 80,000 170,000 250,000 195,000 300,000 250,000 150,000 Year 1 Year 2 Year 3 100,000 S 150,000 200,000 200,000 60,000 140,000 Year 5 Year 6 The company will depreciate the assets using a tax depreciation method called MACRS. This will involve multiplying the cost of the investment by the percentages provided below for the given year MACRS depreciationassumes no salvage value in the calculation. The machines will therefore have a book value of zero at the end of their lives when they are sold and this will result in a gain on the sale of the machines at the end of their lives in the amount of the salvage value, which will be taxable income at that time. Also, the salvage value should be ignored when calculating the average investment in the machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts