Question: Problem#1: Consider four plastic presses. Suppose that each press is capable of producing 120,000 total units per year, but the estimated reject rate is different

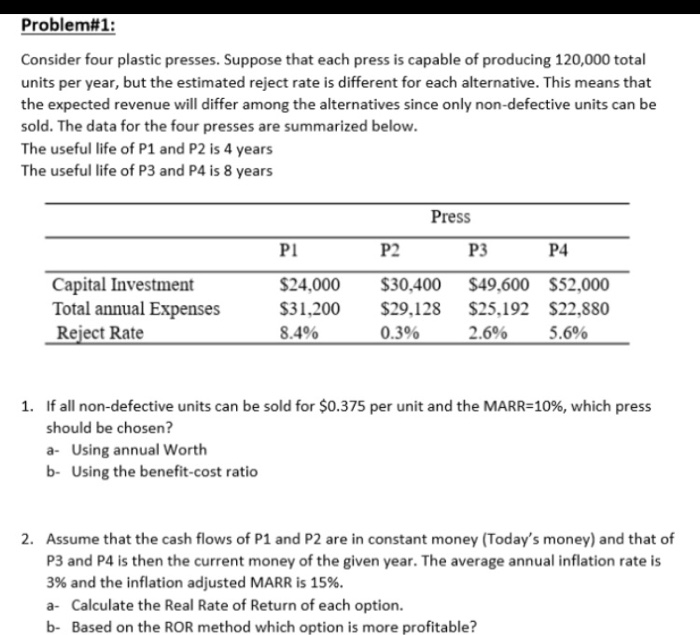

Problem#1: Consider four plastic presses. Suppose that each press is capable of producing 120,000 total units per year, but the estimated reject rate is different for each alternative. This means that the expected revenue will differ among the alternatives since only non-defective units can be sold. The data for the four presses are summarized below. The useful life of P1 and P2 is 4 years The useful life of P3 and P4 is 8 years Press Capital Investment Total annual Expenses Reject Rate P1 $24,000 $31,200 8.4% P2 $30,400 $29,128 0.3% P3 P4 $49,600 $52,000 $25.192 $22.880 2.6% 5.6% 1. If all non-defective units can be sold for $0.375 per unit and the MARR=10%, which press should be chosen? a- Using annual Worth b- Using the benefit-cost ratio 2. Assume that the cash flows of P1 and P2 are in constant money (Today's money) and that of P3 and P4 is then the current money of the given year. The average annual inflation rate is 3% and the inflation adjusted MARR is 15%. a- Calculate the Real Rate of Return of each option. b. Based on the ROR method which option is more profitable? Problem#1: Consider four plastic presses. Suppose that each press is capable of producing 120,000 total units per year, but the estimated reject rate is different for each alternative. This means that the expected revenue will differ among the alternatives since only non-defective units can be sold. The data for the four presses are summarized below. The useful life of P1 and P2 is 4 years The useful life of P3 and P4 is 8 years Press Capital Investment Total annual Expenses Reject Rate P1 $24,000 $31,200 8.4% P2 $30,400 $29,128 0.3% P3 P4 $49,600 $52,000 $25.192 $22.880 2.6% 5.6% 1. If all non-defective units can be sold for $0.375 per unit and the MARR=10%, which press should be chosen? a- Using annual Worth b- Using the benefit-cost ratio 2. Assume that the cash flows of P1 and P2 are in constant money (Today's money) and that of P3 and P4 is then the current money of the given year. The average annual inflation rate is 3% and the inflation adjusted MARR is 15%. a- Calculate the Real Rate of Return of each option. b. Based on the ROR method which option is more profitable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts