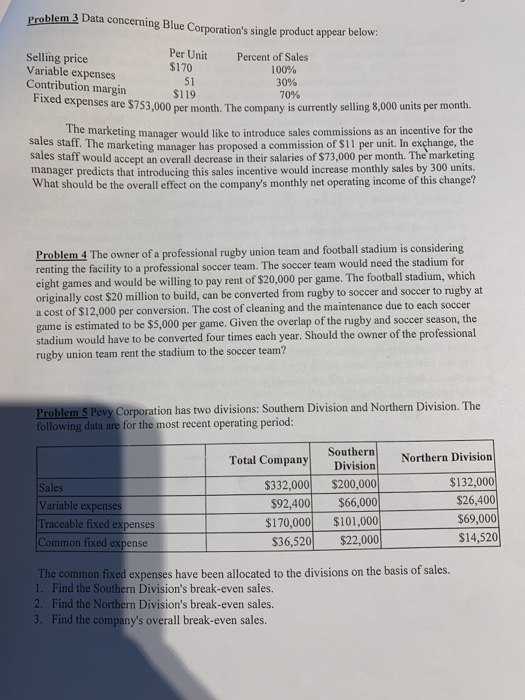

Question: Problem.3 Data concerning Blue Corporation's single product appear below: Per Unit $170 Percent of Sales Selling price Variable expenses Contribution margin 51 30% 70% penses

Problem.3 Data concerning Blue Corporation's single product appear below: Per Unit $170 Percent of Sales Selling price Variable expenses Contribution margin 51 30% 70% penses are $753,000 per month. The company is currently selling 8,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of S11 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $73,000 per month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by 300 units. What should be the overall effect on the company's monthly net operating income of this change? Problem 4 The owner of a professional rugby union team and football stadium is considering renting the facility to a professional soccer team. The soccer team would need eight games and would be willing to pay rent of $20,000 per game. The football stadium, which originally cost $20 a cost of $12,000 per conversion. The cost of cleaning and the maintenance due to each soccer million to build, can be converted from rugby to soccer and soccer to rugby at e is estimated to be $5,000 per game. Given the overlap of the rugby and soccer season, the gam stadium would have to be converted four times each year. Should the owner of the professional rugby union team rent the stadium to the soccer team? Corporation has two divisions: Southern Division and Northern Division. The following data are for the most recent operating period: Southern Northern Division $132,000 $26,400 $69,000 $14,520 Total Company $332,000 $200,000 92,400 $66,000 $170,000 $101,000 36,520 $22,000 Variable expenses Traceable fixed expenses ommon fixed expense The common fixed expenses have been allocated to the divisions on the basis of sales. 1. Find the Southern Division's break-even sales. 2. Find the Northern Division's break-even sales. 3. Find the company's overall break-even sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts