Question: Problem4 Consider pricing a European put option on a foreign currency (currency option). We define So as the current exchange rate (the value of one

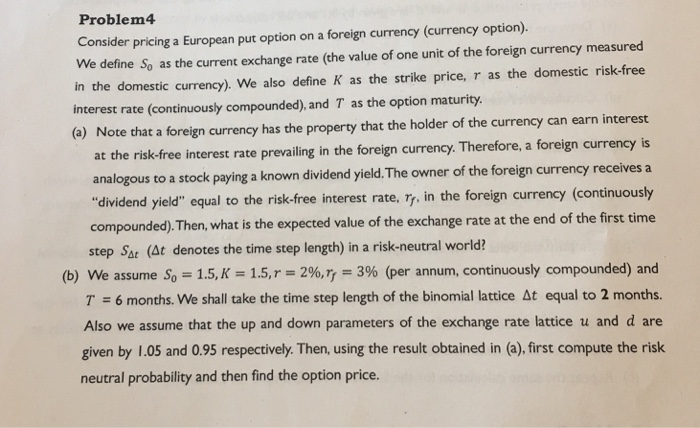

Problem4 Consider pricing a European put option on a foreign currency (currency option). We define So as the current exchange rate (the value of one unit of the foreign currency measured in the domestic currency). We also define K as the strike price, r as the domestic risk-free interest rate (continuously compounded), and T as the option maturity. (a) Note that a foreign currency has the property that the holder of the currency can earn interest at the risk-free interest rate prevailing in the foreign currency. Therefore, a foreign currency is analogous to a stock paying a known dividend yield. The owner of the foreign currency receives a "dividend yield" equal to the risk-free interest rate, ry, in the foreign currency (continuously compounded).Then, what is the expected value of the exchange rate at the end of the first time step Sse (At denotes the time step length) in a risk-neutral world? (b) We assume So-1.5, K-; 1.5,T-296,Tj-: 396 (per annum, continuously compounded) and T 6 months. We shall take the time step length of the binomial lattice t equal to 2 months. Also we assume that the up and down parameters of the exchange rate lattice u and d are given by 1.05 and 0.95 respectively. Then, using the result obtained in (a), first compute the risk neutral probability and then find the option price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts