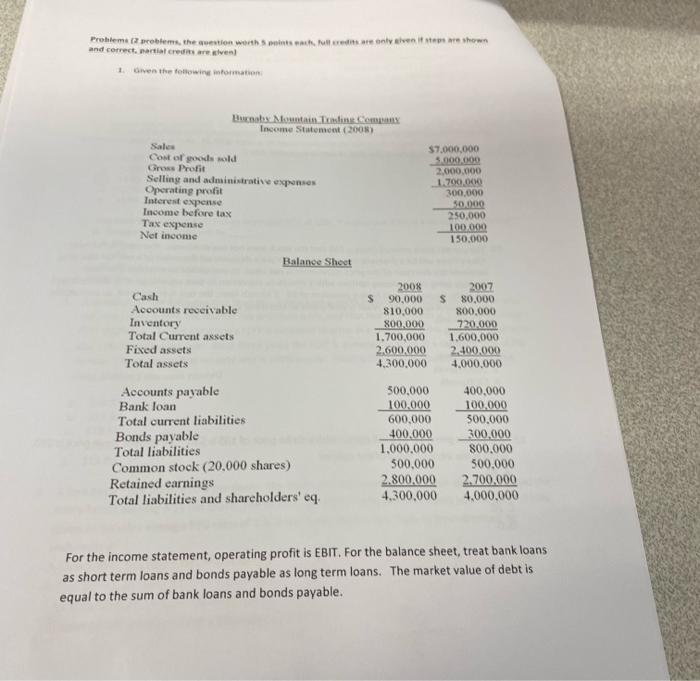

Question: problema problems. thesion worth its en les entre parte shown and correct partial credits reveal 1. Given the following information Bucob Montan TimeCom Income Statement

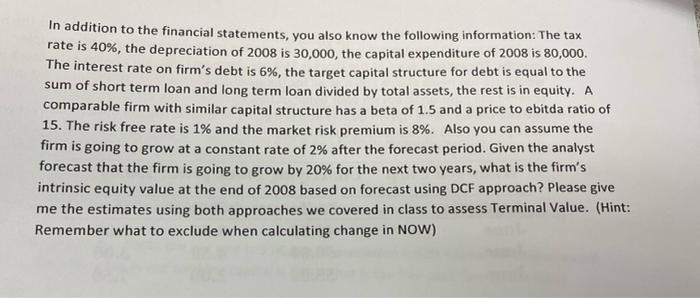

problema problems. thesion worth its en les entre parte shown and correct partial credits reveal 1. Given the following information Bucob Montan TimeCom Income Statement (2008) Sales Cost of goods sold Gross Profit Selling and administrative expenses Operating profit Interest expense Income before tax Tax expense Net income $7.000.000 5.000.000 2.000.000 1.700.000 300.000 50.000 250.000 100.000 150.000 Balance Sheet Cash Accounts receivable Inventory Total Current assets Fixed assets Total assets 2008 S 90,000 810,000 800.000 1.700,000 2.600.000 4.300.000 2007 S 80,000 800.000 720.000 1.600.000 2.400.000 4.000.000 Accounts payable Bank loan Total current liabilities Bonds payable Total liabilities Common stock (20.000 shares) Retained earnings Total liabilities and shareholders' eq 500,000 100,000 600,000 400.000 1.000.000 500,000 2.800.000 4.300.000 400.000 100.000 500.000 300.000 800.000 500.000 2.700.000 4,000,000 For the income statement, operating profit is EBIT. For the balance sheet, treat bank loans as short term loans and bonds payable as long term loans. The market value of debt is equal to the sum of bank loans and bonds payable. In addition to the financial statements, you also know the following information: The tax rate is 40%, the depreciation of 2008 is 30,000, the capital expenditure of 2008 is 80,000. The interest rate on firm's debt is 6%, the target capital structure for debt is equal to the sum of short term loan and long term loan divided by total assets, the rest is in equity. A comparable firm with similar capital structure has a beta of 1.5 and a price to ebitda ratio of 15. The risk free rate is 1% and the market risk premium is 8%. Also you can assume the firm is going to grow at a constant rate of 2% after the forecast period. Given the analyst forecast that the firm is going to grow by 20% for the next two years, what is the firm's intrinsic equity value at the end of 2008 based on forecast using DCF approach? Please give me the estimates using both approaches we covered in class to assess Terminal Value. (Hint: Remember what to exclude when calculating change in NOW) problema problems. thesion worth its en les entre parte shown and correct partial credits reveal 1. Given the following information Bucob Montan TimeCom Income Statement (2008) Sales Cost of goods sold Gross Profit Selling and administrative expenses Operating profit Interest expense Income before tax Tax expense Net income $7.000.000 5.000.000 2.000.000 1.700.000 300.000 50.000 250.000 100.000 150.000 Balance Sheet Cash Accounts receivable Inventory Total Current assets Fixed assets Total assets 2008 S 90,000 810,000 800.000 1.700,000 2.600.000 4.300.000 2007 S 80,000 800.000 720.000 1.600.000 2.400.000 4.000.000 Accounts payable Bank loan Total current liabilities Bonds payable Total liabilities Common stock (20.000 shares) Retained earnings Total liabilities and shareholders' eq 500,000 100,000 600,000 400.000 1.000.000 500,000 2.800.000 4.300.000 400.000 100.000 500.000 300.000 800.000 500.000 2.700.000 4,000,000 For the income statement, operating profit is EBIT. For the balance sheet, treat bank loans as short term loans and bonds payable as long term loans. The market value of debt is equal to the sum of bank loans and bonds payable. In addition to the financial statements, you also know the following information: The tax rate is 40%, the depreciation of 2008 is 30,000, the capital expenditure of 2008 is 80,000. The interest rate on firm's debt is 6%, the target capital structure for debt is equal to the sum of short term loan and long term loan divided by total assets, the rest is in equity. A comparable firm with similar capital structure has a beta of 1.5 and a price to ebitda ratio of 15. The risk free rate is 1% and the market risk premium is 8%. Also you can assume the firm is going to grow at a constant rate of 2% after the forecast period. Given the analyst forecast that the firm is going to grow by 20% for the next two years, what is the firm's intrinsic equity value at the end of 2008 based on forecast using DCF approach? Please give me the estimates using both approaches we covered in class to assess Terminal Value. (Hint: Remember what to exclude when calculating change in NOW)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts