Question: PROBLEMIV TRUE OR FALSE A bond is simply a form of an interest - bearing note. a . True b . False When a corporation

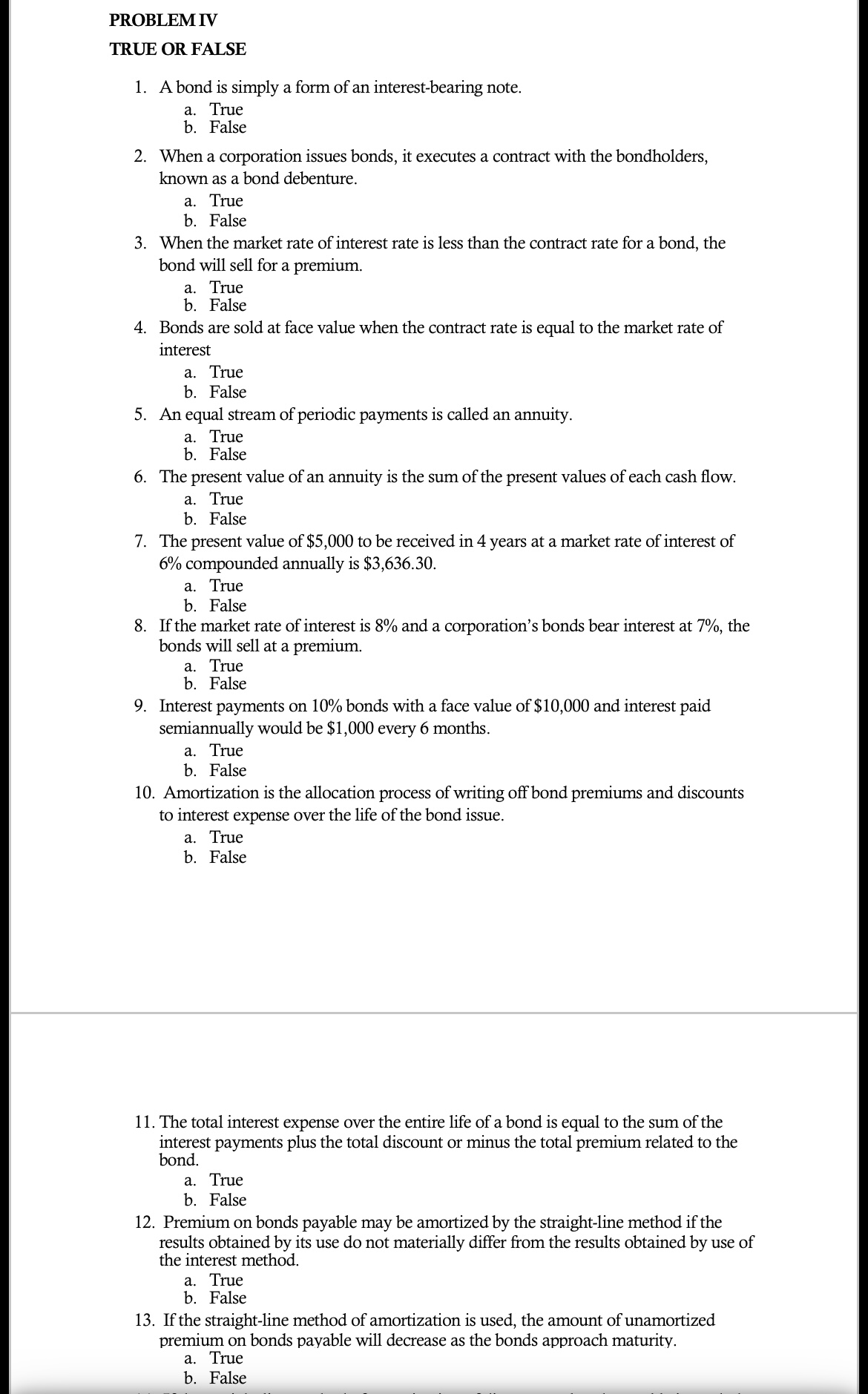

PROBLEMIV

TRUE OR FALSE

A bond is simply a form of an interestbearing note.

a True

b False

When a corporation issues bonds, it executes a contract with the bondholders,

known as a bond debenture.

a True

b False

When the market rate of interest rate is less than the contract rate for a bond, the

bond will sell for a premium.

a True

b False

Bonds are sold at face value when the contract rate is equal to the market rate of

interest

a True

b False

An equal stream of periodic payments is called an annuity.

a True

b False

The present value of an annuity is the sum of the present values of each cash flow.

a True

b False

The present value of $ to be received in years at a market rate of interest of

compounded annually is $

a True

b False

If the market rate of interest is and a corporation's bonds bear interest at the

bonds will sell at a premium.

a True

b False

Interest payments on bonds with a face value of $ and interest paid

semiannually would be $ every months.

a True

b False

Amortization is the allocation process of writing off bond premiums and discounts

to interest expense over the life of the bond issue.

a True

b False

The total interest expense over the entire life of a bond is equal to the sum of the

interest payments plus the total discount or minus the total premium related to the

bond.

a True

b False

Premium on bonds payable may be amortized by the straightline method if the

results obtained by its use do not materially differ from the results obtained by use of

the interest method.

a True

b False

If the straightline method of amortization is used, the amount of unamortized

premium on bonds payable will decrease as the bonds approach maturity.

a True

b False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock