Question: Problems 1 0 - 1 3 Interpreting a LIFO note ( LO 1 0 - 5 , LO 1 0 - 6 , LO 1

Problems Interpreting a LIFO note LO LO LO

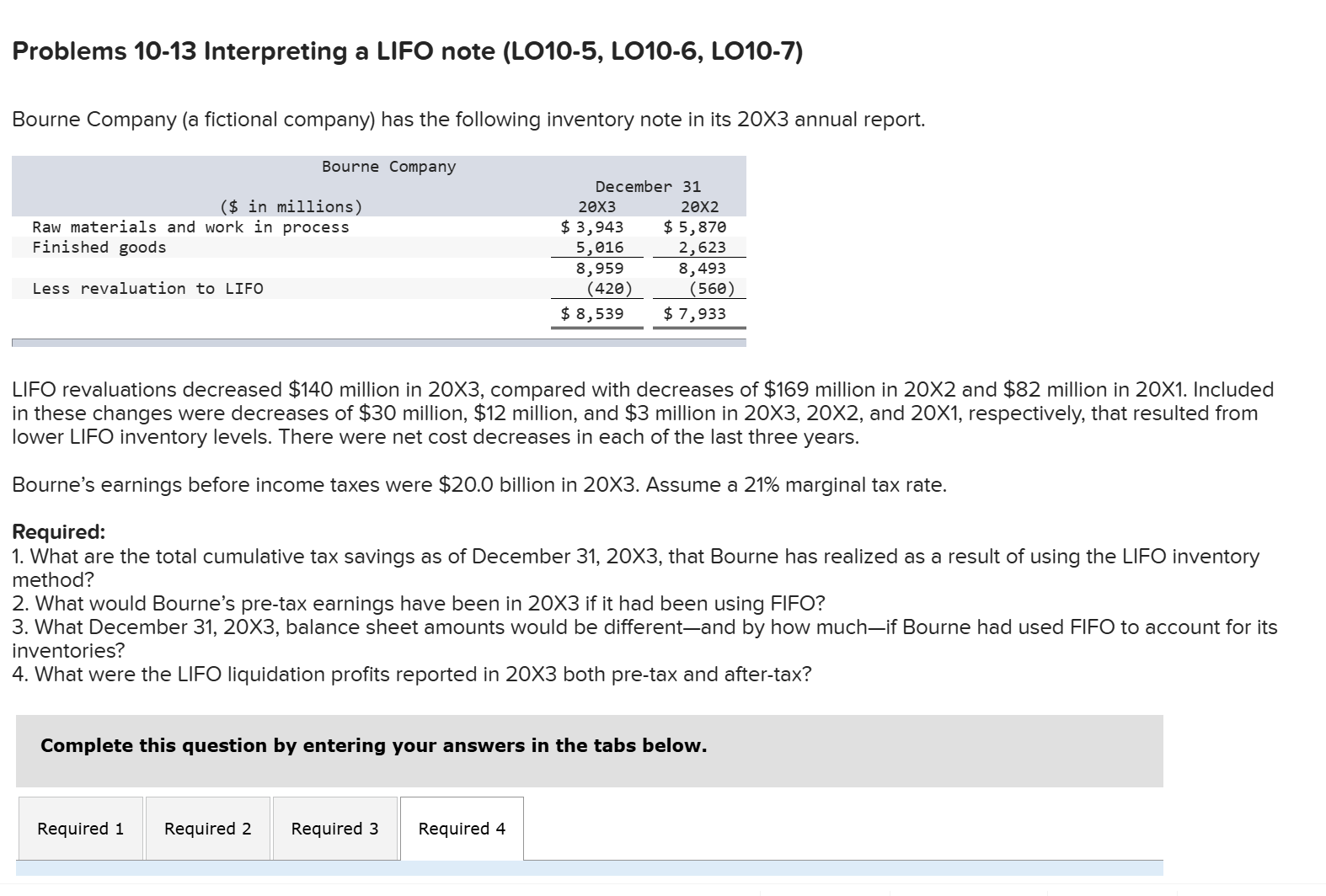

Bourne Company a fictional company has the following inventory note in its X annual report.

LIFO revaluations decreased $ million in X compared with decreases of $ million in X and $ million in X Included in these changes were decreases of $ million, $ million, and $ million in XX and X respectively, that resulted from lower LIFO inventory levels. There were net cost decreases in each of the last three years.

Bourne's earnings before income taxes were $ billion in X Assume a marginal tax rate.

Required:

What are the total cumulative tax savings as of December times that Bourne has realized as a result of using the LIFO inventory method?

What would Bourne's pretax earnings have been in times if it had been using FIFO?

What December X balance sheet amounts would be differentand by how muchif Bourne had used FIFO to account for its inventories?

What were the LIFO liquidation profits reported in times both pretax and aftertax?

Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock