Question: Problems 1, 2, 3, 4, 12, 13, 15, 19 & 20 would like to see them done in a excel sheet if possible I 8.

![8. Corporate borromin 9. Cash Flow [L04] Which was the biggest culprit](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670121ddbc53c_453670121dd29cac.jpg)

![here: Too many orders. 10. Cash Flow [L04] What are some of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670121dea7d71_454670121de0beed.jpg)

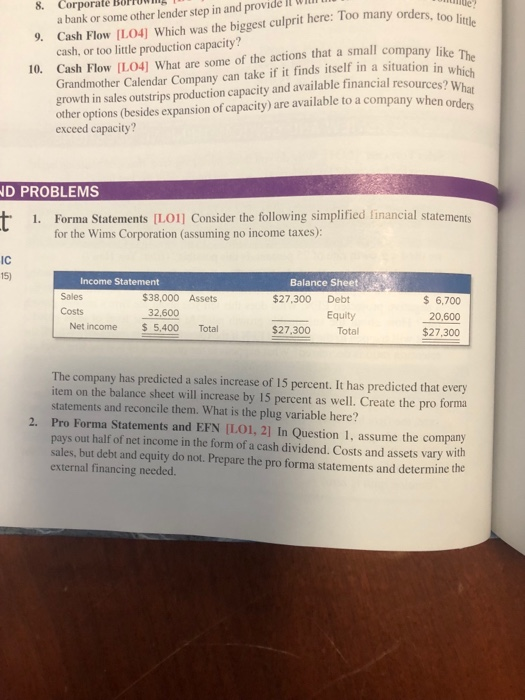

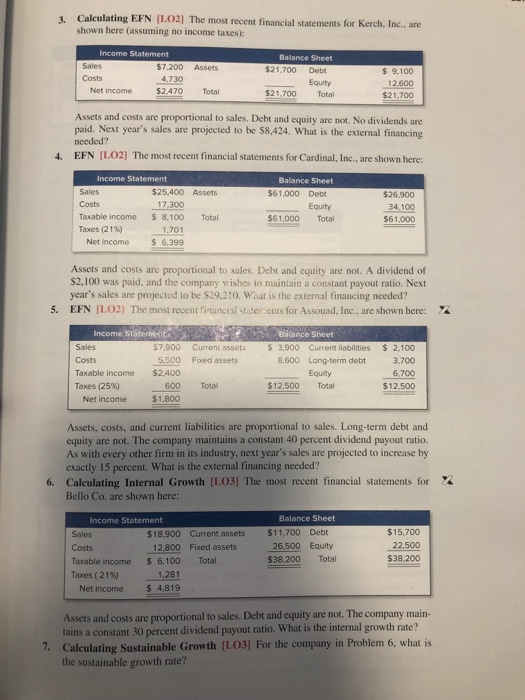

I 8. Corporate borromin 9. Cash Flow [L04] Which was the biggest culprit here: Too many orders. 10. Cash Flow [L04] What are some of the actions that a small company like Th a bank or some other lender step in and provide cash, or too little production capacity? Grandmother Calendar Company can take if it finds itself in a situationin other options (besides expansion of capacity) are available to a company when order ile too little which ? What production capacity and available financial exceed capacity? D PROBLEMS Forma Statements [L01] Consider the following simplified financial statements for the Wims Corporation (assuming no income taxes): 1. IC 15) Income Statement Balance Sheet Sales $38,000 Assets $27,300 Debt 6,700 20,600 $27,300 Costs 32,600 Equity Net income 5,400 Total $27,300 Total The company has predicted a sales increase of 15 percent. It has predicted that every item on the balance sheet will increase by 15 percent as well. Create the pro forma statements and reconcile them. What is the plug variable here? 2. Pro Forma Statements and EFN ILO1, 2] In Question 1, assume the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not. Prepare the pro forma statements and determine the external financing needed. 3. Calculating EFN IL.02] The most recent financial statements for Kerch, Inc., are shown here (assuming no income taxes): Balance Sheet Sales Costs $7.200 Assets $21,700 Deb $9,100 12.600 $21.700 4.730 Equity Net income $2.470 Total $21.700 Total Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $8,424. What is the external financing needed? 4. EFN IL02] The most recent financial statements for Cardinal, Inc., are shown here Income Statement Balance Sheet $25,400 Assets Sales Costs Taxable income Taxes (21%) $61,000 Debt $26,900 34.100 $61,000 17.300 8,100 Total $61,000 Total Net income 6,399 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,100 was paid, and the company wishes to mainiain a constant payout ratio. Next year's sales are projected to be $29.210. Woat is the external financing needed? 5. EFN LO2) The most recent financial staterzents for Assouad, Inc., are shown here: X Income Stat Balance Sheet Costs Taxable income Taxes (25%) $7,900 Current assets 3,900 Current liabilities $ 2.100 8,600 Long.term debt 3,700 6.700 5.500 Fixed assets $2,.400 Equity $12,500 Total 600 Total $1,800 $12,500 Net income Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 40 percent dividend payout ratio. As with every other firm in its industry, next year's sales are projected to increase by exactly 15 percent. What is the external financing needed? 6, Calculating Internal Growth [L03] The most recent financial statements for Bello Co. are shown here: Income Statement Balance Sheet $18,900 Current assets $11,700 Debt Sales Costs Taxable income Taxes (21%) $15,700 22,500 $38,200 26.500 Equity $38,200 Total 12,800 Fixed assets $ 6,100 Total 1,281 Net income $ 4,8159 Assets and costs are proportional to sales. Debt and equity are not. The company main- tains a constant 30 percent dividend payout ratio. What is the internal growth rate? Calculating Sustainable Growth [LO3] For the company in Problem 6, what is the sustainable growth rate? 7. 7 2Financial Statements and Long Tem Financial Planning Sales and Growth (LO2) The most recent financial statements for Alex are shown here 8. Sales a nce Sheet $42,800 Current assets $17.500 Long-term debt 35,500 Fised assets68,300 Equity $37000 48,800 $85,800 Costs $85,800 Total Taxable incom. 7.300 Tial 1.679 Taxes (23%) Net income 562 Assets and costs are proportional to sales. The company maintains a const percent dividend payout ratio and a constant debt-equity ratio. What is the ma increase in sales that can be sustained assuming no new equity is issued? ant 40 9, Calculating Retained Earnings from Pro Forma Income LO1] Consider following income statement for the Heir Jordan Corporation: HEIR JORDAN Income Statement $49,000 40.300 $ 8,700 1,914 $ 6,786 Taxable income Taxes (22%) Net income pacent of fined asset cap wbhefire any new fited as Fred Asets and Capacity U assets are $520,000 and fisad asets are required tooperate at full capaci Gowth and Profit Margin of 12 percent per year, a 5 parcent. The naio of total Fal-Capacity Sales /1.0 $2,400 Addtion to retained earnings 4386 A 20 percent growth rate in sales is projected. Prepare a pro forma income statement assuming costs vary with sales and the dividend payout ratio is constant. What is the projected addition to retained earnings? 10. Applying Percentage of Sales [LO1] The balance sheet for the Heir Jordan Corpora- tion follows. Based on this information and the income statement in the previous lem, supply the missing information using the percentage of sales approach. Assume that accounts payable vary with sales, whereas notes payable do not. Put "n/h" where necded. Balance Sheet Assets Liabilities and Owners' Equity Percentage of Sales Current assets of Sales Current liabilities Cash $ 2,950 Accounts payable Accounts recevable 4,100 6,400 13.450 2,400 5,400 $ 7,800 Notes payable Long-term debt Owners' equity Total Fixed assets Net plant $28,000 - and equipment $41,300 Common stock and paid-in surplus $15,000 Retained eanings 3.950 $18,950 owners' equity $54,750 Total Total assets Total liabilties and $54,750 Chapter 4 Long Term Financial Planning and Growth 119 Il. EFN and Sales IL,02] From the previous two questions, prepare a pro forma bal sheet showing EFN, assuming an increase in sales of 15 percent, no new exter- nternal Growth [LO3] If A7X Co. has an ROA of 7.6 percent and a payout ratio 13. Sustainable Growth [103] If Synyster Corp. has an ROE of 14.7 percent and a 14. Sustainable Growth [L.03] Based on the following information, calculate the sus- nal debt or equity financing, and a constant payout ratio. of 25 percent, what is its internal growth rate? payout ratio of 30 percent, what is its sustainable growth rate? tainable growth rate for Kaleb's Heavy Equipment: 12. I Profit margin Capital intensity ratio-80 Debl-equity ratio 95 Net income Dividends 7.3% $73,000 $24,000 Sustainable Growth ILO3] Assuming the following ratios are constant, what is the sustainable growth rate? 15. Total asset turnover- 2.90 Profit margin 52% Equity mulkiplier1.10 35% Payout ratio 16. Full-Capacity Sales 1.O Hodgkiss Mfg. Inc., is currently operating at only INTERMEDIATE 91 percent of fixed asset capacity. Current sales are $715,000. How fast can sales (Questions 16-26) grow before any new fixed assets are acided? 17. Fixed Assets and Capacity UsageFer the company in Problem 16, suppose fixed assets are $520,000 and sales are projocted to grow to $790,000. How much in new fixed assets are required to support this growtl: in sales? Assume the company wants to operate at full capacity 18. Growth and Profit Margin [L03j Ramble On Co. wishes to maintain a growth rate of 12 percent per year, a debt-equity ratio of .90, and a dividend payout ratio of 25 percent. The ratio of total assets to sales is constant at .85. What profit margin must the firm achieve? 19. Growth and Assets IL03] A firm wishes to maintain an internal growth rate of 7.1 percent and a dividend payout ratio of 25 percent. The current profit margin is 6.5 per- cent, and the firm uses no external financing sources. What must total asset turnover be? Sustainable Growth [LO3] Based on the following information, calculate the sus- tainable growth rate for Hendrix Guitars, Inc. 2 20. Profit margin Total asset turnover 1.75 Total debt ratio 35 Payout ratio 6.3% 30% 21. Sustainable Growth and Outside Financing [1.03] You've collected the follow- ing information about Molino, Inc.: Sales =$215,000 Net income $17,300 Dividends$9.400 Total debt # S77.000 Total equity $59,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts