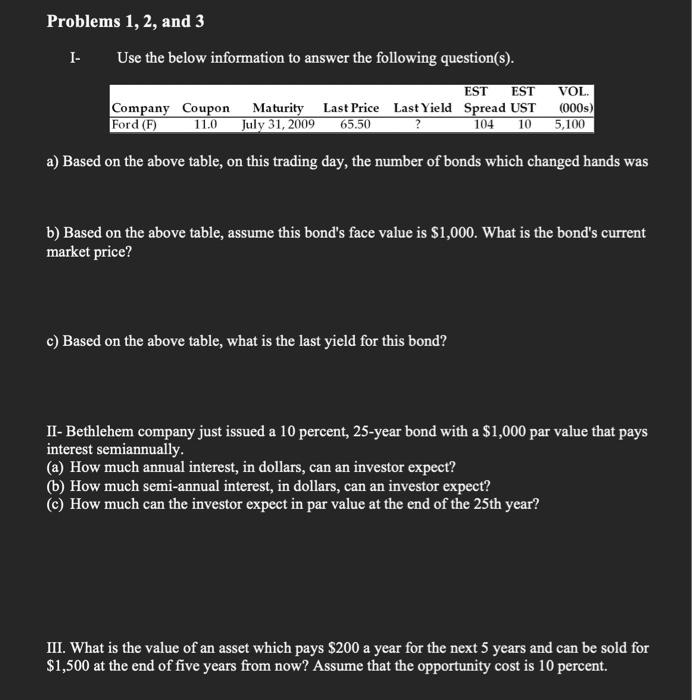

Question: Problems 1, 2, and 3 1. Use the below information to answer the following question(s). EST EST Company Coupon Maturity Last Price Last Yield Spread

Problems 1, 2, and 3 1. Use the below information to answer the following question(s). EST EST Company Coupon Maturity Last Price Last Yield Spread UST Ford (F) 11.0 July 31, 2009 65.50 104 10 VOL. (000) 5,100 a) Based on the above table, on this trading day, the number of bonds which changed hands was b) Based on the above table, assume this bond's face value is $1,000. What is the bond's current market price? c) Based on the above table, what is the last yield for this bond? II- Bethlehem company just issued a 10 percent, 25-year bond with a $1,000 par value that pays interest semiannually. (a) How much annual interest, in dollars, can an investor expect? (b) How much semi-annual interest, in dollars, can an investor expect? (c) How much can the investor expect in par value at the end of the 25th year? III. What is the value of an asset which pays $200 a year for the next 5 years and can be sold for $1,500 at the end of five years from now? Assume that the opportunity cost is 10 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts