Question: problems 1 & 2 go together Problem 1 Gregory Corp. acquired 20% of the 40,000 shares of common stock of Harrison Corp. at a total

problems 1 & 2 go together

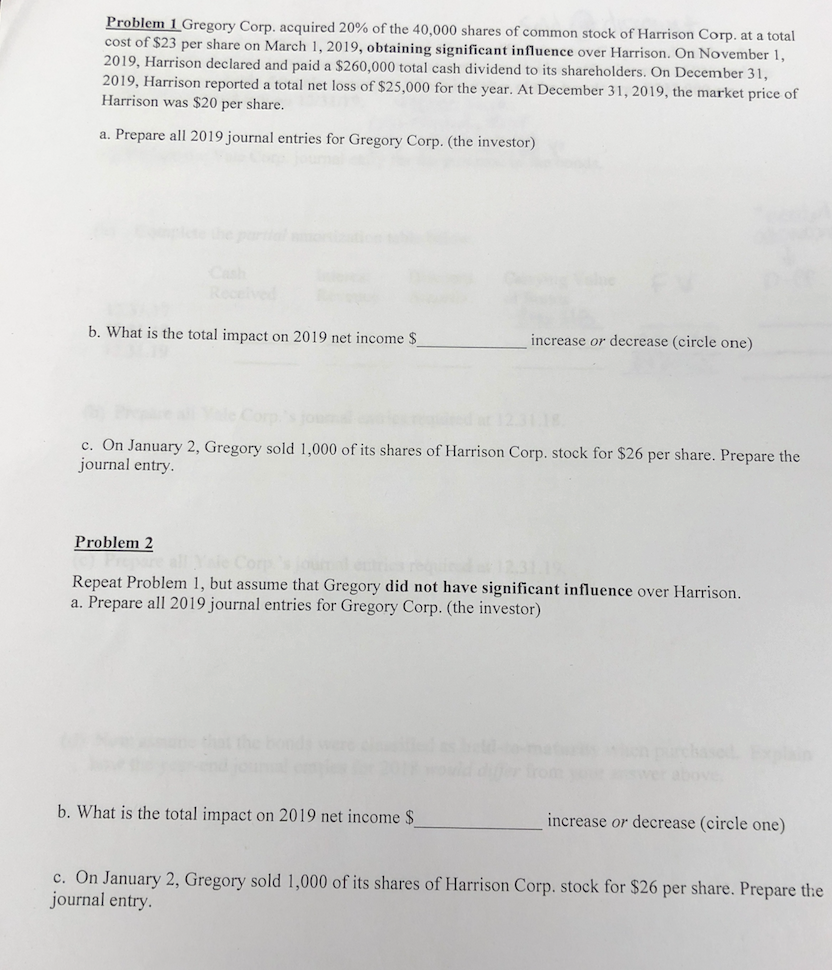

Problem 1 Gregory Corp. acquired 20% of the 40,000 shares of common stock of Harrison Corp. at a total cost of $23 per share on March 1, 2019, obtaining significant influence over Harrison. On November 1, 2019, Harrison declared and paid a $260,000 total cash dividend to its shareholders. On December 31, 2019, Harrison reported a total net loss of $25,000 for the year. At December 31, 2019, the market price of Harrison was $20 per share. a. Prepare all 2019 journal entries for Gregory Corp. (the investor) b. What is the total impact on 2019 net income $ increase or decrease (circle one) c. On January 2, Gregory sold 1,000 of its shares of Harrison Corp. stock for $26 per share. Prepare the journal entry. Problem 2 Repeat Problem 1, but assume that Gregory did not have significant influence over Harrison. a. Prepare all 2019 journal entries for Gregory Corp. (the investor) b. What is the total impact on 2019 net income $ increase or decrease (circle one) c. On January 2, Gregory sold 1,000 of its shares of Harrison Corp. stock for $26 per share. Prepare the journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts