Question: problems 1 and 2 please Problem I Shamber Inc. purchased equipment on January 1, 2018, at a total cost of $68,000. At the time of

problems 1 and 2 please

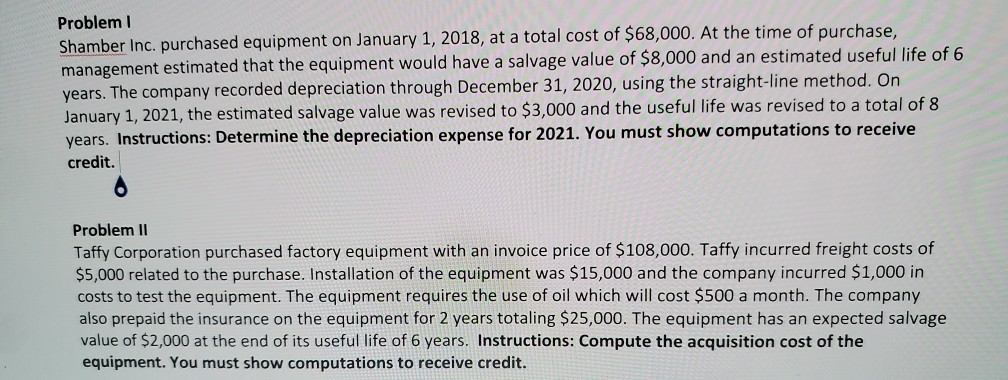

Problem I Shamber Inc. purchased equipment on January 1, 2018, at a total cost of $68,000. At the time of purchase, management estimated that the equipment would have a salvage value of $8,000 and an estimated useful life of 6 years. The company recorded depreciation through December 31, 2020, using the straight-line method. On January 1, 2021, the estimated salvage value was revised to $3,000 and the useful life was revised to a total of 8 years. Instructions: Determine the depreciation expense for 2021. You must show computations to receive credit. Problem II Taffy Corporation purchased factory equipment with an invoice price of $108,000. Taffy incurred freight costs of $5,000 related to the purchase. Installation of the equipment was $15,000 and the company incurred $1,000 in costs to test the equipment. The equipment requires the use of oil which will cost $500 a month. The company also prepaid the insurance on the equipment for 2 years totaling $25,000. The equipment has an expected salvage value of $2,000 at the end of its useful life of 6 years. Instructions: Compute the acquisition cost of the equipment. You must show computations to receive credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts