Question: Problems: 1. Complete problem: Yield to Maturity for Annual Payments XYZ Corporation's bonds have 14 years remaining to maturity. Interest is paid annually, the bonds

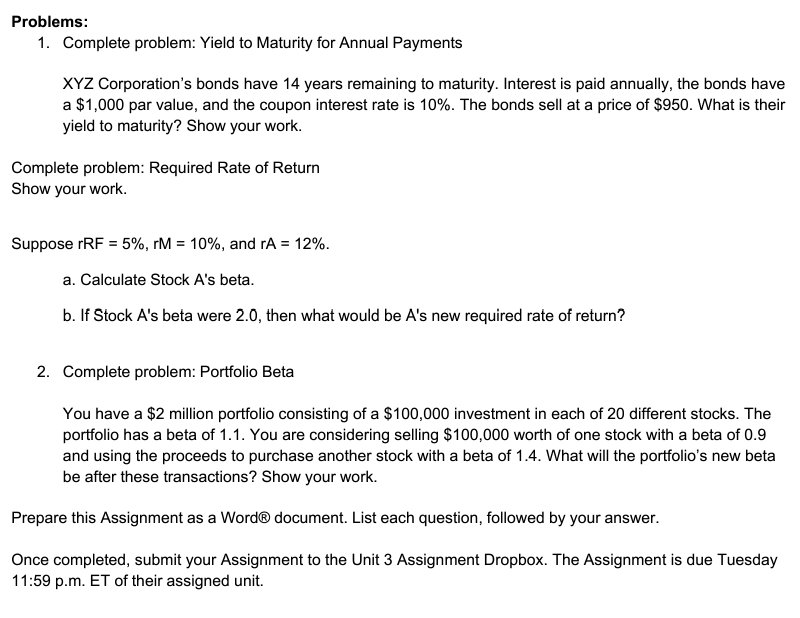

Problems: 1. Complete problem: Yield to Maturity for Annual Payments XYZ Corporation's bonds have 14 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 10%. The bonds sell at a price of $950. What is their yield to maturity? Show your work. Complete problem: Required Rate of Return Show your work. Suppose rRF=5%,rM=10%, and rA=12%. a. Calculate Stock A's beta. b. If Stock A's beta were 2.0 , then what would be A's new required rate of return? 2. Complete problem: Portfolio Beta You have a $2 million portfolio consisting of a $100,000 investment in each of 20 different stocks. The portfolio has a beta of 1.1. You are considering selling $100,000 worth of one stock with a beta of 0.9 and using the proceeds to purchase another stock with a beta of 1.4. What will the portfolio's new beta be after these transactions? Show your work. Prepare this Assignment as a Word document. List each question, followed by your answer. Once completed, submit your Assignment to the Unit 3 Assignment Dropbox. The Assignment is due Tuesday 11:59 p.m. ET of their assigned unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts