Question: Problems 1-15: 5 Points Each 1. A callable bond allows a borrower to: a Refinance when interest rates rise b. Refinance when interest rates fall

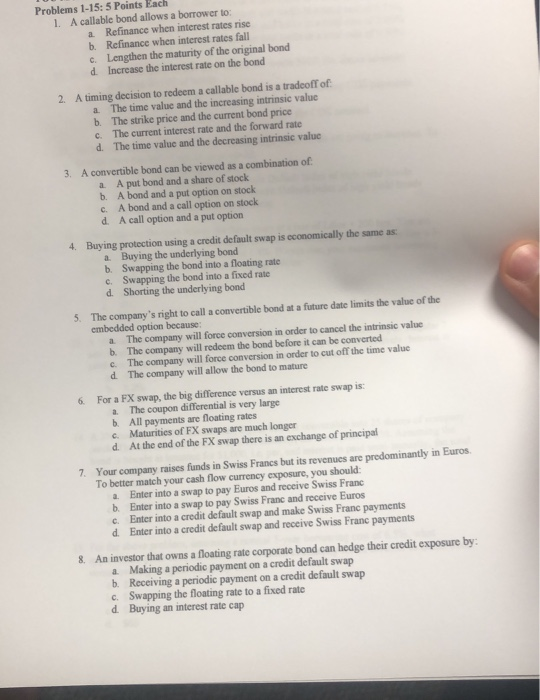

Problems 1-15: 5 Points Each 1. A callable bond allows a borrower to: a Refinance when interest rates rise b. Refinance when interest rates fall C Lengthen the maturity of the original bond d Increase the interest rate on the bond 2. A timing decision to redeem a callable bond is a tradeoff of a The time value and the increasing intrinsic value b. The strike price and the current bond price c. The current interest rate and the forward rate d. The time value and the decreasing intrinsic value 3. A convertible bond can be viewed as a combination of a A put bond and a share of stock b. A bond and a put option on stock c. A bond and a call option on stock d. A call option and a put option 4. Buying protection using a credit default swap is economically the same as a Buying the underlying bond b. Swapping the bond into a floating rate c. Swapping the bond into a fixed rate d Shorting the underlying bond 5. The company's right to call a convertible bond at a future date limits the value of the embedded option because a The company will force conversion in order to cancel the intrinsic value b. The company will redeem the bond before it can be converted c. The company will force conversion in order to cut off the time value d The company will allow the bond to mature 6. For a FX swap, the big difference versus an interest rate swap is: & The coupon differential is very large b. All payments are floating rates Maturities of FX swaps are much longer d At the end of the FX swap there is an exchange of principal 7. Your company raises funds in Swiss Francs but its revenues are predominantly in Euros To better match your cash flow currency exposure, you should: a Enter into a swap to pay Euros and receive Swiss Franc Enter into a swap to pay Swiss Franc and receive Euros C. Enter into a credit default swap and make Swiss Franc payments d Enter into a credit default swap and receive Swiss Franc payments 8. An investor that owns a floating rate corporate bond can hedge their credit exposure by: a Making a periodic payment on a credit default swap b. Receiving a periodic payment on a credit default swap C Swapping the floating rate to a fixed rate d Buying an interest rate cap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts