Question: PROBLEMS 1,2 and 3 (ASAP) PROBLEMS Dividend and Capital Gain Yields, page 348 1. Paul Dargis has analyzed five stocks and estimated the dividends they

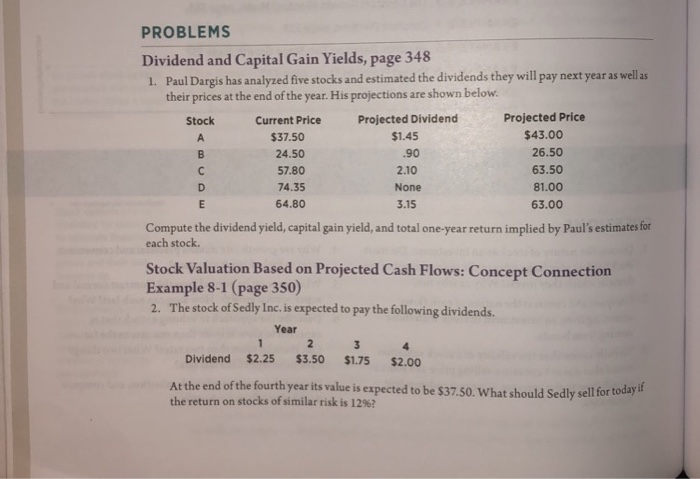

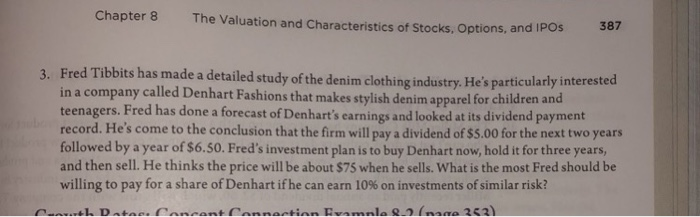

PROBLEMS Dividend and Capital Gain Yields, page 348 1. Paul Dargis has analyzed five stocks and estimated the dividends they will pay next year as well as their prices at the end of the year. His projections are shown below. Stock Current Price Projected Dividend Projected Price $37.50 $1.45 $43.00 24.50 .90 26.50 57.80 2.10 63.50 74.35 None 81.00 64.80 3.15 63.00 Compute the dividend yield, capital gain yield, and total one-year return implied by Paul's estimates for each stock. Stock Valuation Based on Projected Cash Flows: Concept Connection Example 8-1 (page 350) 2. The stock of Sedly Inc. is expected to pay the following dividends. mo Year 1 2 3 4 Dividend $2.25 $3.50 $1.75 $2.00 At the end of the fourth year its value is expected to be $37.50. What should Sedly sell for today the return on stocks of similar risk is 12%? Chapter 8 The Valuation and Characteristics of Stocks. Options, and 387 3. Fred Tibbits has made a detailed study of the denim clothing industry. He's particularly interested in a company called Denhart Fashions that makes stylish denim apparel for children and teenagers. Fred has done a forecast of Denhart's earnings and looked at its dividend payment record. He's come to the conclusion that the firm will pay a dividend of $5.00 for the next two years followed by a year of $6.50. Fred's investment plan is to buy Denhart now, hold it for three years, and then sell. He thinks the price will be about $75 when he sells. What is the most Fred should be willing to pay for a share of Denhart if he can earn 10% on investments of similar risk? Courth Datar Concantonnantian Ewale wana 2621

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts