Question: Problems 13 and 14 are independent problems based on the following scenario: At year-end, the Circle City partnership has the following capital balances: Profits and

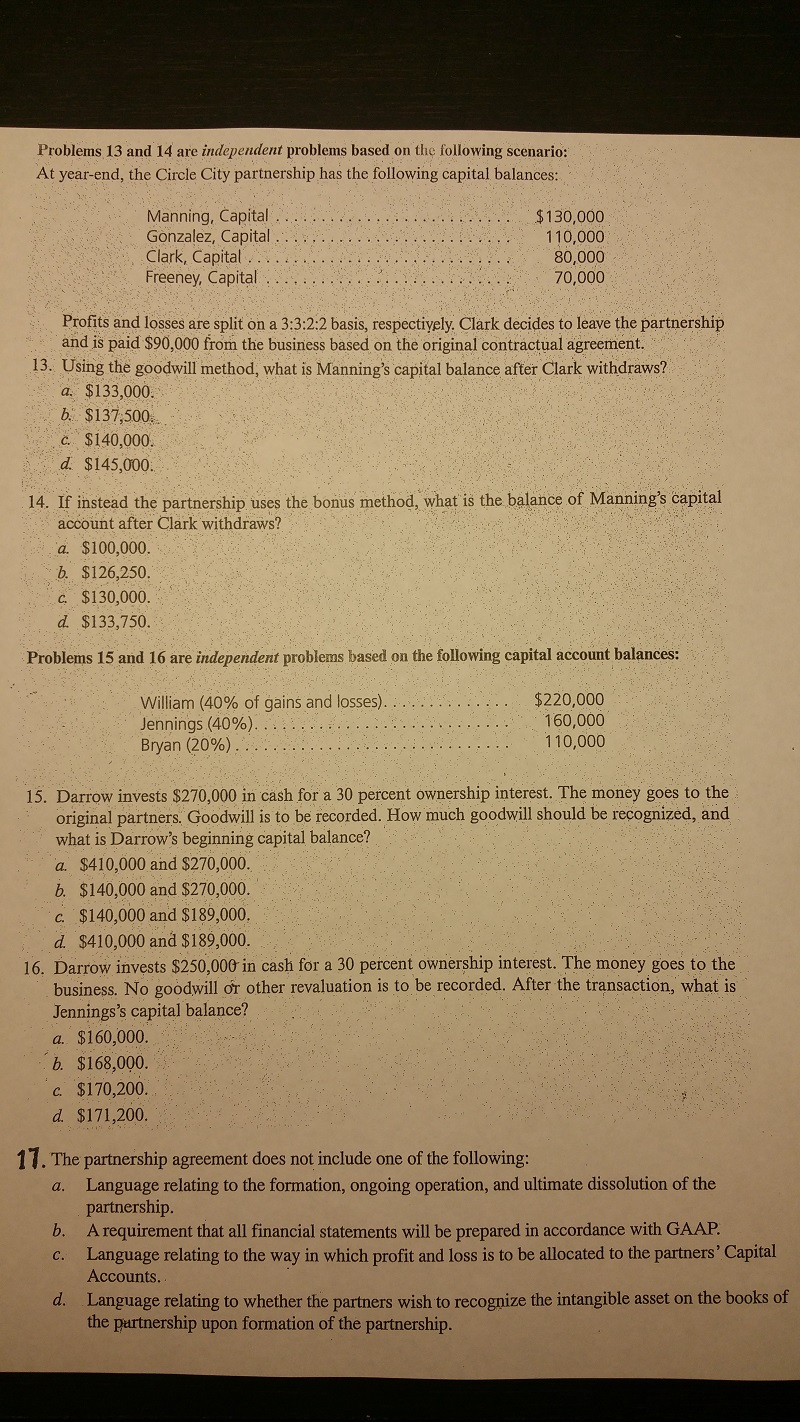

Problems 13 and 14 are independent problems based on the following scenario: At year-end, the Circle City partnership has the following capital balances: Profits and losses are split on a 3:3:2:2 basis, respectively. Clark decides to leave the partnership and is paid S90,000 from the business based on the original contractual agreement. 13. Using the goodwill method, what is Manning's capital balance after Clark withdraws? a.$133,000 b. $137,500:. c. $140,000. ; d. $145,000 14. If instead the partnership uses the bonus method, what is the balance of Manning's capital account after Clark withdraws? a. $100,000. b. $126,250. c. $130,000. d. $133,750. Problems 15 and 16 are independent problems based on the following capital account balances: 15. Darrow invests $270,000 in cash for a 30 percent ownership interest. The money goes to the original partners. Goodwill is to be recorded. How much goodwill should be recognized, and what is Darrow's beginning capital balance? a. $410,000 and $270,000. b. $140,000 and $270,000. c. $140,000 and $189,000. d $410,000 and $189,000. 16. Darrow invests $250,000 in cash for a 30 percent ownership interest. The money goes to the business. No goodwill or other revaluation is to be recorded. After the transaction, what is Jennings's capital balance? a. $160,000. 'b, $168,000. c. $170,200. d $171,200. 17. The partnership agreement does not include one of the following: a. Language relating to the formation, ongoing operation, and ultimate dissolution of the partnership. b. A requirement that all financial statements will be prepared in accordance with GAAP. c. Language relating to the way in which profit and loss is to be allocated to the partners' Capital Accounts. d. Language relating to whether the partners wish to recognize the intangible asset on the books of the partnership upon formation of the partnership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts