Question: Problems 13-2. Optimal capital budget Marble Construction estimates that its WACC is 10 percent if equity comes from retained earnings. However, if the company issues

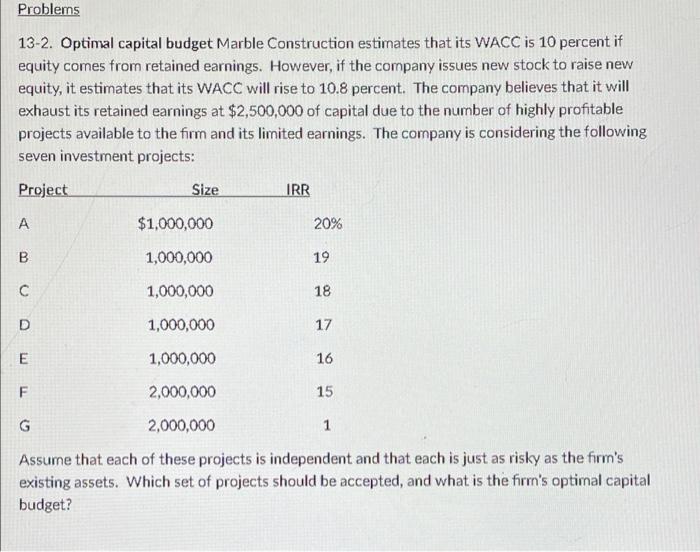

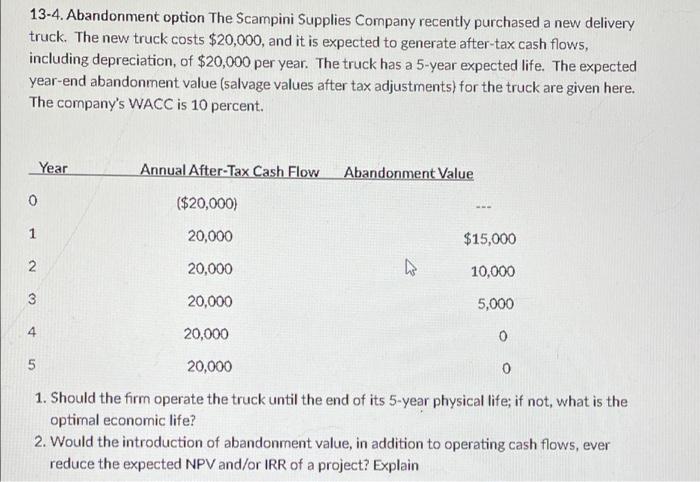

Problems 13-2. Optimal capital budget Marble Construction estimates that its WACC is 10 percent if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8 percent. The company believes that it will exhaust its retained earnings at $2,500,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company is considering the following seven investment projects: Project Size IRR A $1,000,000 20% B 1,000,000 19 C 1,000,000 18 D 1,000,000 17 E 1,000,000 16 F 2,000,000 15 1 G 2,000,000 Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted, and what is the firm's optimal capital budget? 13-4. Abandonment option The Scampini Supplies Company recently purchased a new delivery truck. The new truck costs $20,000, and it is expected to generate after-tax cash flows, including depreciation, of $20,000 per year. The truck has a 5-year expected life. The expected year-end abandonment value (salvage values after tax adjustments) for the truck are given here. The company's WACC is 10 percent. Year Annual After-Tax Cash Flow Abandonment Value 0 ($20,000) 1 20,000 $15,000 2 20,000 ho 10,000 3 20,000 5,000 4 5 20,000 0 20,000 0 1. Should the firm operate the truck until the end of its 5-year physical life; if not, what is the optimal economic life? 2. Would the introduction of abandonment value, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts