Question: Problems 5-1 FUTURE VALUE If you deposit $10,000 in a bank account that pays 10% interest annually, how much will be in your account after

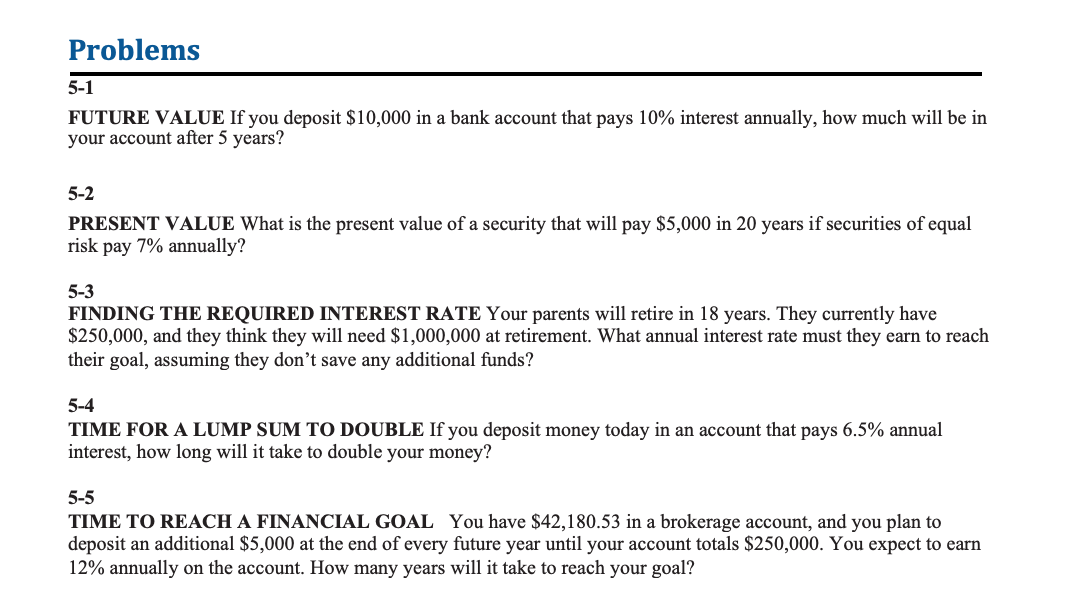

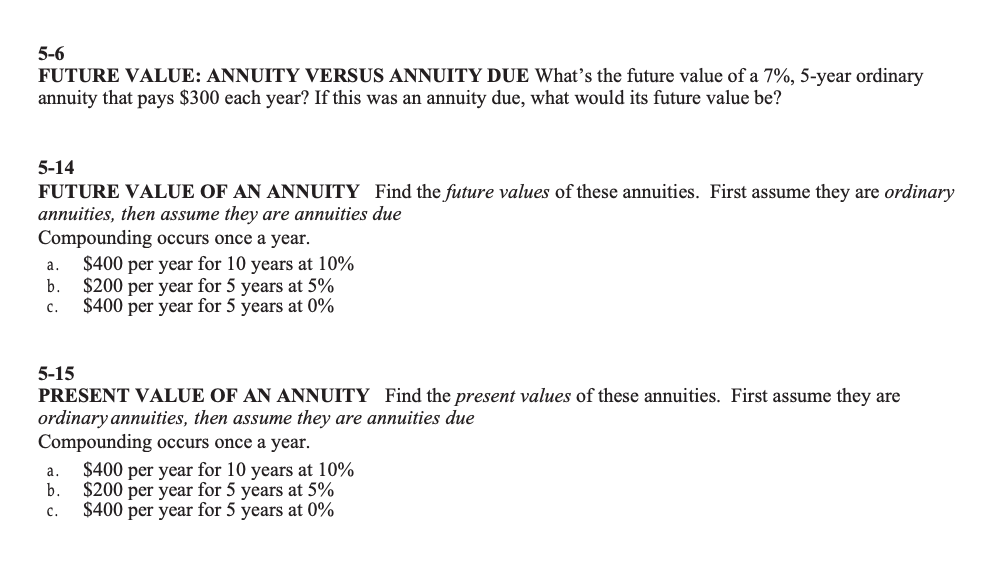

Problems 5-1 FUTURE VALUE If you deposit $10,000 in a bank account that pays 10% interest annually, how much will be in your account after 5 years? 5-2 PRESENT VALUE What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7% annually? 5-3 FINDING THE REQUIRED INTEREST RATE Your parents will retire in 18 years. They currently have $250,000, and they think they will need $1,000,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? 5-4 TIME FOR A LUMP SUM TO DOUBLE If you deposit money today in an account that pays 6.5% annual interest, how long will it take to double your money? 5-5 TIME TO REACH A FINANCIAL GOAL You have $42,180.53 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $250,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal? 5-6 FUTURE VALUE: ANNUITY VERSUS ANNUITY DUE What's the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this was an annuity due, what would its future value be? 5-14 FUTURE VALUE OF AN ANNUITY Find the future values of these annuities. First assume they are ordinary annuities, then assume they are annuities due Compounding occurs once a year. a. $400 per year for 10 years at 10% b. $200 per year for 5 years at 5% C. $400 per year for 5 years at 0% 5-15 PRESENT VALUE OF AN ANNUITY Find the present values of these annuities. First assume they are ordinary annuities, then assume they are annuities due Compounding occurs once a year. a. $400 per year for 10 years at 10% b. $200 per year for 5 years at 5% C. $400 per year for 5 years at 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts