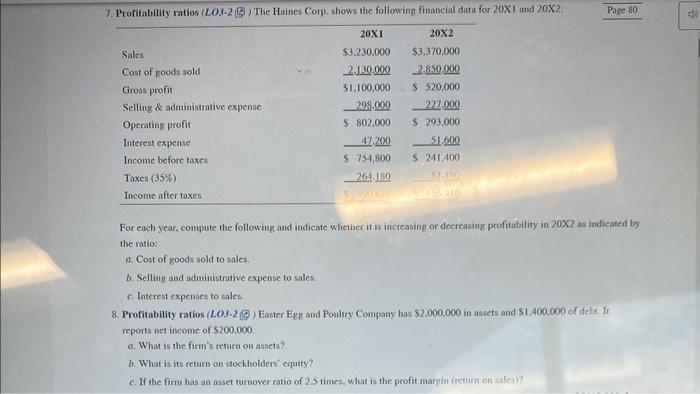

Question: Problems 7-11.. show work please! 7. Profitability ratios (LO3-2 (9)) The Haxines Corp, shows the following financial data for 201 and 202. For each year,

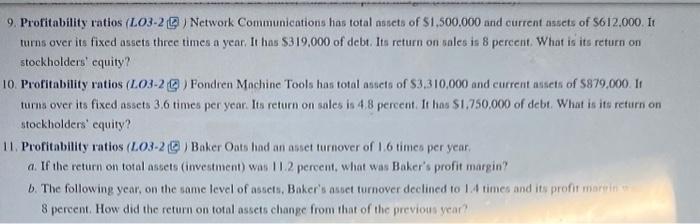

7. Profitability ratios (LO3-2 (9)) The Haxines Corp, shows the following financial data for 201 and 202. For each year, compute the following and indicate whether it is increasing or decreasing profitability in 202 as indieated by the ratio: a. Cost of goods sold to sales. b. Selling and administrative expense to sales. c. Interest expenses to sales: 8. Profitability ratios (LOs-2 (G) Easter Egg and Poultry Company has $2,000.000 in asets and 51,400,000 of debe. ff reports net income of 5200.000 . a. What is the furm's return on assets? b. What is its return on stockbolders' equity? c. If the firm has an asset turnover ratio of 2.5 times, what is the profit margin (return on ialea)? 9. Profitability ratios (LO3-2(0) Network Communications has total assets of $1,500.000 and current assets of $612.000. It Iurns over its fixed assets three times a year. It has $319,000 of debt. Its return on sales is 8 percent. What is its return on stockholders' equity? 10. Profitability ratios (LO3-2 () Fondren Machine Tools has total asiets of $3,310,000 and current assets of 5879,000 . If turis over its fixed assets 3.6 times per year. Its return on sales is 4.8 pereent. It has $1.750.000 of debt. What is ifs return on stockholders' equity? 11. Profitability ratios (L.O3-2 () ) Baker Oats had an asset turnover of 1.6 times per year. a. If the return on total assets (investment) was I1.2 pereent, what was Baker's profit margin? b. The following year, on the same level of assets, Baker's asset turnover deelined to 1.4 times and its profit marein nit 8 pereent. How did the return on total assets change from that of the previous year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts