Question: Problems 8-4, 8-6, 19 (a,b,c,d,f) on excel. please post work. 8-4 8-5 EXPECTED AND REQUIRED RATES OF RETURN Assume that the risk-free rate is 3.5%

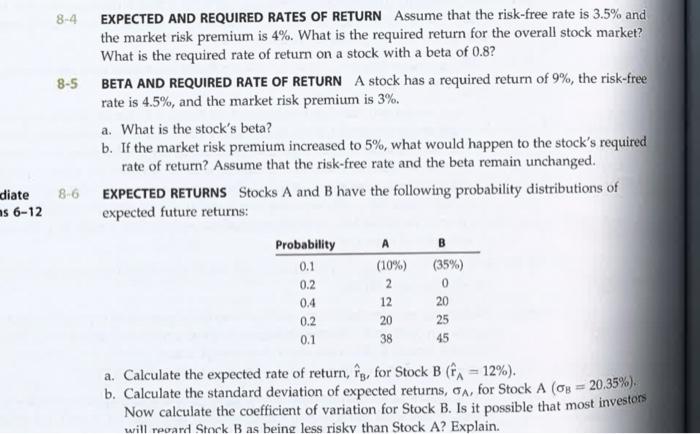

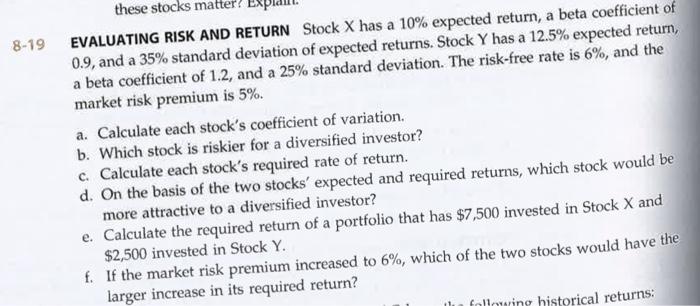

8-4 8-5 EXPECTED AND REQUIRED RATES OF RETURN Assume that the risk-free rate is 3.5% and the market risk premium is 4%. What is the required return for the overall stock market? What is the required rate of return on a stock with a beta of 0.8? BETA AND REQUIRED RATE OF RETURN A stock has a required return of 9%, the risk-free rate is 4.5%, and the market risk premium is 3%. a. What is the stock's beta? b. If the market risk premium increased to 5%, what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged. EXPECTED RETURNS Stocks A and B have the following probability distributions of expected future returns: 8-6 diate s 6-12 A B Probability 0.1 0.2 0.4 0.2 0.1 (10%) 2 12 20 38 (35%) 0 20 25 45 a. Calculate the expected rate of return, ig, for Stock B (fi = 12%). b. Calculate the standard deviation of expected returns, for Stock A (O3 = 20.35%). Now calculate the coefficient of variation for Stock B. Is it possible that most investors will recard Stock B as being less risky than Stock A? Explain. 8-19 these stocks matter EVALUATING RISK AND RETURN Stock X has a 10% expected return, a beta coefficient of 0.9, and a 35% standard deviation of expected returns. Stock Y has a 12.5% expected return, a beta coefficient of 1.2, and a 25% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. a. Calculate each stock's coefficient of variation. b. Which stock is riskier for a diversified investor? c. Calculate each stock's required rate of return. d. On the basis of the two stocks' expected and required returns, which stock would be more attractive to a diversified investor? e. Calculate the required return of a portfolio that has $7,500 invested in Stock X and $2,500 invested in Stock Y. f. If the market risk premium increased to 6%, which of the two stocks would have the larger increase in its required return? follouring historical returns: 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts