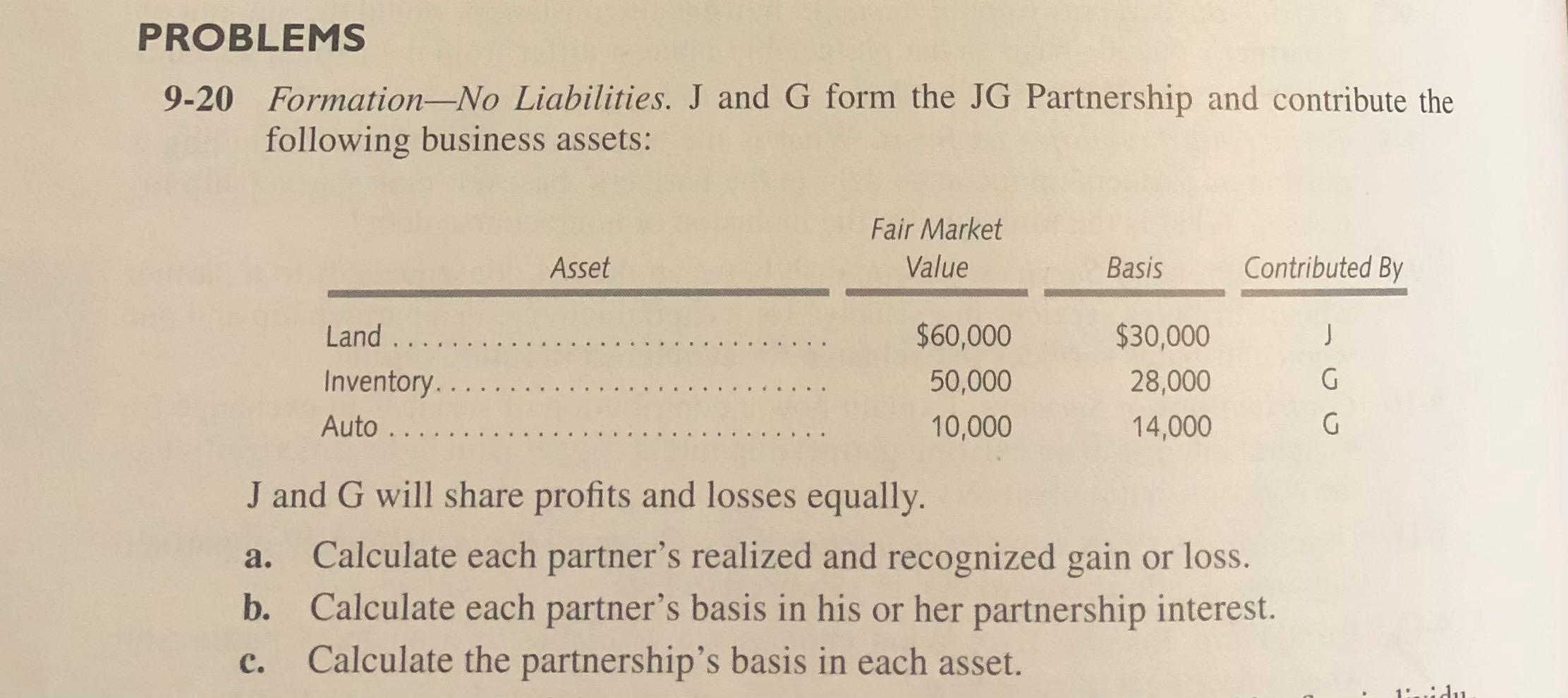

Question: PROBLEMS 9-20 Formation-No Liabilities. J and G form the JG Partnership and contribute the following business assets: Fair Market Asset Value Basis Contributed By Land.

PROBLEMS 9-20 Formation-No Liabilities. J and G form the JG Partnership and contribute the following business assets: Fair Market Asset Value Basis Contributed By Land. Inventory.. Auto .. $60,000 50,000 10,000 $30,000 28,000 14,000 G G a. J and G will share profits and losses equally. Calculate each partner's realized and recognized gain or loss. b. Calculate each partner's basis in his or her partnership interest. Calculate the partnership's basis in each asset. 1: idu PROBLEMS 9-20 Formation-No Liabilities. J and G form the JG Partnership and contribute the following business assets: Fair Market Asset Value Basis Contributed By Land. Inventory.. Auto .. $60,000 50,000 10,000 $30,000 28,000 14,000 G G a. J and G will share profits and losses equally. Calculate each partner's realized and recognized gain or loss. b. Calculate each partner's basis in his or her partnership interest. Calculate the partnership's basis in each asset. 1: idu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts