Question: Problems a-g. Showing excel functions where relevant. t INTEGRATED CASE considering expandin PAied's Fort M Prduthat you were recently hi ALLIED FOOD PROOUCTS AND CASH

Problems a-g. Showing excel functions where relevant.

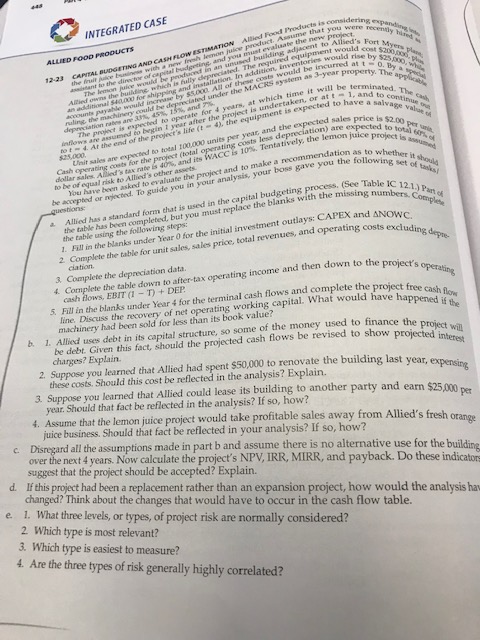

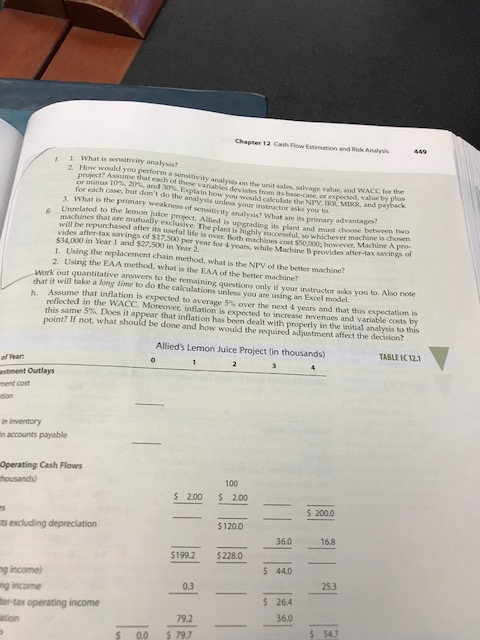

t INTEGRATED CASE considering expandin PAied's Fort M Prduthat you were recently hi ALLIED FOOD PROOUCTS AND CASH FLOW ESTIMATIon Allied Food Products is and you must evaluate the new p e required equipment woul rise by $25 000 All of these costs would be incurres ated under the MACRS system as 3-year properB lation. In addition, inventories would rs The lemon ted. The cash continue unts payahle would increase by 550 nuling, the machinery could be oject is undertaken, or at t 1 The project is expected to operate for 4 years, at which time it will be te fiows are assumed to begin 1 year after the pr At the end of the project's life (t -4), the equipment is expected to have nd to e Per sales Alled's tax rate is 40%, and its wACCs 10%. Tentatively, the lemon have been askexf to evaluate the project and to make a recommendation 3. costs less depreciation juice project is asu iul o 525,000 Unit sales are expected to toeal 100,.000 units per year, and the expected sales Cash opera costs for the project (total to be of equal risk to Allied's other assets be or necned. To guide you in your analysis. your boss gave you the followihethert Table IC 121 it sho of tasks ess. (See Allied has a standard form that is used in the capital budgeting proc the table has been completed, but you must replace the blanks with the m : CAPEX and 0wC. the table using the following steps: . Fill in the blanks under Year 0 for the initial investment price, total revenues, and operating costs excludin 2 Complete the table for unit sales, sales ciation. Complete the depreciation data project's *. Complete the table down to after-tax operating income and then down to the cash flows, EBIT ( T)+DEP Fill in the blanks under Year 4 for the terminal cash flows and complete the project f line. Discuss the recovery of net operating working capital. What would have ha machinery had been sold for less than its book value? happened if the Allied uses debt in its capital structure, so some of the money used to finance be debt. Given this fact, should the projected cash flows be revised to show charges? Explain 2. Suppose you learned that Allied had spent $50,000 to renovate the building last year these costs. Should this cost be 3. Suppose you learned that Allied could lease its building to another party and earn $25.0 year. Should that fact be reflected in the analysis? If so, how? 4. Assume that the lemon juice project would take profitable sales away from Allied's fresh per juice business. Should that fact be reflected in your analysis? If so, how? Disngard all the assumptions made in part b and assume there is no alternative use for the buildine over the next 4 years. Now calculate the project's NPV, IRR, MIRR, and payback. Do these indicaton suggest that the project should be accepted? Explain. h orange d. If this project had been a replacement rather than an expansion project, how would the analysis ha changed? Think about the changes that would have to occur in the cash flow table e. 1. What three levels, or types, of project risk are normally considered? 2 Which type is most relevant? 3. Which type is easiest to measure? 4. Are the three types of risk generally highly correlated? 5 Chapter 12 Cash Flow Escimation and Risk Anahni . 1. What is sensitivity analysis? 2. How woald you perform a sensitivity analysis on the unit sales, salvage value, and WAcc for the peoject? Assume that each of these variables deviates from its base case. or or minus i and Explain how you would cakculate the NPV, IRR, MIRR, and py expected, value by plus for each case, but don't do the analysis 3. What is the primary weakness of sensitivity analysis? What are its primary advantapes? Unrelated to the lemon juice project, Allied is upgrading its plant and us ne is choser machines that are mutually exclusive. The plant is highly successful, so whichever m will be repurchased after its useful life is over. Both machines cost $50, 000: however vides after-tax savings of S17.500per year for 4 years, while Machine B provides after-tax $34,000 in Year 1 and $27,500 in Year 1. Using the replacement chain method, what is the NPV of the better machine? achine Machine A pro- provides after-tax savings of 2. Using the EAA method, what is the EAA of the better machine? Work out quantitative answers to the remaining questions only id your instructor asks you to. Also oe it will take a long time to do the calculations unless you are using an Excel model Assume reflected in the WACC. Moreov this same 5% Dos it appear that inflation has ben dealt with properly in theinitial-nalysis to th that inflation is expected to average 5% over the next 4 years and that this espectations er, inflation is expected to increase revenues and variable costs by point? If not, what should be done and how would the required adjustment affect the decision? Allied's Lemon Juice Project (in thousands) TABLE IC 12.1 estment Outlays ment cost n inventory n accounts payable Operating Cash Flows housands) 100 $2.00 S2.00- 200.0 $120.0 ts excluding depreciation 168 $199.2 $2280 $ 44.0 g income) ng income operating income ation 25.3 $ 264 360 792 54.7 $ 00 $79 t INTEGRATED CASE considering expandin PAied's Fort M Prduthat you were recently hi ALLIED FOOD PROOUCTS AND CASH FLOW ESTIMATIon Allied Food Products is and you must evaluate the new p e required equipment woul rise by $25 000 All of these costs would be incurres ated under the MACRS system as 3-year properB lation. In addition, inventories would rs The lemon ted. The cash continue unts payahle would increase by 550 nuling, the machinery could be oject is undertaken, or at t 1 The project is expected to operate for 4 years, at which time it will be te fiows are assumed to begin 1 year after the pr At the end of the project's life (t -4), the equipment is expected to have nd to e Per sales Alled's tax rate is 40%, and its wACCs 10%. Tentatively, the lemon have been askexf to evaluate the project and to make a recommendation 3. costs less depreciation juice project is asu iul o 525,000 Unit sales are expected to toeal 100,.000 units per year, and the expected sales Cash opera costs for the project (total to be of equal risk to Allied's other assets be or necned. To guide you in your analysis. your boss gave you the followihethert Table IC 121 it sho of tasks ess. (See Allied has a standard form that is used in the capital budgeting proc the table has been completed, but you must replace the blanks with the m : CAPEX and 0wC. the table using the following steps: . Fill in the blanks under Year 0 for the initial investment price, total revenues, and operating costs excludin 2 Complete the table for unit sales, sales ciation. Complete the depreciation data project's *. Complete the table down to after-tax operating income and then down to the cash flows, EBIT ( T)+DEP Fill in the blanks under Year 4 for the terminal cash flows and complete the project f line. Discuss the recovery of net operating working capital. What would have ha machinery had been sold for less than its book value? happened if the Allied uses debt in its capital structure, so some of the money used to finance be debt. Given this fact, should the projected cash flows be revised to show charges? Explain 2. Suppose you learned that Allied had spent $50,000 to renovate the building last year these costs. Should this cost be 3. Suppose you learned that Allied could lease its building to another party and earn $25.0 year. Should that fact be reflected in the analysis? If so, how? 4. Assume that the lemon juice project would take profitable sales away from Allied's fresh per juice business. Should that fact be reflected in your analysis? If so, how? Disngard all the assumptions made in part b and assume there is no alternative use for the buildine over the next 4 years. Now calculate the project's NPV, IRR, MIRR, and payback. Do these indicaton suggest that the project should be accepted? Explain. h orange d. If this project had been a replacement rather than an expansion project, how would the analysis ha changed? Think about the changes that would have to occur in the cash flow table e. 1. What three levels, or types, of project risk are normally considered? 2 Which type is most relevant? 3. Which type is easiest to measure? 4. Are the three types of risk generally highly correlated? 5 Chapter 12 Cash Flow Escimation and Risk Anahni . 1. What is sensitivity analysis? 2. How woald you perform a sensitivity analysis on the unit sales, salvage value, and WAcc for the peoject? Assume that each of these variables deviates from its base case. or or minus i and Explain how you would cakculate the NPV, IRR, MIRR, and py expected, value by plus for each case, but don't do the analysis 3. What is the primary weakness of sensitivity analysis? What are its primary advantapes? Unrelated to the lemon juice project, Allied is upgrading its plant and us ne is choser machines that are mutually exclusive. The plant is highly successful, so whichever m will be repurchased after its useful life is over. Both machines cost $50, 000: however vides after-tax savings of S17.500per year for 4 years, while Machine B provides after-tax $34,000 in Year 1 and $27,500 in Year 1. Using the replacement chain method, what is the NPV of the better machine? achine Machine A pro- provides after-tax savings of 2. Using the EAA method, what is the EAA of the better machine? Work out quantitative answers to the remaining questions only id your instructor asks you to. Also oe it will take a long time to do the calculations unless you are using an Excel model Assume reflected in the WACC. Moreov this same 5% Dos it appear that inflation has ben dealt with properly in theinitial-nalysis to th that inflation is expected to average 5% over the next 4 years and that this espectations er, inflation is expected to increase revenues and variable costs by point? If not, what should be done and how would the required adjustment affect the decision? Allied's Lemon Juice Project (in thousands) TABLE IC 12.1 estment Outlays ment cost n inventory n accounts payable Operating Cash Flows housands) 100 $2.00 S2.00- 200.0 $120.0 ts excluding depreciation 168 $199.2 $2280 $ 44.0 g income) ng income operating income ation 25.3 $ 264 360 792 54.7 $ 00 $79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts