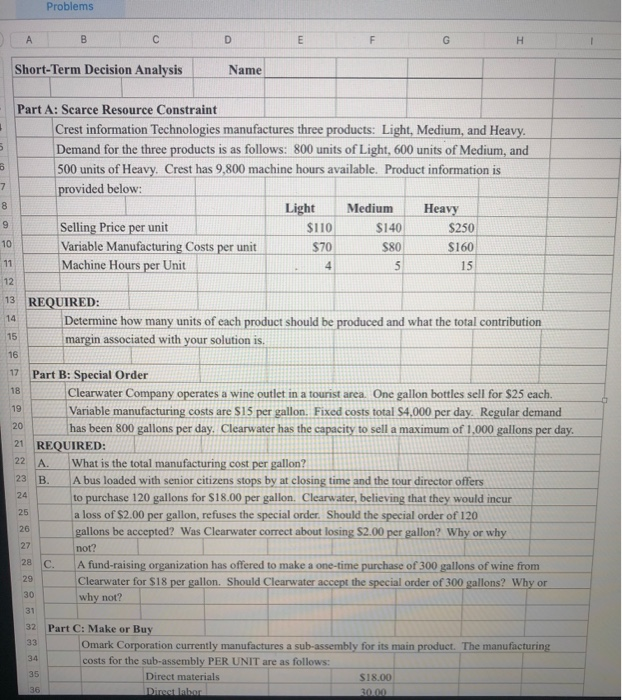

Question: Problems B D E F G H Short-Term Decision Analysis Name 5 8 7 Part A: Scarce Resource Constraint Crest information Technologies manufactures three products:

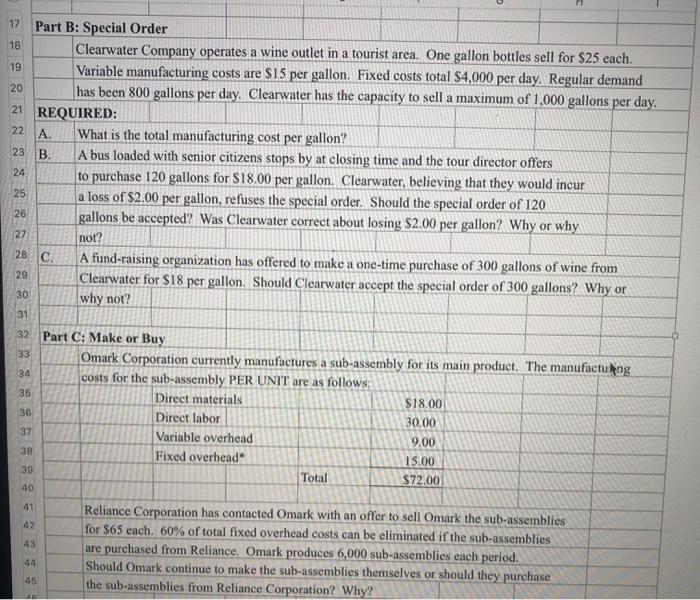

Problems B D E F G H Short-Term Decision Analysis Name 5 8 7 Part A: Scarce Resource Constraint Crest information Technologies manufactures three products: Light, Medium, and Heavy. Demand for the three products is as follows: 800 units of Light, 600 units of Medium, and 500 units of Heavy. Crest has 9,800 machine hours available. Product information is provided below: Light Medium Heavy Selling Price per unit $110 $140 $250 Variable Manufacturing Costs per unit $70 $80 $160 Machine Hours per Unit 5 15 8 9 10 11 4 12 14 15 17 18 19 20 21 A. B. 23 13 REQUIRED: Determine how many units of each product should be produced and what the total contribution margin associated with your solution is 16 Part B: Special Order Clearwater Company operates a wine outlet in a tourist area. One gallon bottles sell for $25 each. Variable manufacturing costs are $15 per gallon. Fixed costs total $4,000 per day. Regular demand has been 800 gallons per day. Clearwater has the capacity to sell a maximum of 1,000 gallons per day. REQUIRED: 22 What is the total manufacturing cost per gallon? A bus loaded with senior citizens stops by at closing time and the tour director offers to purchase 120 gallons for $18.00 per gallon. Clearwater, believing that they would incur a loss of $2.00 per gallon, refuses the special order. Should the special order of 120 gallons be accepted? Was Clearwater correct about losing $2.00 per gallon? Why or why not? C. A fund-raising organization has offered to make a one-time purchase of 300 gallons of wine from Clearwater for $18 per gallon. Should Clearwater accept the special order of 300 gallons? Why or why not? 31 32 Part C: Make or Buy 33 Omark Corporation currently manufactures a sub-assembly for its main product. The manufacturing 34 costs for the sub-assembly PER UNIT are as follows: 35 Direct materials S18.00 36 Director 30.00 24 25 26 27 28 29 30 17 18 19 20 22 25 26 27 Part B: Special Order Clearwater Company operates a wine outlet in a tourist area. One gallon bottles sell for $25 each. Variable manufacturing costs are $15 per gallon. Fixed costs total $4,000 per day. Regular demand has been 800 gallons per day. Clearwater has the capacity to sell a maximum of 1,000 gallons per day. 21 REQUIRED: A. What is the total manufacturing cost per gallon? 23 B. A bus loaded with senior citizens stops by at closing time and the tour director offers 24 to purchase 1 20 gallons for $18.00 per gallon. Clearwater, believing that they would incur a loss of $2.00 per gallon, refuses the special order. Should the special order of 120 gallons be accepted? Was Clearwater correct about losing $2.00 per gallon? Why or why not? A fund-raising organization has offered to make a one-time purchase of 300 gallons of wine from Clearwater for $18 per gallon. Should Clearwater accept the special order of 300 gallons? Why or why not? 31 32 Part C: Make or Buy 33 Omark Corporation currently manufactures a sub-assembly for its main product. The manufactung costs for the sub-assembly PER UNIT are as follows: Direct materials $18.00 Direct labor 30.00 37 Variable overhead 9.00 Fixed overhead 15.00 Total $72.00 28 C. 29 30 34 35 36 38 39 40 41 42 43 Reliance Corporation has contacted Omark with an offer to sell Omark the sub-assemblies for $65 each. 60% of total fixed overhead costs can be eliminated if the sub-assemblies are purchased from Reliance. Omark produces 6,000 sub-assemblies each period. Should Omark continue to make the sub-assemblies themselves or should they purchase the sub-assemblies from Reliance Corporation? Why? 44 45 AR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts