Question: Problems COMPREHENSIVE PROBLEM 4 Nova Company provided the following shareholders' equity on December 31, 2018: Cumulative preference share capital, P100 par, 8% 500,000 Ordinary share

Problems

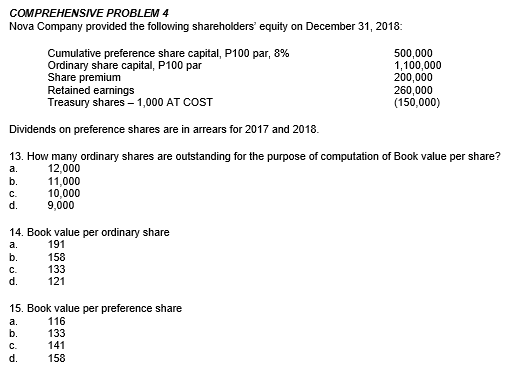

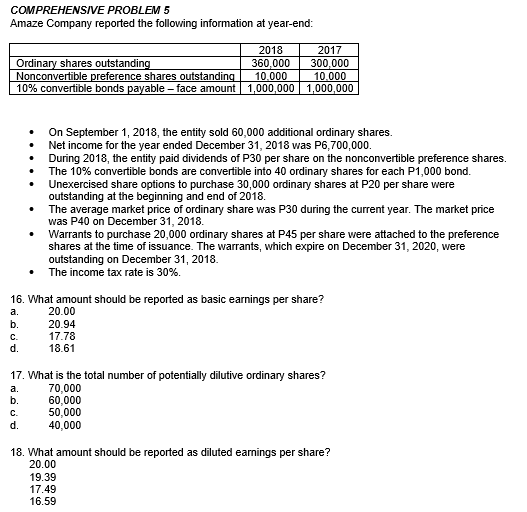

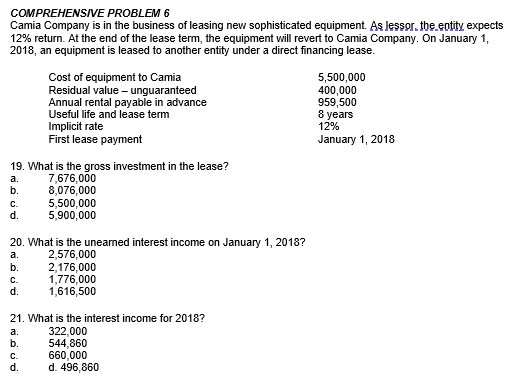

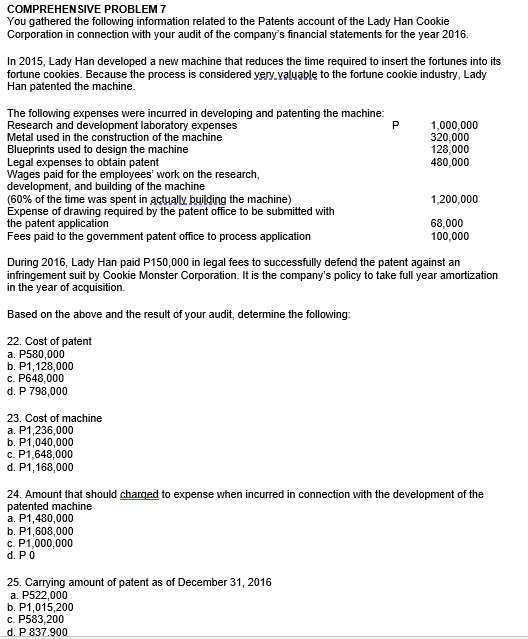

COMPREHENSIVE PROBLEM 4 Nova Company provided the following shareholders' equity on December 31, 2018: Cumulative preference share capital, P100 par, 8% 500,000 Ordinary share capital, P100 par 1,100,000 Share premium 200,000 Retained earnings 260,000 Treasury shares - 1,000 AT COST (150,000) Dividends on preference shares are in arrears for 2017 and 2018. 13. How many ordinary shares are outstanding for the purpose of computation of Book value per share? a. 12,000 b. 11,000 C. 10,000 d. 9,000 14. Book value per ordinary share a. 191 b. 158 C. 133 d 121 15. Book value per preference share a. 116 b. 133 C. 141 d. 158COMPREHENSIVE PROBLEM 5 Amaze Company reported the following information at year-end: 2018 2017 Ordinary shares outstanding 360,000 300,000 Nonconvertible preference shares outstanding 10.000 10.000 10% convertible bonds payable - face amount | 1,000,000 | 1,000,000 On September 1, 2018, the entity sold 60,000 additional ordinary shares. Net income for the year ended December 31, 2018 was P6,700,000. During 2018, the entity paid dividends of P30 per share on the nonconvertible preference shares. The 10% convertible bonds are convertible into 40 ordinary shares for each P1,000 bond Unexercised share options to purchase 30,000 ordinary shares at P20 per share were outstanding at the beginning and end of 2018 The average market price of ordinary share was P30 during the current year. The market price was P40 on December 31, 2018. Warrants to purchase 20,000 ordinary shares at P45 per share were attached to the preference shares at the time of issuance. The warrants, which expire on December 31, 2020, were outstanding on December 31, 2018. The income tax rate is 30%. 16. What amount should be reported as basic earnings per share? a. 20.00 b. 20.94 17.78 18.61 17. What is the total number of potentially dilutive ordinary shares? a. 70,000 60.000 C. 50,000 40,000 18. What amount should be reported as diluted earnings per share? 20.00 19.39 17.49 16.59COMPREHENSIVE PROBLEM 6 Camia Company is in the business of leasing new sophisticated equipment. As lessor,the entity expects 12% return. At the end of the lease term, the equipment will revert to Camia Company. On January 1, 2018, an equipment is leased to another entity under a direct financing lease. Cost of equipment to Camia 5,500,000 Residual value - unguaranteed 400,000 Annual rental payable in advance 959,500 Useful life and lease term 8 years Implicit rate 12% First lease payment January 1, 2018 19. What is the gross investment in the lease? a. 7,676,000 b. 8,076,000 C. 5,500,000 d. 5,900,000 20. What is the unearned interest income on January 1, 2018? a. 2,576,000 b. 2,176,000 C. 1,776,000 d. 1,616,500 21. What is the interest income for 2018? 3. 322,000 b. 544.860 C. 660,000 d. d. 496,860COMPREHENSIVE PROBLEM 7 You gathered the following information related to the Patents account of the Lady Han Cookie Corporation in connection with your audit of the company's financial statements for the year 2016. In 2015, Lady Han developed a new machine that reduces the time required to insert the fortunes into its fortune cookies. Because the process is considered very valuable to the fortune cookie industry, Lady Han patented the machine. The following expenses were incurred in developing and patenting the machine: Research and development laboratory expenses P 1,000,000 Metal used in the construction of the machine 320,000 Blueprints used to design the machine 128,000 Legal expenses to obtain patent 480,000 Wages paid for the employees' work on the research, development, and building of the machine (60% of the time was spent in actually building the machine) 1,200,000 Expense of drawing required by the patent office to be submitted with the patent application 68,000 Fees paid to the government patent office to process application 100,000 During 2016, Lady Han paid P150,000 in legal fees to successfully defend the patent against an infringement suit by Cookie Monster Corporation. It is the company's policy to take full year amortization in the year of acquisition. Based on the above and the result of your audit, determine the following: 22. Cost of patent a. P580,000 b. P1,128,000 C. P648,000 d. P 798,000 23. Cost of machine a. P1,236,000 b. P1,040,000 C. P1,648,000 d. P1,168,000 24. Amount that should charged to expense when incurred in connection with the development of the patented machine a. P1,480,000 b. P1,608,000 C. P1,000,000 d. PO 25. Carrying amount of patent as of December 31, 2016 a. P522,000 b. P1,015,200 C. P583,200 d. P 837.900