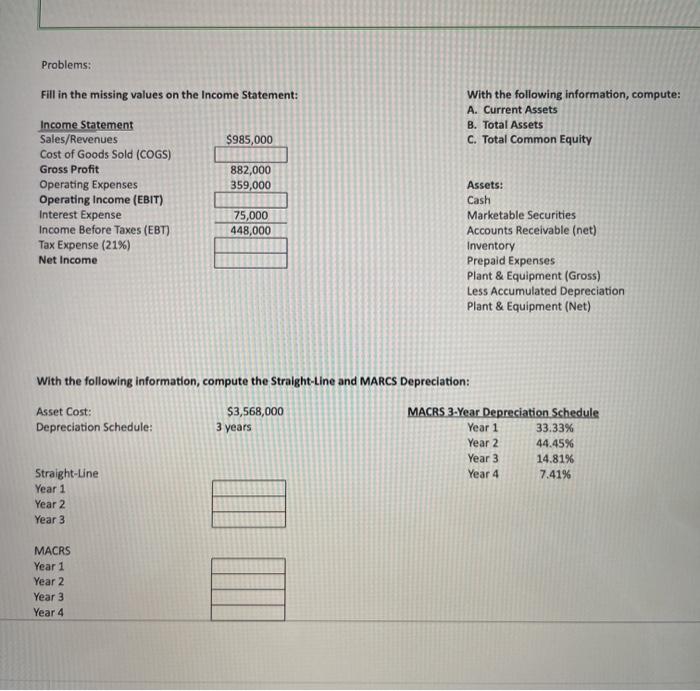

Question: Problems: Fill in the missing values on the Income Statement: With the following information, compute: A. Current Assets B. Total Assets C. Total Common

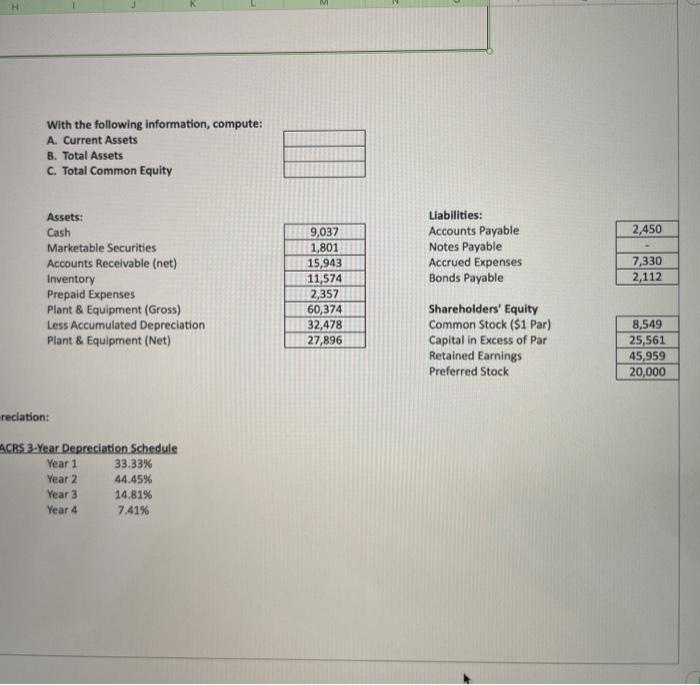

Problems: Fill in the missing values on the Income Statement: With the following information, compute: A. Current Assets B. Total Assets C. Total Common Equity Income Statement Sales/Revenues $985,000 Cost of Goods Sold (COGS) Gross Profit 882,000 Operating Expenses 359,000 Operating Income (EBIT) Interest Expense 75,000 Income Before Taxes (EBT) 448,000 Tax Expense (21%) Net Income Assets: Cash Marketable Securities Accounts Receivable (net) Inventory Prepaid Expenses Plant & Equipment (Gross) Less Accumulated Depreciation Plant & Equipment (Net) With the following information, compute the Straight-Line and MARCS Depreciation: Asset Cost: Depreciation Schedule: $3,568,000 3 years Straight-Line Year 1 Year 2 Year 3 MACRS Year 1 Year 2 Year 3 Year 4 MACRS 3-Year Depreciation Schedule Year 1 33.33% Year 2 44.45% Year 3 14.81% Year 4 7.41%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts