Question: Problems for Lecture 14 1. Consider a 6-month forward contract delivers one unit of the security) on a security that is expected to pay a

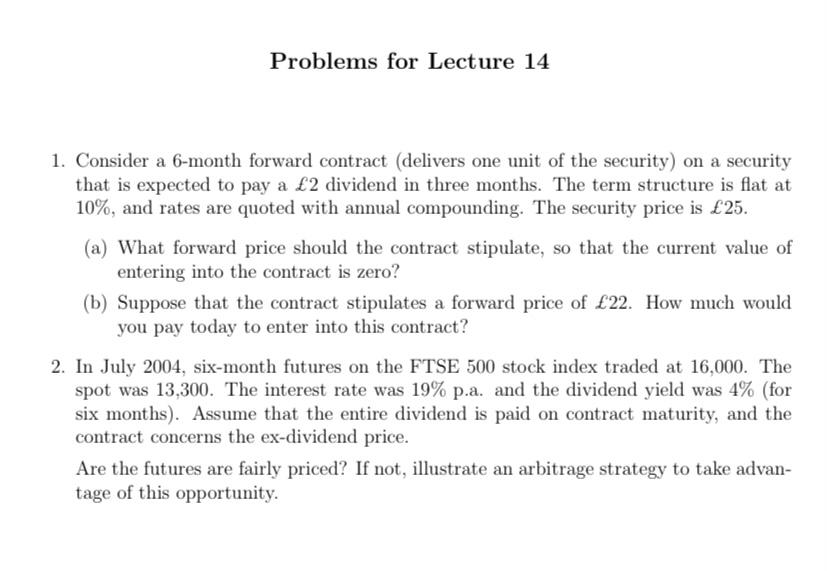

Problems for Lecture 14 1. Consider a 6-month forward contract delivers one unit of the security) on a security that is expected to pay a 2 dividend in three months. The term structure is flat at 10%, and rates are quoted with annual compounding. The security price is 25. (a) What forward price should the contract stipulate, so that the current value of entering into the contract is zero? (b) Suppose that the contract stipulates a forward price of 22. How much would you pay today to enter into this contract? 2. In July 2004, six-month futures on the FTSE 500 stock index traded at 16,000. The spot was 13,300. The interest rate was 19% p.a. and the dividend yield was 4% (for six months). Assume that the entire dividend is paid on contract maturity, and the contract concerns the ex-dividend price. Are the futures are fairly priced? If not, illustrate an arbitrage strategy to take advan- tage of this opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts