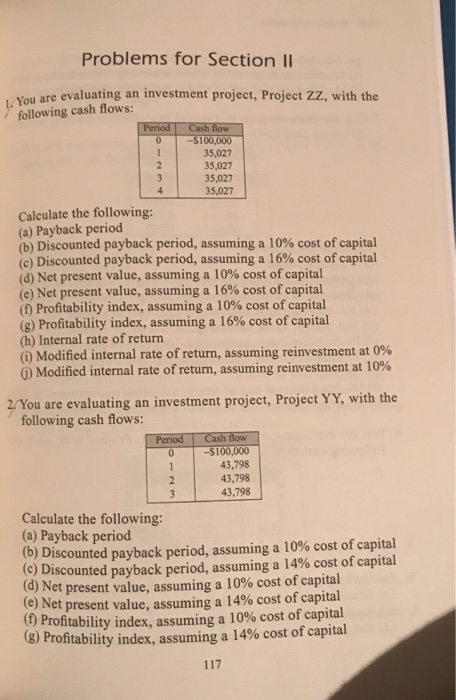

Question: Problems for Section II You are evaluating an investment project, Project ZZ, with the following cash flows: Period Cash flow 0$100,000 35,027 35,027 35,027 35,027

Problems for Section II You are evaluating an investment project, Project ZZ, with the following cash flows: Period Cash flow 0$100,000 35,027 35,027 35,027 35,027 Calculate the following: (a) Payback period (b) Discounted payback period, assuming a 10% cost of capital (c) Discounted payback period, assuming a 16% cost of capital (d) Net present value, assuming a 10% cost of capital (e) Net present value, assuming a 16% cost ofcapital (f) Profitability index, assuming a 10% cost of capital (g) Profitability index, assuming a 16% cost of capital (h) Internal rate of return (i) Modified internal rate of return, assuming reinvestment at 0% (j) Modified internal rate of return, assuming reinvestment at 10% 2/ You are evaluating an investment project, Project YY, with the following cash flows: |Period-1-Cashflow -$100,000 43,798 43,798 43,798 Calculate the following: (a) Payback period b) Discounted payback period, assuming a 10% cost of capital (c) Discounted payback period, assuming a 14% cost of capital et present value, assuming a 10% cost of capital et present value, assuming a 14% cost of capital Profitability index, assuming a 10% cost of capital (g) Profitability index, assuming a 14% cost of capital (d) N (e) N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts