Question: Problems General Cereal common stock dividends have been growing at an annual rate of percent per year over the past 10 years. Current dividends are

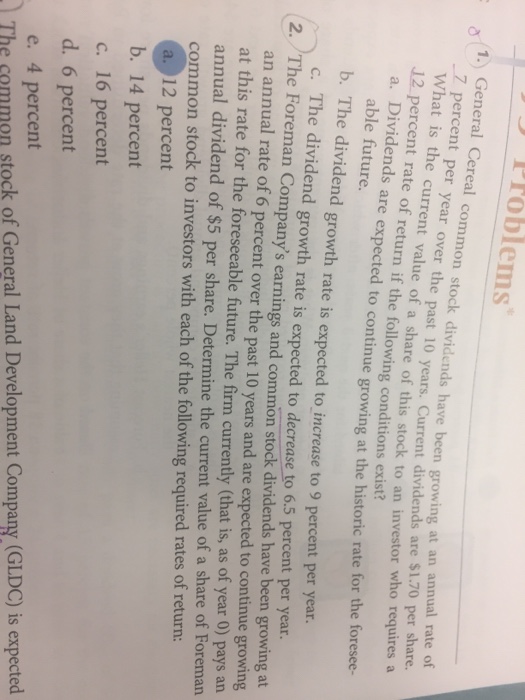

Problems General Cereal common stock dividends have been growing at an annual rate of percent per year over the past 10 years. Current dividends are $1.70 per share. What is the current value of a share of this stock to an investor who requires a 12 percent rate of return if the following conditions exist? a. Dividends ar e expected to continue growing at the historic rate for the foresee- able future. b. The dividend growth rate is expected to increase to 9 percent per year. c. The dividend growth rate is expected to decrease to 6.5 percent per year. 2. The Foreman Company's earnings and common stock dividends have been growing at an annual rate of 6 percent over the past 10 years and are expected to continue growing at this rate for the foreseeable future. The firm currently (that is, as of year 0) pays an annual dividend of $5 per share. Determine the current value of a share of Foreman common stock to investors with each of the following required rates of return: a 12 percent b. 14 percent c. 16 percent d. 6 percent e. 4 percent The cemmen stock of General Land Development Company (GLDC) is expected Problems General Cereal common stock dividends have been growing at an annual rate of percent per year over the past 10 years. Current dividends are $1.70 per share. What is the current value of a share of this stock to an investor who requires a 12 percent rate of return if the following conditions exist? a. Dividends ar e expected to continue growing at the historic rate for the foresee- able future. b. The dividend growth rate is expected to increase to 9 percent per year. c. The dividend growth rate is expected to decrease to 6.5 percent per year. 2. The Foreman Company's earnings and common stock dividends have been growing at an annual rate of 6 percent over the past 10 years and are expected to continue growing at this rate for the foreseeable future. The firm currently (that is, as of year 0) pays an annual dividend of $5 per share. Determine the current value of a share of Foreman common stock to investors with each of the following required rates of return: a 12 percent b. 14 percent c. 16 percent d. 6 percent e. 4 percent The cemmen stock of General Land Development Company (GLDC) is expected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts