Question: Problems Help Save &Exit Submit Check my work Madeline Rollins is trying to decide whether she can afford a loan she needs in order to

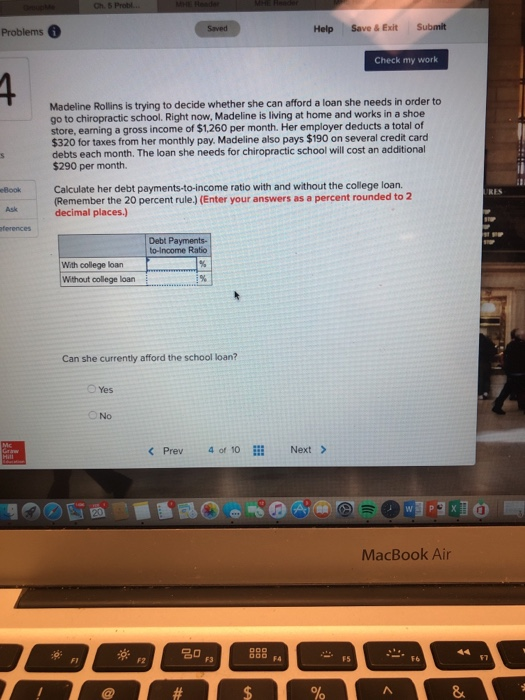

Problems Help Save &Exit Submit Check my work Madeline Rollins is trying to decide whether she can afford a loan she needs in order to go to chiropractic school. Right now, Madeline is living at home and works in a shoe stor e, earning a gross income of $1,260 per month. Her employer deducts a total of $320 for taxes from her monthly pay. Madeline also pays $190 on several credit card debts each month. The loan she needs for chiropractic school will cost an additional $290 per month. Calculate her debt payments-to-income ratio with and without the college loan. Remember the 20 percent rule.) (Enter your answers as a percent rounded to 2 decimal places.) Ask Debt Payments- to-Income Ratio With college loan Without college loan Can she currently afford the school loan? Yes MacBook Air 8 FA FI F2 F3 F5 F6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts