Question: Problems I need help with... On August 2, Jun Company receives a $7,600,90-day, 14.5% note from customer Ryan Albany as payment on his $7,600 account

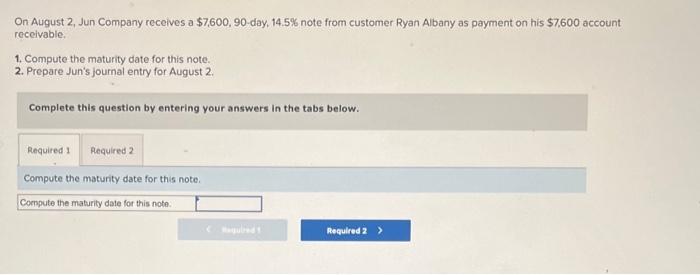

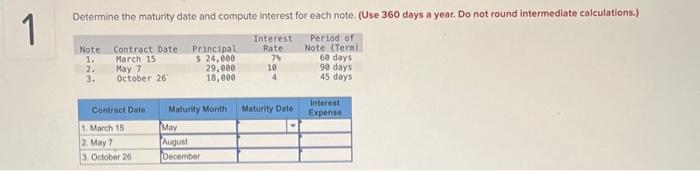

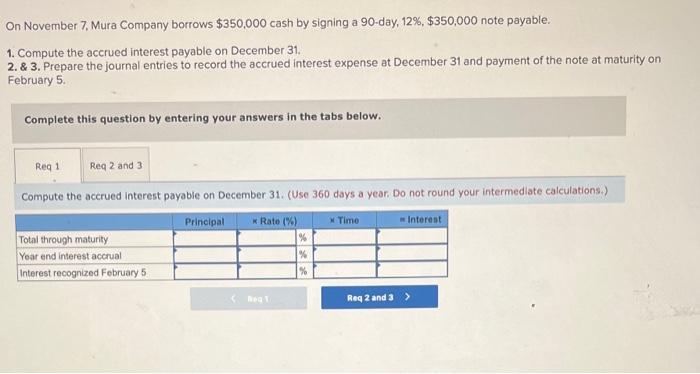

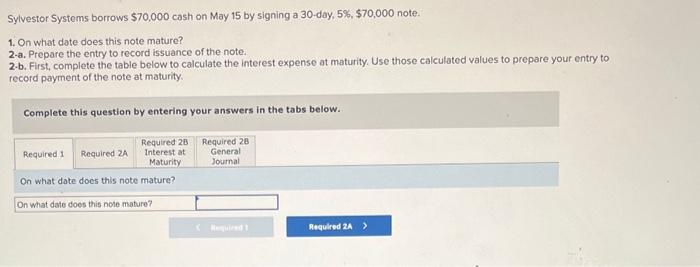

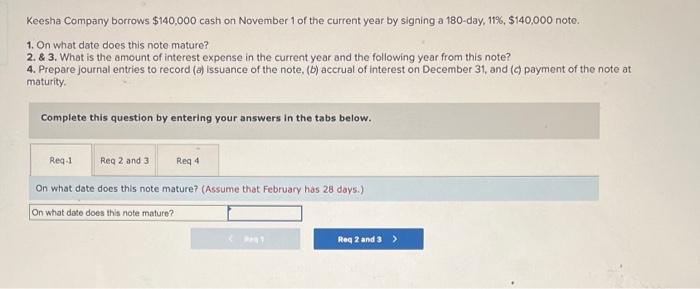

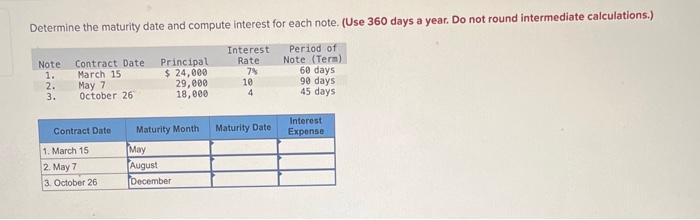

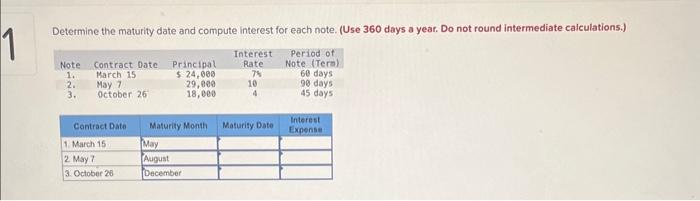

On August 2, Jun Company receives a $7,600,90-day, 14.5% note from customer Ryan Albany as payment on his $7,600 account receivable. 1. Compute the maturity date for this note. 2. Prepare Jun's journal entry for August 2 . Complete this question by entering your answers in the tabs below. Compute the maturity date for this note. Determine the maturity date and compute interest for each note. (Use 360 days a year. Do not round intermediate calculations.) \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Contract Date } & \multicolumn{1}{|l|}{ Maturity Momth } & Maturity Date & \multicolumn{1}{|c|}{ Interest Expense } \\ \hline 1. March 15 & May & & & \\ \hline 2. May 7 & August & & \\ \hline 3. Octobor 20 & December & & \\ \hline \end{tabular} On November 7, Mura Company borrows $350,000 cash by signing a 90 -day, 12%,$350,000 note payable. 1. Compute the accrued interest payable on December 31. 2. \& 3. Prepare the journal entries to record the accrued interest expense at December 31 and payment of the note at maturity on February 5. Complete this question by entering your answers in the tabs below. Compute the accrued interest payable on December 31. (Use 360 days a year. Do not round your intermediate calculations.) Sylvestor Systems borrows $70,000 cash on May 15 by signing a 30-day, 5%,$70,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2.b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. On what dote does this note mature? Keesha Company borrows $140,000 cash on November 1 of the current year by signing a 180-day, 11%,$140,000 note. 1. On what date does this note mature? 2. \& 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note a maturity. Complete this question by entering your answers in the tabs below. On what date does this note mature? (Assume that February has 28 days.) Determine the maturity date and compute interest for each note. (Use 360 days a year. Do not round intermediate calculations.) Determine the maturity date and compute interest for each note. (Use 360 days a year. Do not round intermediate caiculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts