Question: Problems i Saved Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax

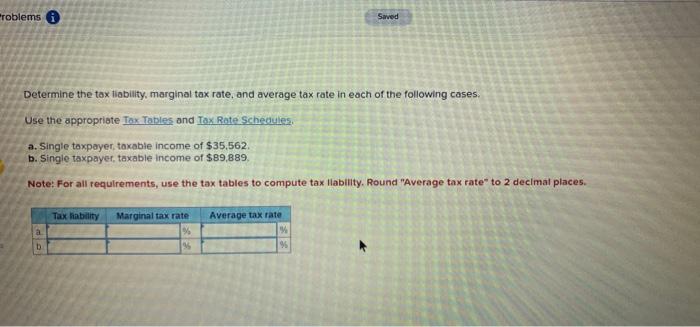

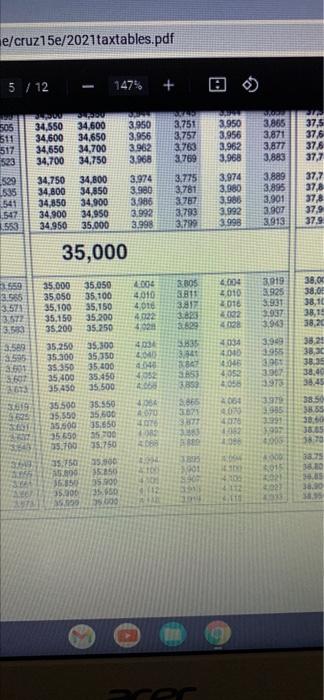

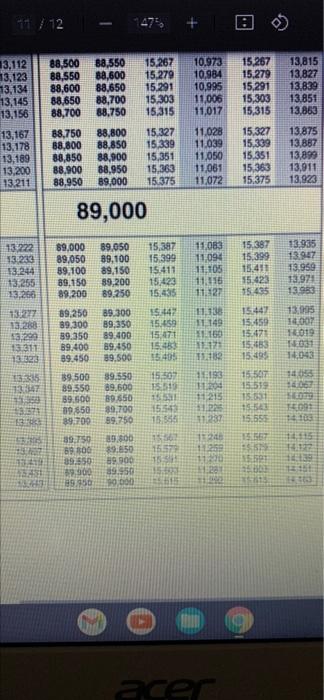

Problems i Saved Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Single taxpayer, taxable income of $35,562. b. Single taxpayer, taxable income of $89,889. Note: For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places. Tax liability Marginal tax rate Average tax rate a % b 96

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock