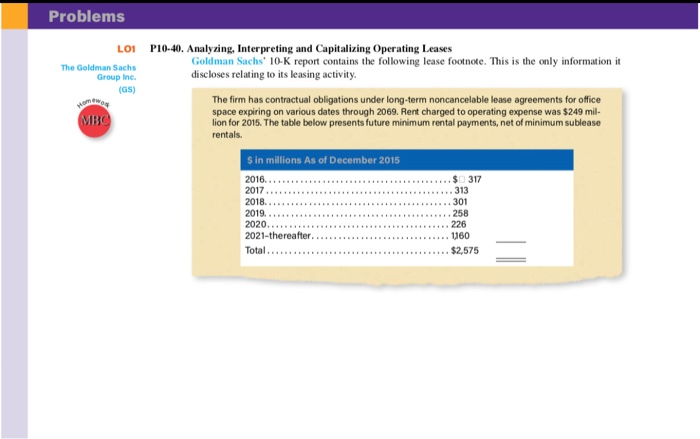

Question: Problems LO1 P10-40. Analyzing, Interpreting and Capitalizing Operating Leases Goldman Sachs' 10-K report contains the following lease footnote. This is the only information it discloses

Problems LO1 P10-40. Analyzing, Interpreting and Capitalizing Operating Leases Goldman Sachs' 10-K report contains the following lease footnote. This is the only information it discloses relating to its leasing activity. The Goldman Sachs Group Inc. (OS) MBC The firm has contractual obligations under long-term noncancelable lease agreements for office space expiring on various dates through 2069. Rent charged to operating expense was $249 mil- lion for 2015. The table below presents future minimum rental payments, net of minimum sublease rentals. $ in millions As of December 2015 2016... S317 313 2017 301 258 2018 2019 2020.......... 2021-thereafter. Total... 226 1160 $2,575 Module 10 Leases, Pensions, and Income Taxes 10-52 Required a. What lease assets and lease liabilities does Goldman Sachs report on its balance sheet? How do we know? b. What effect does the lease classification have on Goldman Sachs balance sheet? Over the life of the lease, what effect does this classification have on the company's net income? c. Using a 6% discount rate and rounding the remaining lease life to the nearest whole year, estimate the assets and liabilities that Goldman Sachs fails to report as a result of its off-balance-sheet lease financing What adjustments would we consider to Goldman Sachs'income statement corresponding to the adjustments we would make to its balance sheet in part? e. Indicate the direction (increase or decrease of the effect that capitalizing these leases would have on the following financial items and ratios for Goldman Sachs: retum on equity (ROE), net operat ing profit after tax (NOPAT), net operating assets (NOA), net operating profit margin (NOPM), net operating asset tumover (NOAT), and measures of financial leverage. Problems LO1 P10-40. Analyzing, Interpreting and Capitalizing Operating Leases Goldman Sachs' 10-K report contains the following lease footnote. This is the only information it discloses relating to its leasing activity. The Goldman Sachs Group Inc. (OS) MBC The firm has contractual obligations under long-term noncancelable lease agreements for office space expiring on various dates through 2069. Rent charged to operating expense was $249 mil- lion for 2015. The table below presents future minimum rental payments, net of minimum sublease rentals. $ in millions As of December 2015 2016... S317 313 2017 301 258 2018 2019 2020.......... 2021-thereafter. Total... 226 1160 $2,575 Module 10 Leases, Pensions, and Income Taxes 10-52 Required a. What lease assets and lease liabilities does Goldman Sachs report on its balance sheet? How do we know? b. What effect does the lease classification have on Goldman Sachs balance sheet? Over the life of the lease, what effect does this classification have on the company's net income? c. Using a 6% discount rate and rounding the remaining lease life to the nearest whole year, estimate the assets and liabilities that Goldman Sachs fails to report as a result of its off-balance-sheet lease financing What adjustments would we consider to Goldman Sachs'income statement corresponding to the adjustments we would make to its balance sheet in part? e. Indicate the direction (increase or decrease of the effect that capitalizing these leases would have on the following financial items and ratios for Goldman Sachs: retum on equity (ROE), net operat ing profit after tax (NOPAT), net operating assets (NOA), net operating profit margin (NOPM), net operating asset tumover (NOAT), and measures of financial leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts