Question: Problems Problem #1 (25 points total) Using the 2023 and 2024 financial data for East Bay Software Inc., given in the area shaded in green,

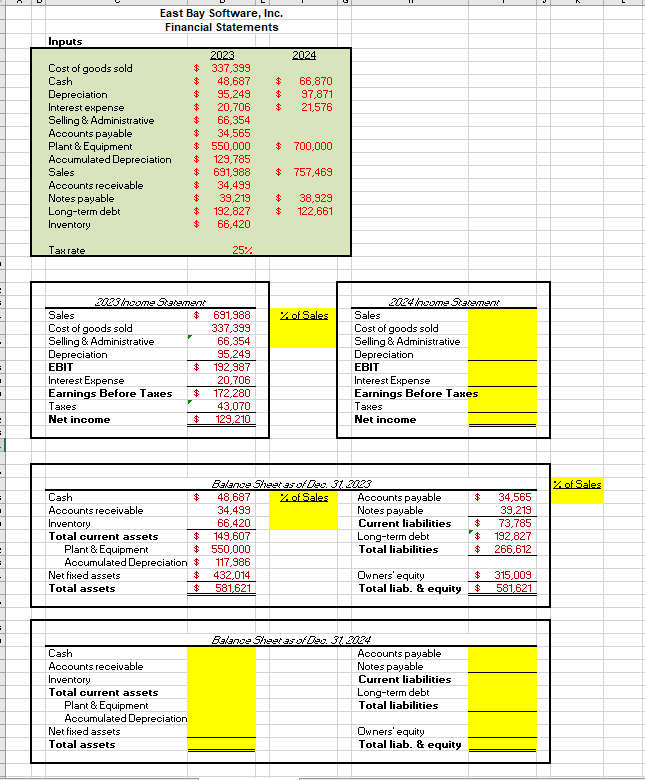

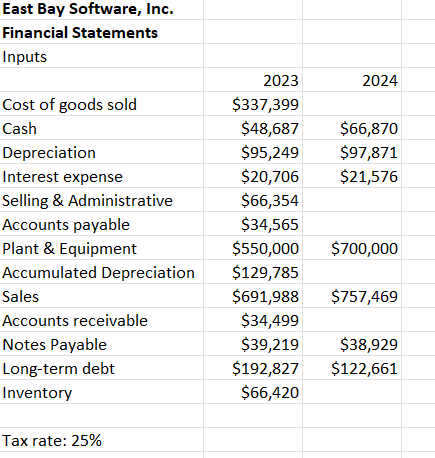

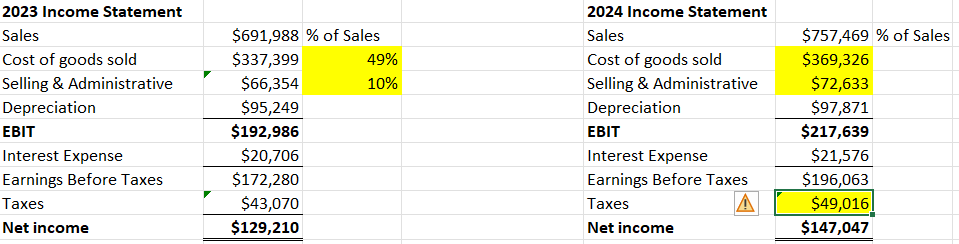

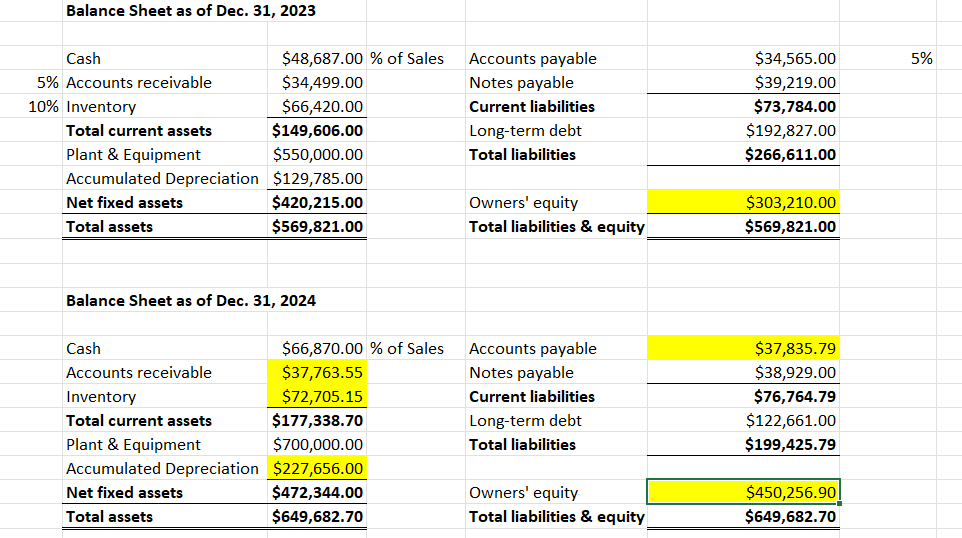

Problems Problem #1 (25 points total) Using the 2023 and 2024 financial data for East Bay Software Inc., given in the area shaded in green, complete the 2024 Income Statement and 2024 Balance Sheet. Use the Percent of Sales method we learned in class where appropriate to complete the 2024 financial statements. Please report your final answers in the yellow boxes provided. Any answers outside the yellow answer box will not be counted as answers. Points will be deducted for not following this requirement.

\fEast Bay Software, Inc. Financial Statements Inputs Cost of goods sold Cash Depreciation Interest expense Selling & Administrative Accounts payable Plant & Equipment Accumulated Depreciation Sales Accounts receivable Notes Payable Long-term debt Inventory Tax rate: 25% 2023 $337,399 $48,687 $95,249 $20,706 $66,354 $34,565 $550,000 $129,785 $691,988 $34,499 $39,219 $192,827 $66,420 2024 $66,870 $97,871 $21,576 $700,000 $757,469 $38,929 $122,661 2023 Income Statement Sales Cost of goods sold Selling & Administrative Depreciation EBIT Interest Expense Earnings Before Taxes Taxes Net income 5691,988 % of Sales $337,399 $66,354 $95,249 $192,986 $20,706 $172,280 $43,070 $129,210 49% 10% 2024 Income Statement Sales Cost of goods sold Selling & Administrative Depreciation EBIT Interest Expense Earnings Before Taxes Taxes A Net income $757,469 % of Sales $369,326 $72,633 $97,871 $217,639 $21,576 $196,063 |' 549,016_| $147,047 5% 10% Balance Sheet as of Dec. 31, 2023 Cash 548,687.00 Accounts receivable $34,499.00 Inventory 566,420.00 Total current assets Plant & Equipment $550,000.00 Accumulated Depreciation $129,785.00 Net fixed assets $420,215.00 $149,606.00 Total assets $569,821.00 Balance Sheet as of Dec. 31, 2024 Cash 566,870.00 Accounts receivable 537,763.55 Inventory $72,705.15 $177,338.70 $700,000.00 Total current assets Plant & Equipment Accumulated Depreciation $227,656.00 $472,344.00 $649,682.70 Net fixed assets Total assets % of Sales % of Sales Accounts payable Notes payable Current liabilities Long-term debt Total liabilities Owners' equity Total liabilities & equity Accounts payable Motes payable Current liabilities Long-term debt Total liabilities Owners' equity Total liabilities & equity $34,565.00 $39,219.00 $73,784.00 $192,827.00 $266,611.00 $303,210.00 $569,821.00 $37,835.79 $38,929.00 $76,764.79 $122,661.00 $199,425.79 | 5450'256'9! $649,682.70 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts