Question: PROBLEMS Problem 11-1 (AICPA Adapted) During 2020, Orca Company decided to change from the FIFO method of inventory valuation to the weighted average method. FIFO

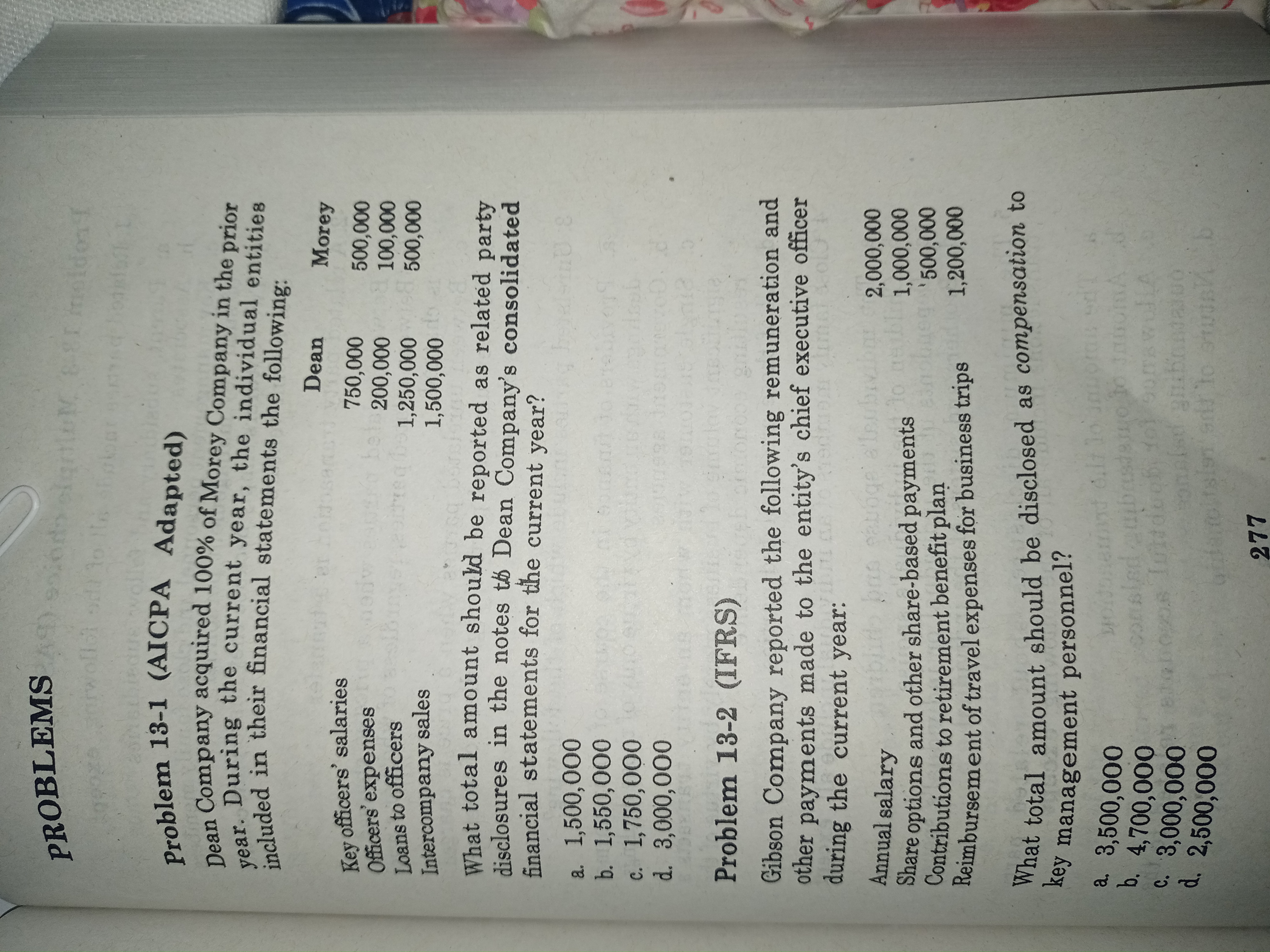

PROBLEMS Problem 11-1 (AICPA Adapted) During 2020, Orca Company decided to change from the FIFO method of inventory valuation to the weighted average method. FIFO Weighted average 7,100,000 7,700,000 January 1 7,900,000 8,300,000 December 31 In the statement of retained earnings for 2020, what amount should be reported as the pretax cumulative effect of this accounting change? 1,000,000 addition 1,000,000 deduction 600,000 addition 600,000 deduction Problem 11-2 (AICPA Adapted) Goddard Company had used the FIFO method of inventory valuation since it began operations in 2017. The entity decided to change to the weighted average method for measuring inventory at the beginning of 2020. The following schedule shows year-end inventory balances: Year FIFO Weighted average 2017 4,500,000 5,400,000 2018 7,800,000 2019 7,100,000 8,300,000 7,800,000 What pretax amount should be reported in the statement of retained earnings for 2020 as the cumulative effect of the change in accounting policy? 500,000 decrease 300,000 decrease 500,000 increase 300,000 increaseProblem 11-3 (LAA) Blue Company purchased a machine on January 1, 2017 for P6,000,000. At the date of acquisition, the machine had a life of six years with no residual value. The machine was depreciated on a straight line basis. On January 1, 2020, the entity determined that the machine had a useful life of eight years from the date of acquisition with no residual value. What is the depreciation of the machine for 2020? 750,000 600,000 375,000 500,000 Problem 11-4 (AICPA Adapted) On January 1, 2017, Flax Company purchased a machine for P5,280,000 and depreciated it by the straight line method using an estimated useful life of eight years with no residual value. On January 1, 2020, the entity determined that the machine had a useful life of six years from the date of acquisition and the residual value was P480,000. An accounting change was made in 2020 to reflect this additional information What is the accumulated depreciation for the machine on December 31, 2020? a. 2,920,000 b. 3,080,000 C. 3,200,000 d. 3,520,000Problem 12-2 (IFRS) Prob Norway Company reported that the year-end is December Elain 31, 2020 and the financial statements are authorized for showe issue on March 15, 2021. 31, 20 finan 1. On December 31, 2020, Norway Company had a receivable of P400,000 from a customer that is due 60 A fire days after the end of reporting period. On January 15, with P4,0 2021, a receiver was appointed for the said customer take The receiver informed Norway that the P400,000 would be paid in full by June 30, 2021. The be r 2. Norway Company measured share investments held for trading at fair value through profit or loss. On December Wha 31, 2020, these investments were recorded at the market fina value of P5,000,000. During the period up to February 15, 2021, there was a steady decline in the market value of all the shares in the portfolio, and on February 15, 2021, the market value had fallen to P2,000,000 3. Norway Company had reported a contingent liability on December 31, 2020 related to a court case in which Norway Company was the defendant. The case was not heard until the first week of February 2021. On March 1, 2021, the judge handed down a decision against Norway Company. The judge determined that Norway Company was liable to pay damages and costs totaling P3,000,000. On December 31, 2020, Norway Company had an account receivable from a large customer in the amount of P3,500,000. On January 31, 2021, Norway Company was advised by the liquidator of the said customer that the customer was insolvent and would be unable to repay the full amount owed to Norway Company. The liquidator advised Norway Company in writing that only 10% of the account receivable will be paid on April 30, 2021. Required: Prepare adjusting entries on December 31, 2020 to reflect the events after reporting period.Problem 12-3 (IFRS) Elaine Company prepared draft financial statements that showed the income me before tax for the year ended December 31, 2020 at P9,000,000. The board of directors authorized the financial statements for issue on March 20, 2021. A fire occurred at one of Elaine's sites on January 15, 2021 with resulting damage amounting to P7,000,000, only P4,000,000 of which is covered by insurance. The repairs will take place and be paid for in April 2021 The P4,000, 000 claim from the insurance entity will however be received on February 14, 2021. What amount should be reported as income before tax in the financial statements? 2,000,000 b. . 9,000,000 4,000,000 d. 6,000,000 Problem 12-4 (IFRS) During 2020, Marian Company was sued by a competitor for P5,000,000 for infringement of a patent. Based on the advice of the legal counsel, the entity accrued the sum of P3,000,000 as a provision in the financial statements for the year ended December 31, 2020. Subsequently, on March 15, 2021, the Supreme Court decided in favor of the party alleging infringement of the patent and ordered the defendant to pay the aggrieved party a sum of P3,500,000. The financial statements were prepared by the entity's management on February 15, 2021 and approved by the board of directors on March 31, 2021. What amount should be recognized as accrued liability on December 31, 2020 to reflact the event after reporting period? 5,000,000 3,500,000 3,000,000 OPROBLEMS & er Moldon! airwolfet odd to le obgloat gertand bookfoster Problem 13-1 (AICPA Adapted) Dean Company acquired 100% of Morey Company in the prior year. During the current year, the individual entities included in their financial statements the following: thathe er Mentosers Dean Morey Key officers' salaries 750,000 500,000 Officers' expenses be 200,000 100,000 Loans to officers 1,250,000 500,000 Intercompany sales 1,500,000 What total amount should be reported as related party disclosures in the notes to Dean Company's consolidated financial statements for the current year? a. 1,500,000 b. 1,550,000 C. 1,750,000 d. 3,000,000 Problem 13-2 (IFRS) Gibson Company reported the following remuneration and other payments made to the entity's chief executive officer during the current year: 2,000,000 Annual salary Share options and other share-based payments 1,000,000 Contributions to retirement benefit plan '500,000 Reimbursement of travel expenses for business trips 1,200,000 What total amount should be disclosed as compensation to key management personnel? a. 3,500,000 b. 4,700,000 constad ethbastergo to shootan C. 3,000,000 d. 2,500,000 277

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts