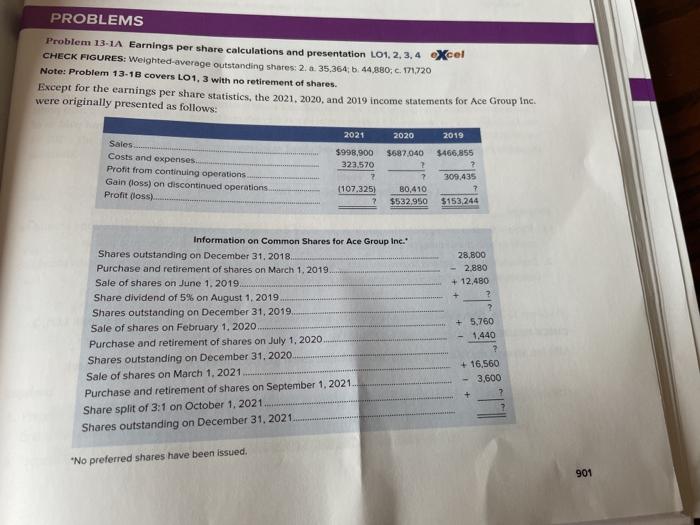

Question: PROBLEMS Problem 13-1A Earnings per share calculations and presentation LO1, 2, 3, 4 CHECK FIGURES: Weighted average outstanding shares: 2. a 35,364, 6-44,880, c. 171.720

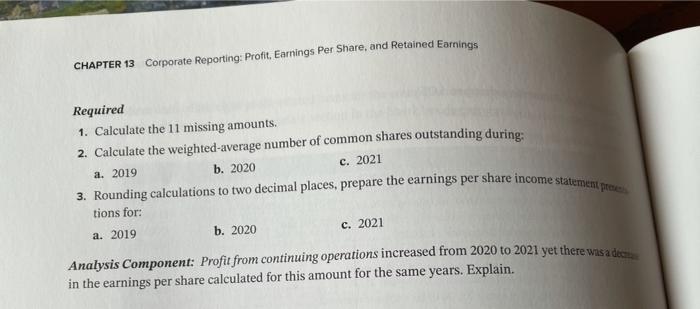

PROBLEMS Problem 13-1A Earnings per share calculations and presentation LO1, 2, 3, 4 CHECK FIGURES: Weighted average outstanding shares: 2. a 35,364, 6-44,880, c. 171.720 Note: Problem 13-18 covers LO1, 3 with no retirement of shares Except for the earnings per share statistics, the 2021, 2020, and 2019 income statements for Ace Group Inc. were originally presented as follows: Xcel 2020 2019 $687.040 $466,855 Sales Costs and expenses Profit from continuing operations Gain (loss) on discontinued operations Profit doss) 2021 $998,900 323,570 2 (107.325) 309,435 2 80,410 $532,950 $153,244 28.800 - 2.880 + 12.480 Information on Common Shares for Ace Group Inc." Shares outstanding on December 31, 2018 Purchase and retirement of shares on March 1, 2019 Sale of shares on June 1. 2019 Share dividend of 5% on August 1, 2019 Shares outstanding on December 31, 2019 Sale of shares on February 1, 2020 Purchase and retirement of shares on July 1, 2020 Shares outstanding on December 31, 2020 Sale of shares on March 1, 2021 Purchase and retirement of shares on September 1, 2021 Share split of 3:1 on October 1, 2021. Shares outstanding on December 31, 2021 2 5,760 1,440 ? + 16.560 3,600 2 "No preferred shares have been issued. 901 CHAPTER 13 Corporate Reporting: Profit, Earnings Per Share, and Retained Earnings Required 1. Calculate the 11 missing amounts. 2. Calculate the weighted-average number of common shares outstanding during: c. 2021 a. 2019 b. 2020 3. Rounding calculations to two decimal places, prepare the earnings per share income statemente tions for: b. 2020 c. 2021 a. 2019 Analysis Component: Profit from continuing operations increased from 2020 to 2021 yet there was a deci in the earnings per share calculated for this amount for the same years. Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts