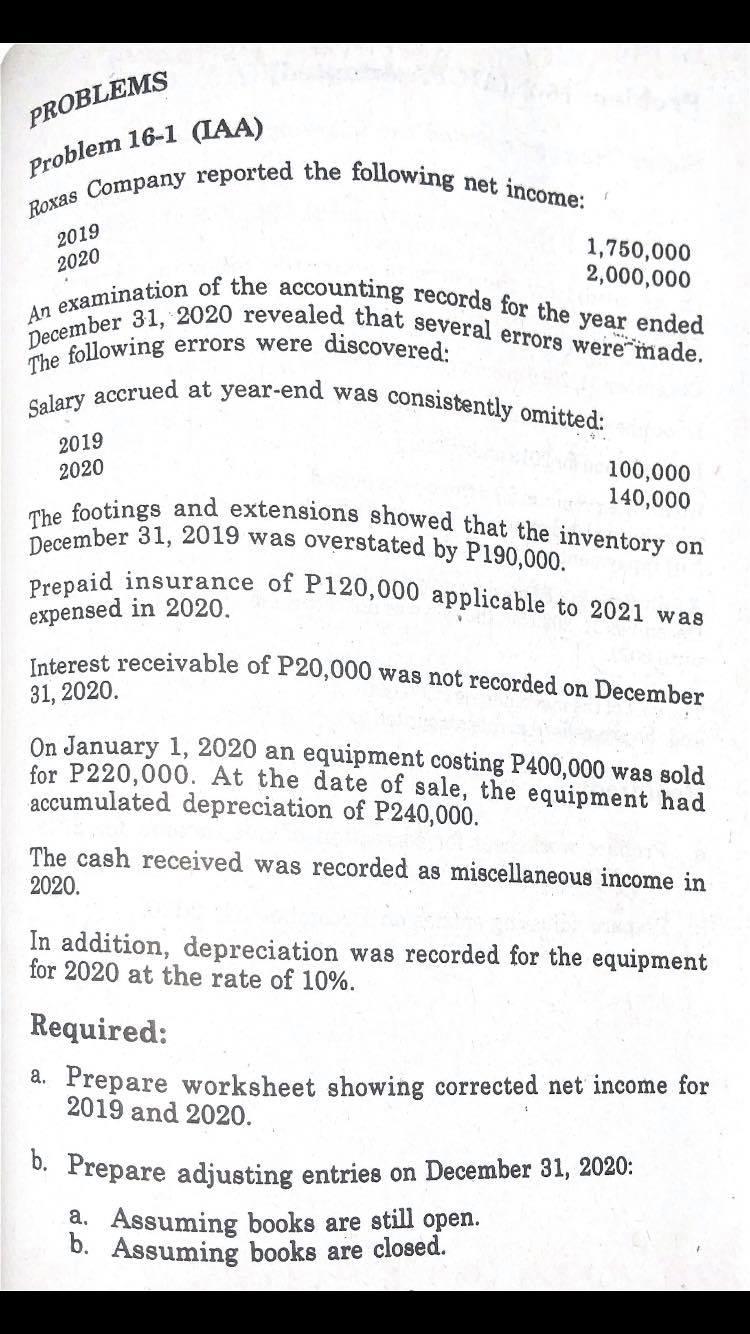

Question: PROBLEMS Problem 16-1 (IAA) Roxas Company reported the following net income: 2019 2020 1,750,000 2,000,000 An examination of the accounting records for the year ended

PROBLEMS Problem 16-1 (IAA) Roxas Company reported the following net income: 2019 2020 1,750,000 2,000,000 An examination of the accounting records for the year ended December 31, 2020 revealed that several errors were made. The following errors were discovered: Salary accrued at year-end was consistently omitted: 2019 2020 100,000 140,000 The footings and extensions showed that the inventory on December 31, 2019 was overstated by P190,000. Prepaid insurance of P120,000 applicable to 2021 was expensed in 2020. Interest receivable of P20,000 was not recorded on December 31, 2020. On January 1, 2020 an equipment costing P400,000 was sold for P220,000. At the date of sale, the equipment had accumulated depreciation of P240,000. The cash received was recorded as miscellaneous income in 2020. In addition, depreciation was recorded for the equipment for 2020 at the rate of 10%. Required: a. Prepare worksheet showing corrected net income for 2019 and 2020. b. Prepare adjusting entries on December 31, 2020: a. Assuming books are still open. b. Assuming books are closed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts