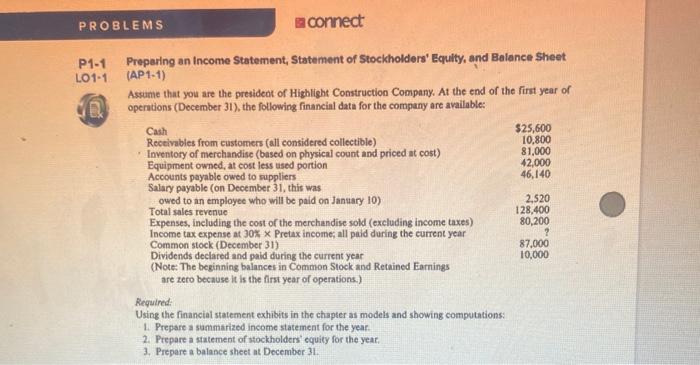

Question: PROBLEMS sconnect P1-1 101-1 D Preparing an Income Statement, Statement of Stockholders' Equity, and Balance Sheet (AP1-1) Assume that you are the president of Highlight

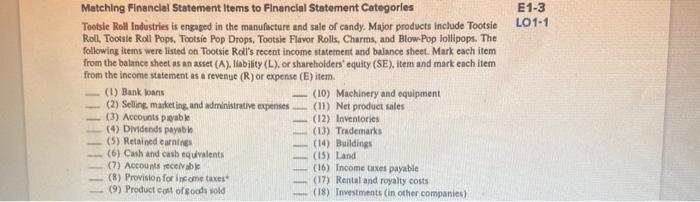

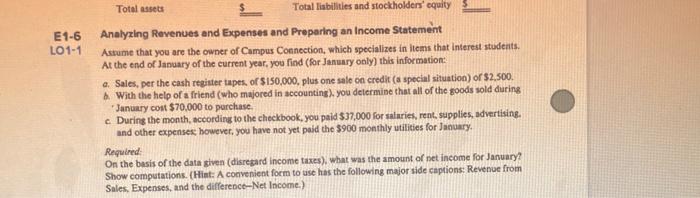

PROBLEMS sconnect P1-1 101-1 D Preparing an Income Statement, Statement of Stockholders' Equity, and Balance Sheet (AP1-1) Assume that you are the president of Highlight Construction Company. At the end of the first year of operations (December 31), the following financial data for the company are available: Cash $25,600 Receivables from customers (all considered collectible) 10.800 Inventory of merchandisc (based on physical count and priced at cost) 81,000 Equipment owned, at cost less used portion 42,000 Accounts payable owed to suppliers 46,140 Salary payable (on December 31, this was owed to an employee who will be paid on January 10) 2.520 Total sales revenue 128,400 Expenses, including the cost of the merchandise sold (excluding income taxes) 80,200 Income tax expense at 30% * Pretax income, all paid during the current year Common stock (December 31) 87.000 Dividends declared and paid during the current year 10,000 (Note: The beginning balances in common Stock and Retained Earnings are zeto because it is the first year of operations.) Required: Using the financial statement exhibits in the chapter as models and showing computations: 1. Prepare a summarized income statement for the year 2. Prepare a statement of stockholders equity for the year, 3. Prepare a balance sheet at December 31 ? E1-3 LO1-1 Matching Financial Statement Items to Financial Statement Categories Tootsie Roll Industries is engaged in the manufacture and sale of candy. Major products include Tootsie Roll, Toorsie Roll Pops. Tootsie Pop Drops, Tootsie Flavor Rolls, Charms, and Blow.Pop lollipops. The following items were listed on Tootsie Roll's recent income statement and balance sheet. Mark each item from the balance sheet as an asset (A). Hability (L), or shareholders' equity (SE), item and mark each item from the income statement as a revenue (R) or expense (E) item (1) Bank loans (10) Machinery and equipment (2) Selling marketing, and administrative expenses (11) Net product sales (3) Accounts payable (12) Inventories (4) Dividends payable (13) Trademarks (5) Retained earnings (14) Buildings (6) Cash and cash equivalent (15) Land (7) Accounts receivable (16) Income taxes payable (8) Provision for income taxes (17) Rental and royalty costs (9) Product cost of soods sold (18) Investments in other companies) Total assets Total liabilities and stockholders' equity E1-6 LO1-1 Analyzing Revenues and Expenses and Preparing an Income Statement Astume that you are the owner of Campus Connection, which specializes in items that interest students. At the end of January of the current year, you find (for January only) this information: a. Sales, per the cash register tapes of $150,000, plus one sale on credit (a special situation) of $2,500. With the help of a friend (who majored in accounting), you determine that all of the goods sold during January cost $70,000 to purchase c. During the month, according to the checkbook, you paid $37.000 for salaries, rent, supplies, advertising. and other expenses: however, you have not yet paid the $900 monthly utilities for January Required On the basis of the data given (disregard income taxes), what was the amount of net income for January Show computations. (Hint: A convenient form to use has the following major side captions: Revenue from Sales Expenses, and the difference - Net Income.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts