Question: PROBLEMS: SET A Prepare budgeted income statement and supporting budgets. (LO 2, 3) P23-1A Cook Farm Supply Company manufactures and sells a pesticide called Snare.

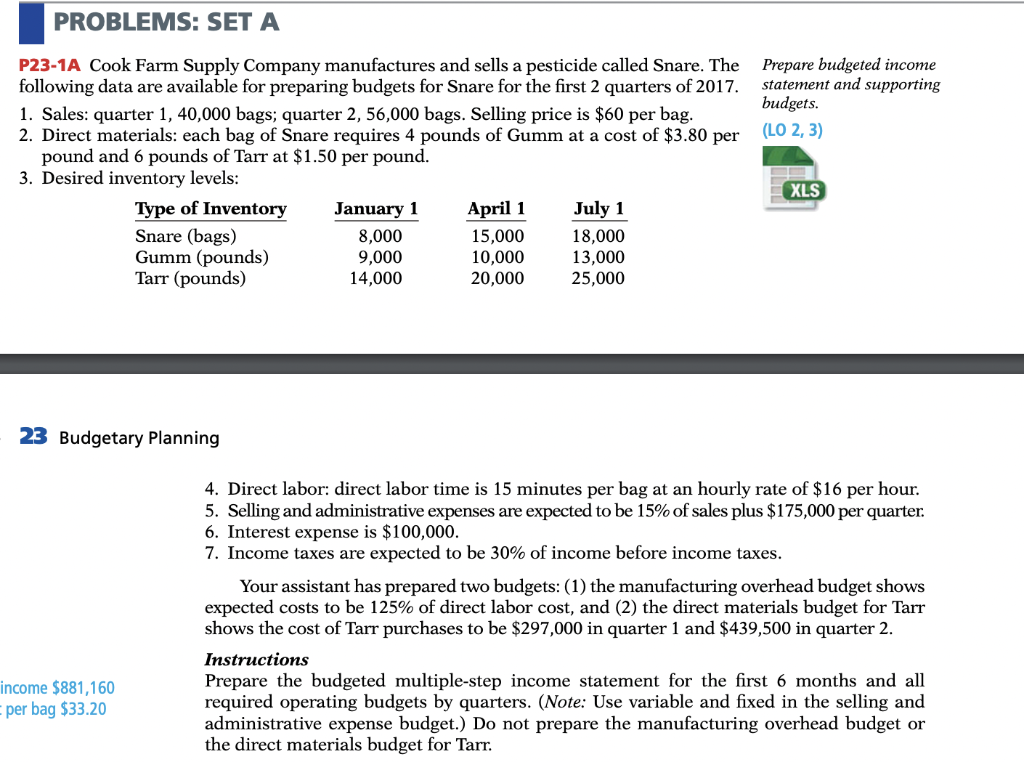

PROBLEMS: SET A Prepare budgeted income statement and supporting budgets. (LO 2, 3) P23-1A Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2017. 1. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: Type of Inventory January 1 April 1 July 1 Snare (bags) 8,000 15,000 18,000 Gumm (pounds) 9,000 10,000 13,000 Tarr (pounds) 14,000 20,000 25,000 XLS 23 Budgetary Planning 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are expected to be 15% of sales plus $175,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $297,000 in quarter 1 and $439,500 in quarter 2. Instructions Prepare the budgeted multiple-step income statement for the first 6 months and all required operating budgets by quarters. (Note: Use variable and fixed in the selling and administrative expense budget.) Do not prepare the manufacturing overhead budget or the direct materials budget for Tarr. income $881,160 per bag $33.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts