Question: PROBLEMS t 1. Suppose that on December 31, 2012 IBM issues a two-year, floating-rate bond in the amount of $100 million on which it pays

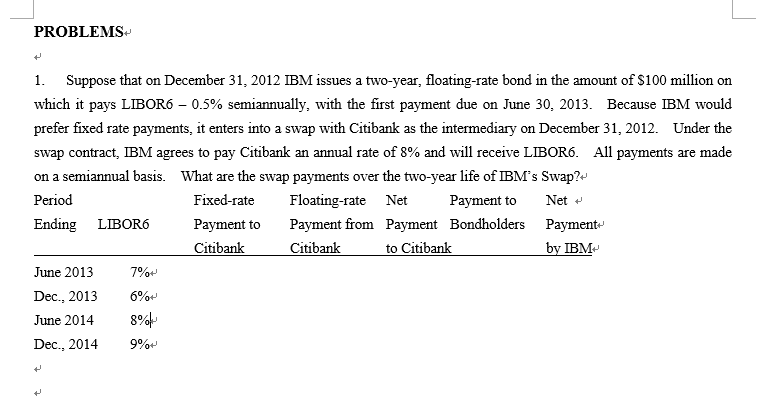

PROBLEMS t 1. Suppose that on December 31, 2012 IBM issues a two-year, floating-rate bond in the amount of $100 million on which it pays LIBOR6 0.5% semiannually, with the first payment due on June 30, 2013. Because IBM would prefer fixed rate payments, it enters into a swap with Citibank as the intermediary on December 31, 2012. Under the swap contract, IBM agrees to pay Citibank an annual rate of 8% and will receive LIBOR6. All payments are made on a semiannual basis. What are the swap payments over the two-year life of IBM's Swap? Period Fixed-rate Floating-rate Net Payment to Net + Ending LIBOR Payment to Payment from Payment Bondholders Payment- Citibank Citibank to Citibank by IBM June 2013 7% Dec., 2013 6% June 2014 8%+ Dec., 2014 9% t t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts