Question: Problems Three and Four draw from the attached financial statement excerpts for Sprouts Farmers Market, Inc. Attachments from Sprouts Farmers Market 2014 financial report (Form

Problems Three and Four draw from the attached financial statement excerpts for Sprouts Farmers Market, Inc. Attachments from Sprouts Farmers Market 2014 financial report (Form 10-K) are on pages 20 through 23 and include the following:

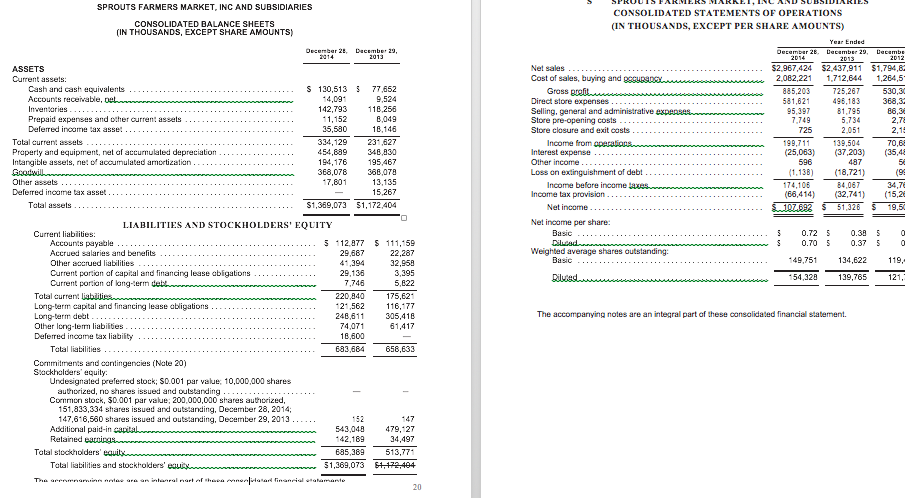

Balance Sheets

Statements of Operations

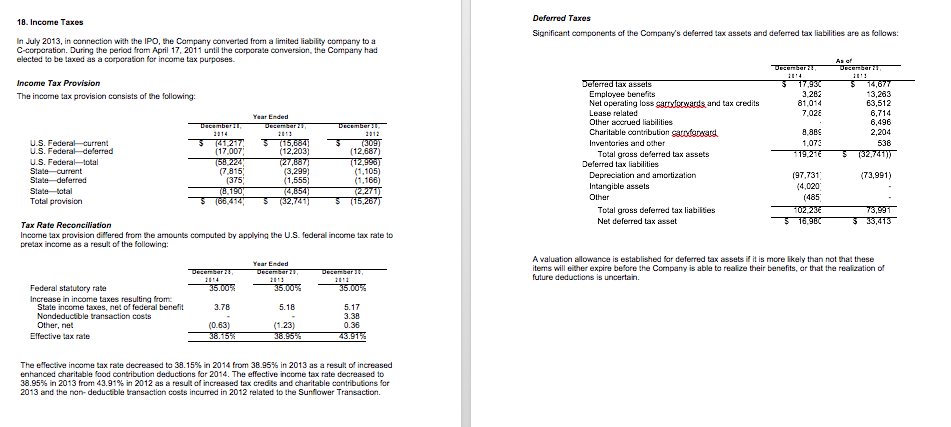

Footnote 18 on Income Taxes

Where necessary, you may assume that the marginal tax rate is equal to the statutory tax rate of 35% disclosed by Sprouts Farmers Market, Inc. in Note 18.

Required:

What is the amount of Sprouts Farmers Markets total income tax obligation to all governmental entities (that is, the amount of taxes due that would be reported on the companys tax returns) for the year ended December 28, 2014?

b) What entry was recorded by Sprouts Farmers Market to record its income tax provision for fiscal year 2014?

c) Note 18 discloses that the effective income tax rate for Sprouts Farmers Market is 38.15% for the year ended December 28, 2014. Show the calculation of this income tax rate using only information in Sprout Farmers Markets income statement.

Problem Three Deferred Income Taxes (continued):

Note: The deferred income tax example we worked through in class using coursenotes #9 (pages 35 through 37) and the analyses using the income tax disclosure on pages 45 and 46 will be useful when completing parts (d) and (e) below.

d) Assume that the statutory tax rate of 35% was used to calculate deferred tax liabilities related to depreciation and amortization.

As of December 28, 2014, which system has recognized a larger expense over time relating to depreciation and amortization: tax or financial accounting?

What is the approximate dollar magnitude of this difference?

What would be the balance in Properties and equipment, net on the balance sheet at December 28, 2014 if tax depreciation methods had been used throughout the assets lives instead of the reported methods?

SPROUTS FARMERS MARKET, INC AND SUBSIDIARIES CONSOLIDATED STATEMIENTS OF OPERATIONS CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE AMOUNTS) IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) Oecember 2, December 29 .. . Net sales Cost of sales, buying and guSrr2,082,221 1,712,644 1,264,5 ASSETS $2,967,424 $2,437,911 $1,794,8 Cash and cash quivalents S 130,513 77,652 725,267 4,09 42,793 118,256 Selling, general and administrative Prepaid expenses and oer curren: assets Deferred incame ax asse Store closure and exit costs 334,129 231,627 348,830 195,467 Gcodwils368,078 38,078 Tatal curren: assets Property and equiprent, net of accurmulated depreciation Intangible assets, ne: ofaccumulated arnortizatian 139,504 (25,063) (37,203) (35,48 Income from Interest expense Other income Loss on exdinguishrment of debt 1,138) (18,721) Income befare income axesw174,10 Deferred incame tax asset 5.267 $1,369,073 51,172,404 6,414) (32,741 5,2 51,326 19,5 Income tax provision Net income....-... S1 Net incame per share: LIABILITIES AND STOCKHOLDERS' EQUITY Current liablities: 5 12,877 111,159 22,287 2,958 Weighted average shares outstanding Accrued sglaries and benefits Other accrued liabilities Current poran of eapital and financing lease abigations Current portian af kang-erm dettmmnmmmmmm 49,751134,622 119, Tatal curren Lorig-term capital and fiacing lease abligations 21,562116,77 The accompanying notes are an integral part of these financial statement. 18,600 E83,6845635 658,633 Cormmitmers and cantingencies (Note 20) Undesignated preferred stock; S0.001 par value 10,000,000 shares authorized, no shares issued and outstanding Cornmon stock, $0.001 par value; 200,000,000 shares authorized, 151,833,334 stares issued and outstanding, Deceriber 28, 2014; 147,616,560 shares issued and outstanding, December 29, 2013.... .. 543,048 479,127 34,497 Additicial paid-in Total stckholders Total liabilities and stockhoders 51,369,073 472 484 SPROUTS FARMERS MARKET, INC AND SUBSIDIARIES CONSOLIDATED STATEMIENTS OF OPERATIONS CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE AMOUNTS) IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) Oecember 2, December 29 .. . Net sales Cost of sales, buying and guSrr2,082,221 1,712,644 1,264,5 ASSETS $2,967,424 $2,437,911 $1,794,8 Cash and cash quivalents S 130,513 77,652 725,267 4,09 42,793 118,256 Selling, general and administrative Prepaid expenses and oer curren: assets Deferred incame ax asse Store closure and exit costs 334,129 231,627 348,830 195,467 Gcodwils368,078 38,078 Tatal curren: assets Property and equiprent, net of accurmulated depreciation Intangible assets, ne: ofaccumulated arnortizatian 139,504 (25,063) (37,203) (35,48 Income from Interest expense Other income Loss on exdinguishrment of debt 1,138) (18,721) Income befare income axesw174,10 Deferred incame tax asset 5.267 $1,369,073 51,172,404 6,414) (32,741 5,2 51,326 19,5 Income tax provision Net income....-... S1 Net incame per share: LIABILITIES AND STOCKHOLDERS' EQUITY Current liablities: 5 12,877 111,159 22,287 2,958 Weighted average shares outstanding Accrued sglaries and benefits Other accrued liabilities Current poran of eapital and financing lease abigations Current portian af kang-erm dettmmnmmmmmm 49,751134,622 119, Tatal curren Lorig-term capital and fiacing lease abligations 21,562116,77 The accompanying notes are an integral part of these financial statement. 18,600 E83,6845635 658,633 Cormmitmers and cantingencies (Note 20) Undesignated preferred stock; S0.001 par value 10,000,000 shares authorized, no shares issued and outstanding Cornmon stock, $0.001 par value; 200,000,000 shares authorized, 151,833,334 stares issued and outstanding, Deceriber 28, 2014; 147,616,560 shares issued and outstanding, December 29, 2013.... .. 543,048 479,127 34,497 Additicial paid-in Total stckholders Total liabilities and stockhoders 51,369,073 472 484

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts