Question: Problems to Lecture 9 Problem 2 (Option combinations). One popular option combination is called a bull spread and consists of one long European call with

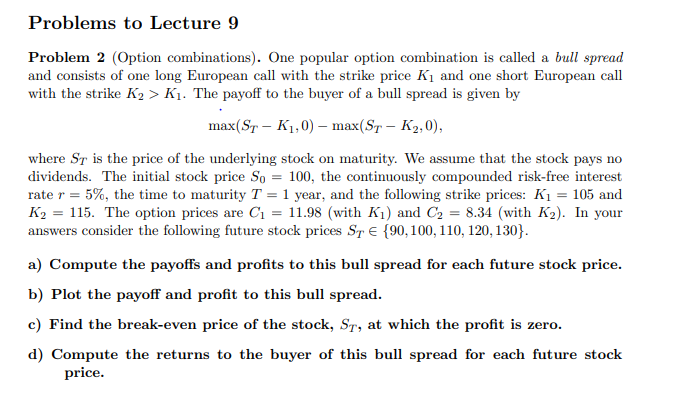

Problems to Lecture 9 Problem 2 (Option combinations). One popular option combination is called a bull spread and consists of one long European call with the strike price Ki and one short European call with the strike K2 > Kj. The payoff to the buyer of a bull spread is given by max(ST-K1,0) max(ST- K2,0), where Sy is the price of the underlying stock on maturity. We assume that the stock pays no dividends. The initial stock price So = 100, the continuously compounded risk-free interest rate r = 5%, the time to maturity T = 1 year, and the following strike prices: Ki = 105 and K2 = 115. The option prices are C = 11.98 (with K) and C2 = 8.34 (with K2). In your answers consider the following future stock prices ST E {90, 100, 110, 120, 130}. a) Compute the payoffs and profits to this bull spread for each future stock price. b) Plot the payoff and profit to this bull spread. c) Find the break-even price of the stock, St, at which the profit is zero. d) Compute the returns to the buyer of this bull spread for each future stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts