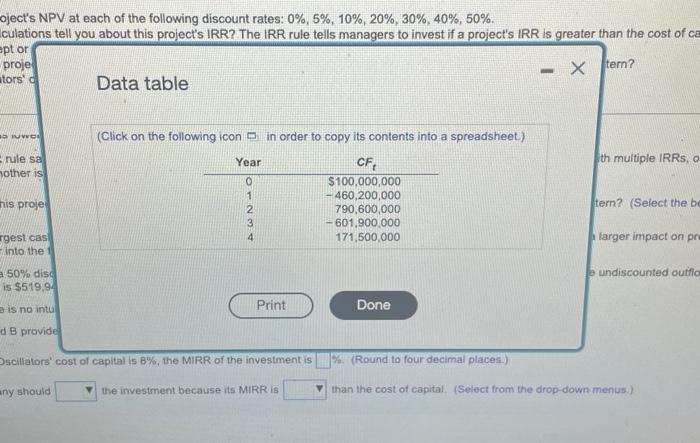

Question: Problems with the IRR method Acme Oscillators is considering an investment project that has the following rather unusual cash flow pattern: IAB a. Calculate the

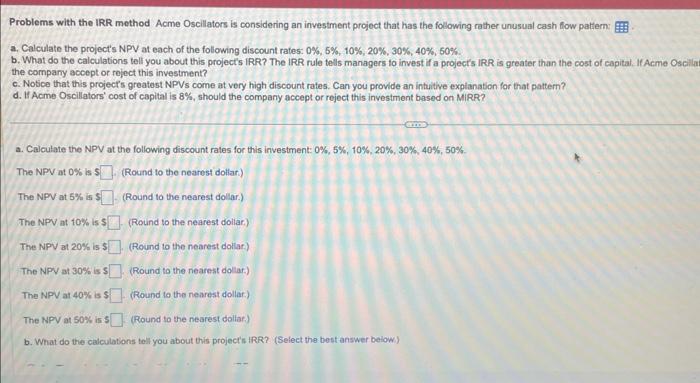

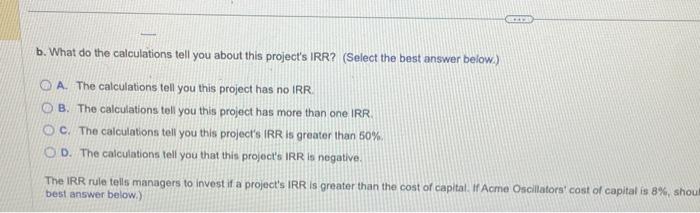

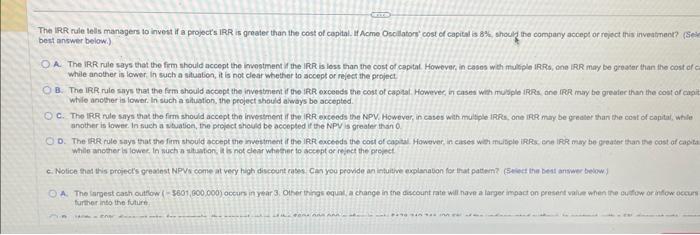

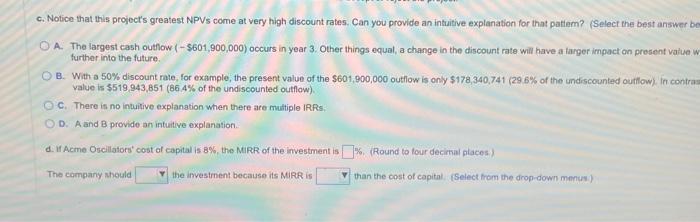

Problems with the IRR method Acme Oscillators is considering an investment project that has the following rather unusual cash flow pattern: IAB a. Calculate the project's NPV at each of the folowing discount rates: 0%,5%,10%,20%,30%,40%,50%. b. What do the calculations tell you about this project's IRR? The IRR rule tells managers to invest if a project's IRR is greater than the cost of capital, If Acme Oscilin the company acoept or reject this investment? c. Notice that this project's greatest NPVs come at very high discount rates. Can you provide an intuitive explanabion for that pattem? d. If Acme Oscillators' cost of capital is 8%, should the company accept or reject this investment based on MiRR? a. Calculate the NPV at the following discount rates for this investment: 0%,5%,10%,20%,30%,40%,50%. The NPV at 0% is 5 (Round to the nearest dollar) The NPN at 5% is $ (Round to the nearest dollar.) The NPV at 10\% is $ (Round to the nearest doliar.) The NPY at 20% is 5 (Round to the nearest dollar) The NPV at 30% is 5 (Round to the nearest dollar.) The NPV at 40% is $ (Round to the nearest dollar.) The NPV at 50% is 5 (Round to the nearest dollar.) b. What do the calculations tell you about this project's IRR? (Select the best answer beiow.) b. What do the calculations tell you about this project's IRR? (Select the best answer below.) A. The calculations tell you this project has no IRR. B. The calculations tell you this project has more than one IRR. C. The calculations tell you this project's IRR is greater than 50%. D. The calculations tell you that this projoct's IRR is negative. The IRR rule tells managers to invest if a project's IRR is greater than the cost of capital. If Acme Oscillators' cost of capital is 8%, shou best answer below.) The IRR rule tels managers to invest if a project's IRR is greater than the cost of copital. Hf Acme Oscillator' cost of capital is 8%, should the company accept or roikct this inveutmeot? bert answer belowi) A. The IRR rule says that the frm should accept the imostment if the IRR is iess than the cost of capitat However, in cesos weh mulople IRRs, one IRR may be groaser than the cost of while another is lower in such a stuaben, it is not clear whether to sccept or rejeer the project B. The IRR rulo says that the frm thould accopt the investment if the IRR oxceeds the cost of caphat. Howevec, in cases with musple iRRs ane IRR miny be greafec than the cost of capi while anether is lower. In soch a situation, the project should aleways bo accepted. c. The IRR nule says that the frm should accept the investment if the iRR exceeds the NPV, However, in cases with muliple iRRs, one ifR may be grealer than the coat of capital, while another is lower. In such a stuation, the prolect should be accopled it the NPV is greater itand 0 . While anotier ls lowee, in such a whaptani in is not clear wheser to aceppt or reinet the grofect further inta the future c. Notice that this project's greatest NPVs come at very high discount rates. Can you provide an intuitive explanation for that patiem? (Select the best answer be A. The largest cash outhow ($601,900,000) occurs in year 3. Other things equal, a change in the discount rate will have a farger impact on present value w further into the future. B. With a 50% discount rale, for example, the present value of the $601,900,000 outhow is only $178,340,741 (29.6\% of the undiscounted ouillow) in contraz value is $519,943,851(66.4% of the undiscounted outfow). C. There is no intuitive explanation when there are multiple IRRs; D. A and B provide an intuitive explanation. d. If Acme Oscillators' cost of capital is 8%, the MARiR of the investment is o. (Round to four decimal places) The company should the investrnent because its MRRR is than the cost of capital. (Select from the drop-down menus.) ject's NPV at each of the following discount rates: 0%,5%,10%,20%,30%,40%,50%. culations tell you about this project's IRR? The IRR rule tells managers to invest if a project's IRR is greater than the cost of c Data table (Click on the following icon in order to copy its contents into a spreadsheet) th multiple IRRs, 0 tern? (Select the bi farger impact on pr 2 undiscounted outfio scillators" cost of capital is B\%, the MIRR of the investment is F. (Round to four decimal places.) ny shouid the investment because its MIRR is than the cost of capital (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts