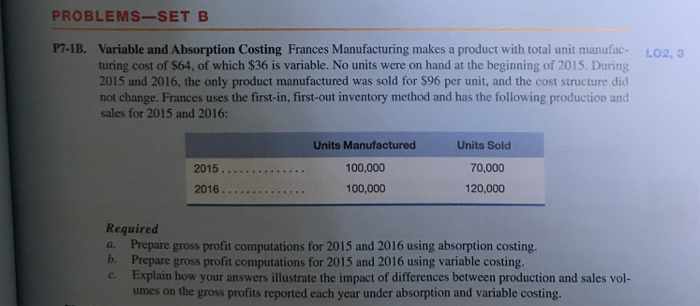

Question: PROBLEMS-SET B P7-1B. Variable and Absorption Costing Frances Manufacturing makes a product with total unit manufac- turing cost of $64, of which $36 is variable.

PROBLEMS-SET B P7-1B. Variable and Absorption Costing Frances Manufacturing makes a product with total unit manufac- turing cost of $64, of which $36 is variable. No units were on hand at the beginning of 2015. During 2015 and 2016, the only product manufactured was sold for $96 per unit, and the cost structure did not change. Frances uses the first-in, first-out inventory method and has the following production and sales for 2015 and 2016: LO2,3 Units Manufactured 100,000 100,000 Units Sold 70,000 120,000 2016. Required a. Prepare gross profit computations for 2015 and 2016 using absorption costing. b. Prepare gross profit computations for 2015 and 2016 using variable costing. c. Explain how your answers illustrate the impact of differences between production and sales vol- umes on the gross profits reported each year under absorption and variable costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts