Question: proceed with data from yahoo finance pls help me with this.only need help for number 8 google 11:23 U ASSIGNMENT... ASSIGNMENT FOR BFN BFN3164 Dateline

proceed with data from yahoo finance pls help me with this.only need help for number 8 google

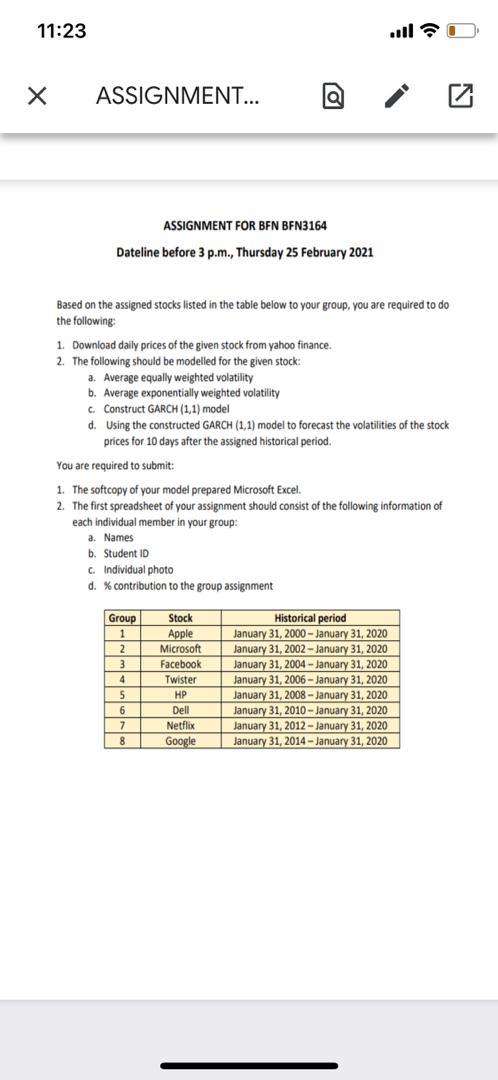

11:23 U ASSIGNMENT... ASSIGNMENT FOR BFN BFN3164 Dateline before 3p.m., Thursday 25 February 2021 Based on the assigned stocks listed in the table below to your group, you are required to do the following: 1. Download daily prices of the given stock from yahoo finance. 2. The following should be modelled for the given stock: a. Average equally weighted volatility b. Average exponentially weighted volatility c Construct GARCH (1,1) model d. Using the constructed GARCH (1,1) model to forecast the volatilities of the stock prices for 10 days after the assigned historical period. You are required to submit: 1. The softcopy of your model prepared Microsoft Excel. 2. The first spreadsheet of your assignment should consist of the following information of each individual member in your group: a. Names b. Student ID c. Individual photo d. % contribution to the group assignment Group 1 2 3 4 Stock Apple Microsoft Facebook Twister un HP Dell Netflix Google Historical period January 31, 2000 - January 31, 2020 January 31, 2002 - January 31, 2020 January 31, 2004 - January 31, 2020 January 31, 2006 - January 31, 2020 January 31, 2008 - January 31, 2020 January 31, 2010-January 31, 2020 January 31, 2012 - January 31, 2020 January 31, 2014 - January 31, 2020 5 6 5 7 8 11:23 U ASSIGNMENT... ASSIGNMENT FOR BFN BFN3164 Dateline before 3p.m., Thursday 25 February 2021 Based on the assigned stocks listed in the table below to your group, you are required to do the following: 1. Download daily prices of the given stock from yahoo finance. 2. The following should be modelled for the given stock: a. Average equally weighted volatility b. Average exponentially weighted volatility c Construct GARCH (1,1) model d. Using the constructed GARCH (1,1) model to forecast the volatilities of the stock prices for 10 days after the assigned historical period. You are required to submit: 1. The softcopy of your model prepared Microsoft Excel. 2. The first spreadsheet of your assignment should consist of the following information of each individual member in your group: a. Names b. Student ID c. Individual photo d. % contribution to the group assignment Group 1 2 3 4 Stock Apple Microsoft Facebook Twister un HP Dell Netflix Google Historical period January 31, 2000 - January 31, 2020 January 31, 2002 - January 31, 2020 January 31, 2004 - January 31, 2020 January 31, 2006 - January 31, 2020 January 31, 2008 - January 31, 2020 January 31, 2010-January 31, 2020 January 31, 2012 - January 31, 2020 January 31, 2014 - January 31, 2020 5 6 5 7 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts