Question: Proceed with these steps: step one: read the Case Study step two: make notes and and proceed with calculations in Excel spreadsheet (upgraded!) (calculate missed

Proceed with these steps:

step one: read the Case Study

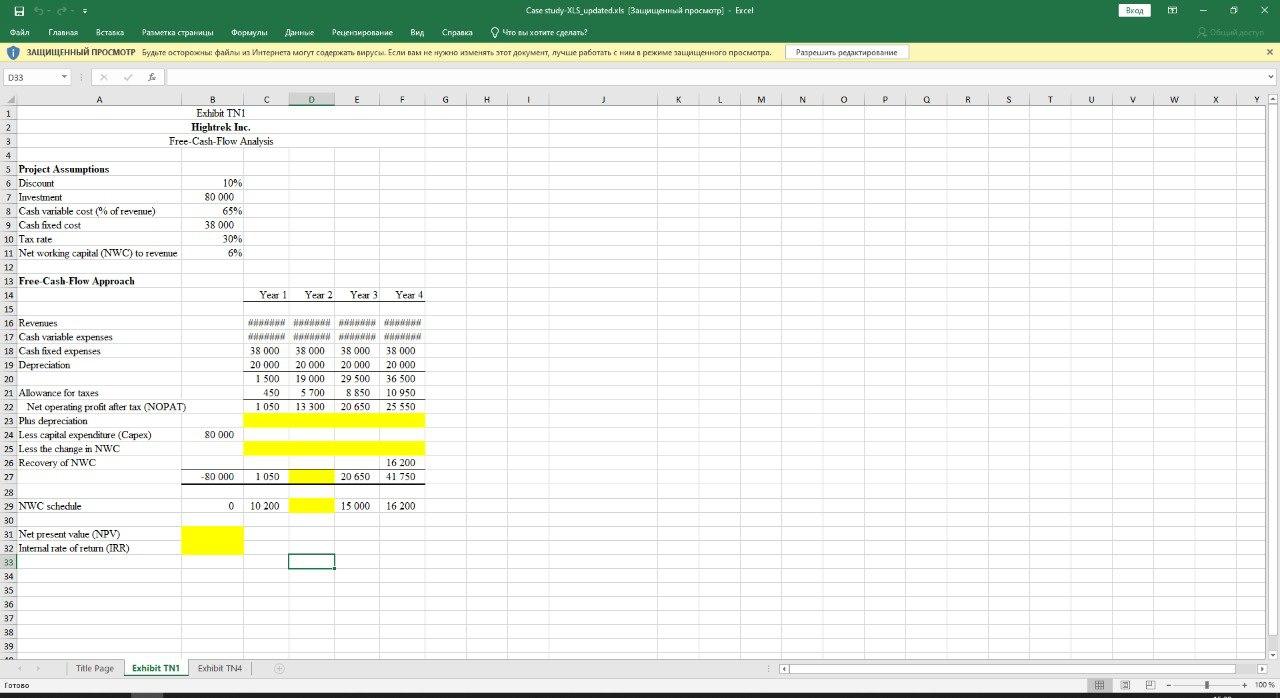

step two: make notes and and proceed with calculations in Excel spreadsheet (upgraded!) (calculate missed numbers, highlighted in yellow)

step three: construct NPV profiles for projects

0 - - Case study XLS_updated.xls aumenpochop - Excel go ? : . , . D33 f v G X .. M N P Q R S T W 10% A B C 0 E F 1 1 Exhibit TN1 2 Hightrek Inc. 3 Free-Cash-Flow Analysis 4 4 5 Project Assumptions 5 6 Discount 7 Investment 80 000 8 Cash variable cost of reveme) 65% 9 Cash fixed cost 38 000 10 Tax rate 30% 11 Networking capital (NWC) to revenue ( 69 12 13 Free Cash Flow Approach 14 Year 1 1 Year 2 Year 3 Year 4 15 16 Revenues WWWWWWWWWWWWWWWWWWWWWWW 17 Cash variable expenses W W W W W W W 18 Cash fixed expenses 38 000 38 000 38 000 38 000 19 Depreciation 20 000 20 000 20 000 20 000 20 1 500 19 000 29 500 36 500 21 Allowance for taxes 450 5 700 8 830 10 950 22 Net operating profit after tax (NOPAT) 1050 13 300 20 650 25 350 23 Plus depreciation 24 Less capital expenditure (Capex) 80 000 25 Less the change in NWC 26 Recovery of NWC 16 200 27 -80 000 1 050 20 650 41 750 28 29 NWC schedule 0 10 200 15 000 16 200 30 31 Net present value (NPV) 32 Internal rate of return (IRR) 33 34 35 36 37 38 39 Title Page Exhibit TNI Exhibit TN4 -+ 100% 0 - - Case study XLS_updated.xls aumenpochop - Excel go ? : . , . D33 f v G X .. M N P Q R S T W 10% A B C 0 E F 1 1 Exhibit TN1 2 Hightrek Inc. 3 Free-Cash-Flow Analysis 4 4 5 Project Assumptions 5 6 Discount 7 Investment 80 000 8 Cash variable cost of reveme) 65% 9 Cash fixed cost 38 000 10 Tax rate 30% 11 Networking capital (NWC) to revenue ( 69 12 13 Free Cash Flow Approach 14 Year 1 1 Year 2 Year 3 Year 4 15 16 Revenues WWWWWWWWWWWWWWWWWWWWWWW 17 Cash variable expenses W W W W W W W 18 Cash fixed expenses 38 000 38 000 38 000 38 000 19 Depreciation 20 000 20 000 20 000 20 000 20 1 500 19 000 29 500 36 500 21 Allowance for taxes 450 5 700 8 830 10 950 22 Net operating profit after tax (NOPAT) 1050 13 300 20 650 25 350 23 Plus depreciation 24 Less capital expenditure (Capex) 80 000 25 Less the change in NWC 26 Recovery of NWC 16 200 27 -80 000 1 050 20 650 41 750 28 29 NWC schedule 0 10 200 15 000 16 200 30 31 Net present value (NPV) 32 Internal rate of return (IRR) 33 34 35 36 37 38 39 Title Page Exhibit TNI Exhibit TN4 -+ 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts