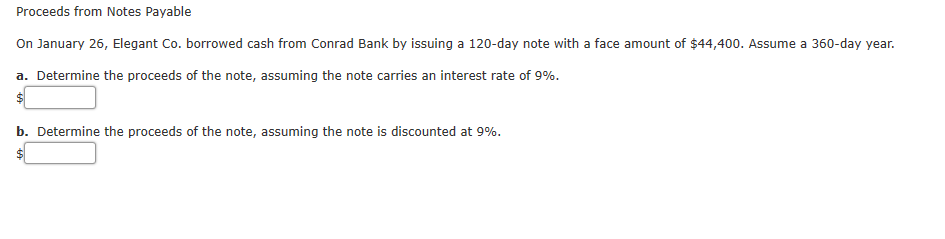

Question: Proceeds from Notes Payable On January 26, Elegant Co. borrowed cash from Conrad Bank by issuing a 120-day note with a face amount of $44,400.

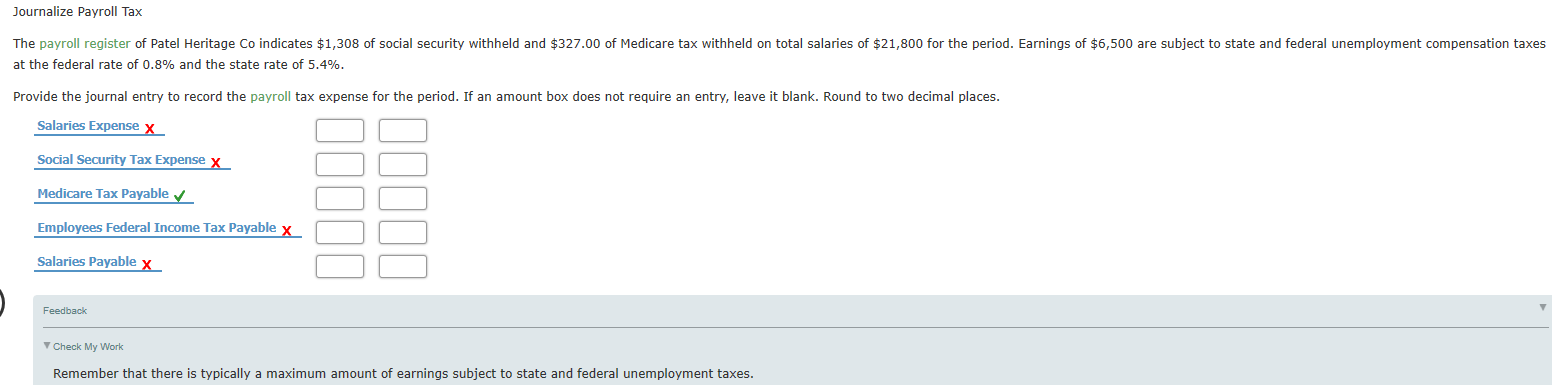

Proceeds from Notes Payable On January 26, Elegant Co. borrowed cash from Conrad Bank by issuing a 120-day note with a face amount of $44,400. Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of 9%. b. Determine the proceeds of the note, assuming the note is discounted at 9%. Journalize Payroll Tax The payroll register of Patel Heritage Co indicates $1,308 of social security withheld and $327.00 of Medicare tax withheld on total salaries of $21,800 for the period. Earnings of $6,500 are subject to state and federal unemployment compensation taxes at the federal rate of 0.8% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places. Salaries Expensex Social Security Tax Expense x Medicare Tax Payable Employees Federal Income Tax Payable x Salaries Payable x Feedback Check My Work Remember that there is typically a maximum amount of earnings subject to state and federal unemployment taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts