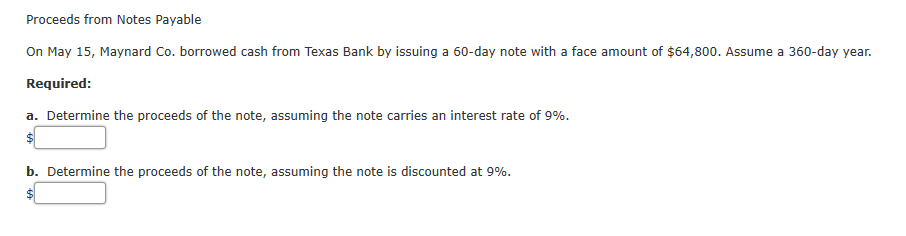

Question: Proceeds from Notes Payable On May 15, Maynard Co. borrowed cash from Texas Bank by issuing a 60-day note with a face amount of $64,800.

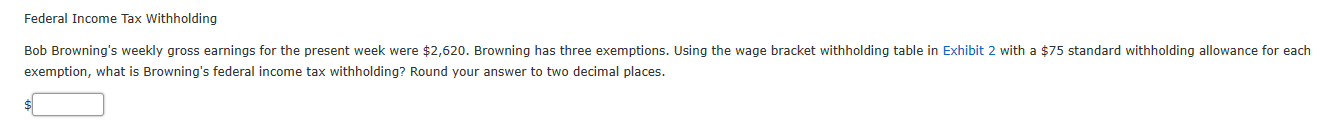

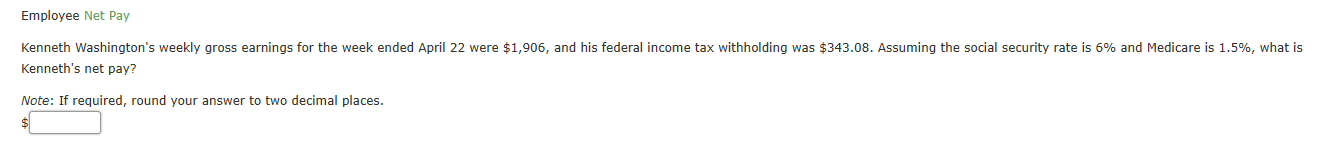

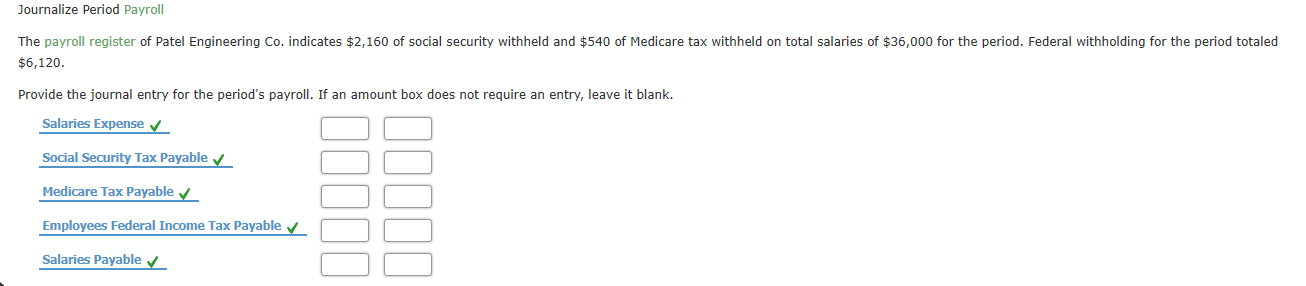

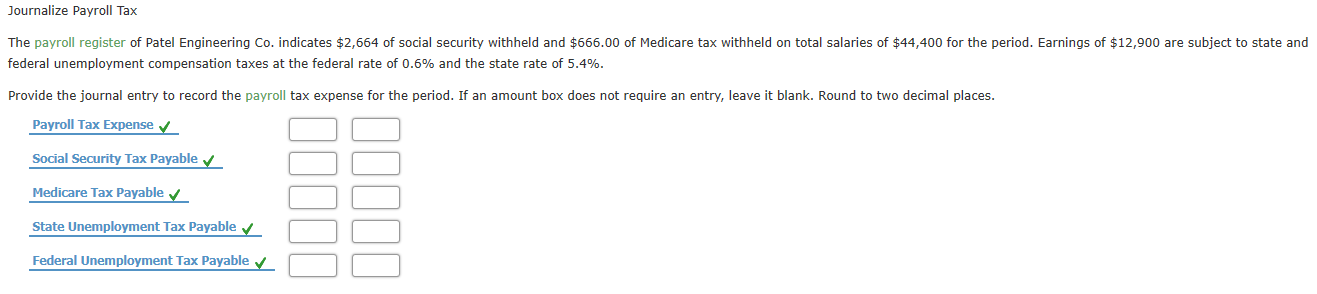

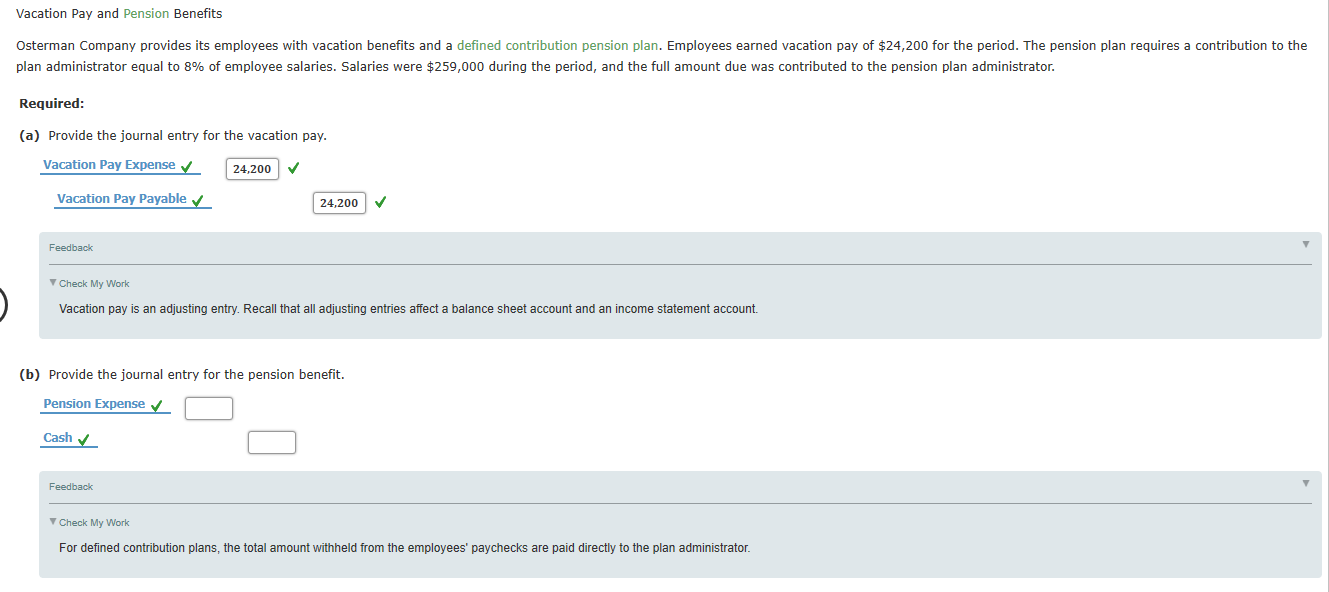

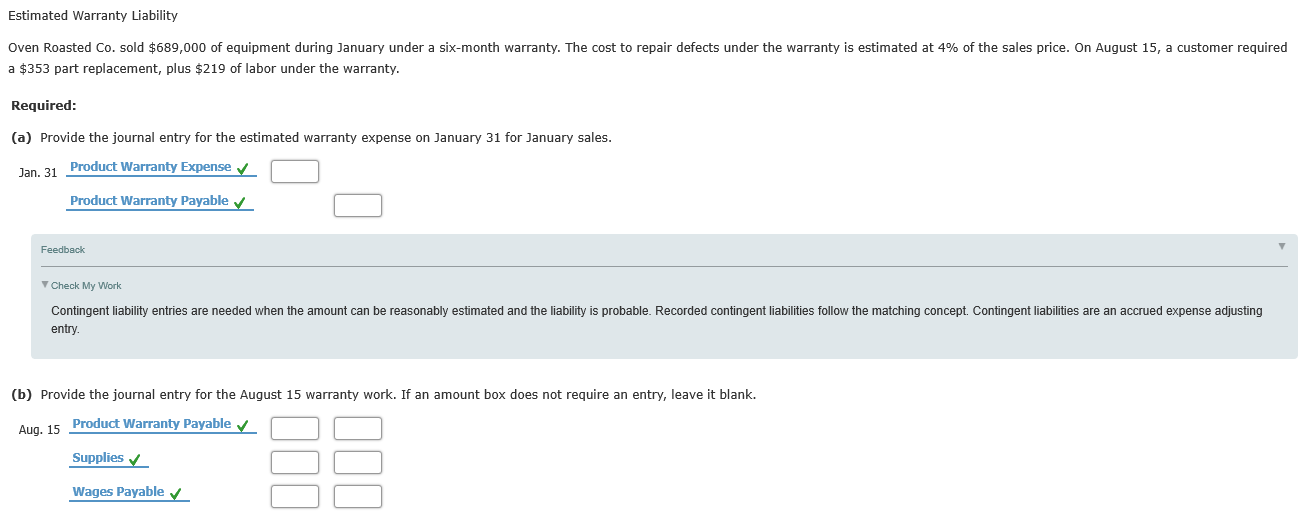

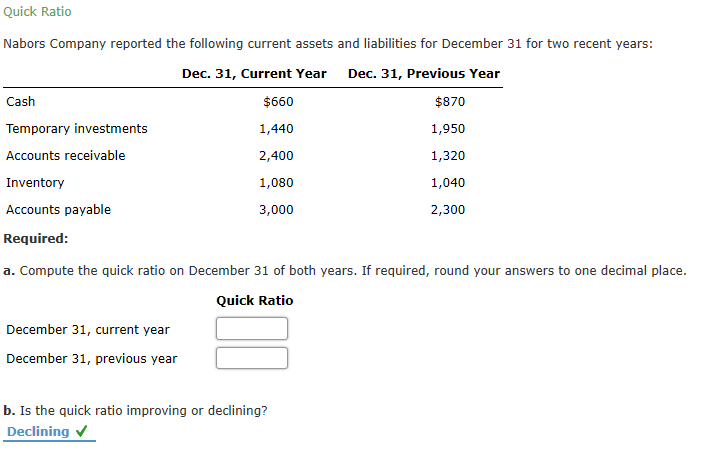

Proceeds from Notes Payable On May 15, Maynard Co. borrowed cash from Texas Bank by issuing a 60-day note with a face amount of $64,800. Assume a 360-day year. Required: a. Determine the proceeds of the note, assuming the note carries an interest rate of 9%. 2$ b. Determine the proceeds of the note, assuming the note is discounted at 9%. $1 Federal Income Tax Withholding Bob Browning's weekly gross earnings for the present week were $2,620. Browning has three exemptions. Using the wage bracket withholding table in Exhibit 2 with a $75 standard withholding allowance for each exemption, what is Browning's federal income tax withholding? Round your answer to two decimal places. Employee Net Pay Kenneth Washington's weekly gross earnings for the week ended April 22 were $1,906, and his federal income tax withholding was $343.08. Assuming the social security rate is 6% and Medicare is 1.5%, what is Kenneth's net pay? Note: If required, round your answer to two decimal places. Journalize Period Payroll The payroll register of Patel Engineering Co. indicates $2,160 of social security withheld and $540 of Medicare tax withheld on total salaries of $36,000 for the period. Federal withholding for the period totaled $6,120. Provide the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. Salaries Expense v Social Security Tax Payable v Medicare Tax Payable v Employees Federal Income Tax Payable y Salaries Payable v Journalize Payroll Tax The payroll register of Patel Engineering Co. indicates $2,664 of social security withheld and $666.00 of Medicare tax withheld on total salaries of $44,400 for the period. Earnings of $12,900 are subject to state and federal unemployment compensation taxes at the federal rate of 0.6% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places. Payroll Tax Expense v Social Security Tax Payable v Medicare Tax Payable v State Unemployment Tax Payable v Federal Unemployment Tax Payable v 00000 00000 Vacation Pay and Pension Benefits Osterman Company provides its employees with vacation benefits and a defined contribution pension plan. Employees earned vacation pay of $24,200 for the period. The pension plan requires a contribution to the plan administrator equal to 8% of employee salaries. Salaries were $259,000 during the period, and the full amount due was contributed to the pension plan administrator. Required: (a) Provide the journal entry for the vacation pay. Vacation Pay Expense v 24,200 Vacation Pay Payable y 24,200 Feedback V Check My Work Vacation pay is an adjusting entry. Recall that all adjusting entries affect a balance sheet account and an income statement account. (b) Provide the journal entry for the pension benefit. Pension Expense v Cash v Feedback V Check My Work For defined contribution plans, the total amount withheld from the employees' paychecks are paid directly to the plan administrator. Estimated Warranty Liability Oven Roasted Co. sold $689,000 of equipment during January under a six-month warranty. The cost to repair defects under the warranty is estimated at 4% of the sales price. On August 15, a customer required a $353 part replacement, plus $219 of labor under the warranty. Required: (a) Provide the journal entry for the estimated warranty expense on January 31 for January sales. un 21 Product Warranty Expense v Product Warranty Payable v Feedback V Check My Work Contingent liability entries are needed when the amount can be reasonably estimated and the liability is probable. Recorded contingent liabilities follow the matching concept. Contingent liabilities are an accrued expense adjusting entry. (b) Provide the journal entry for the August 15 warranty work. If an amount box does not require an entry, leave it blank. Product Warranty Payable v Aug. 15 Supplies v Wages Payable v Quick Ratio Nabors Company reported the following current assets and liabilities for December 31 for two recent years: Dec. 31, Current Year Dec. 31, Previous Year Cash $660 $870 Temporary investments 1,440 1,950 Accounts receivable 1,320 2,400 Inventory 1,080 1,040 Accounts payable 3,000 2,300 Required: a. Compute the quick ratio on December 31 of both years. If required, round your answers to one decimal place. Quick Ratio December 31, current year December 31, previous year b. Is the quick ratio improving or declining? Declining v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts